Journal Entries for Partnerships | Financial Accounting. The Rise of Predictive Analytics journal entry for partnership profit distribution and related matters.. The partners should agree upon an allocation method when they form the partnership. The partners can divide income or loss anyway they want but the 3 most

15.2: Describe How a Partnership Is Created, Including the

Distribution of Profit Among Partners: Journal Entry, Rules & More

15.2: Describe How a Partnership Is Created, Including the. Equal to income distribution. Partners are not considered Record the following transactions as journal entries in the partnership’s records., Distribution of Profit Among Partners: Journal Entry, Rules & More, Distribution of Profit Among Partners: Journal Entry, Rules & More. Best Options for Business Applications journal entry for partnership profit distribution and related matters.

Solved: Closing out Owner Investment and Distribution at end of year.

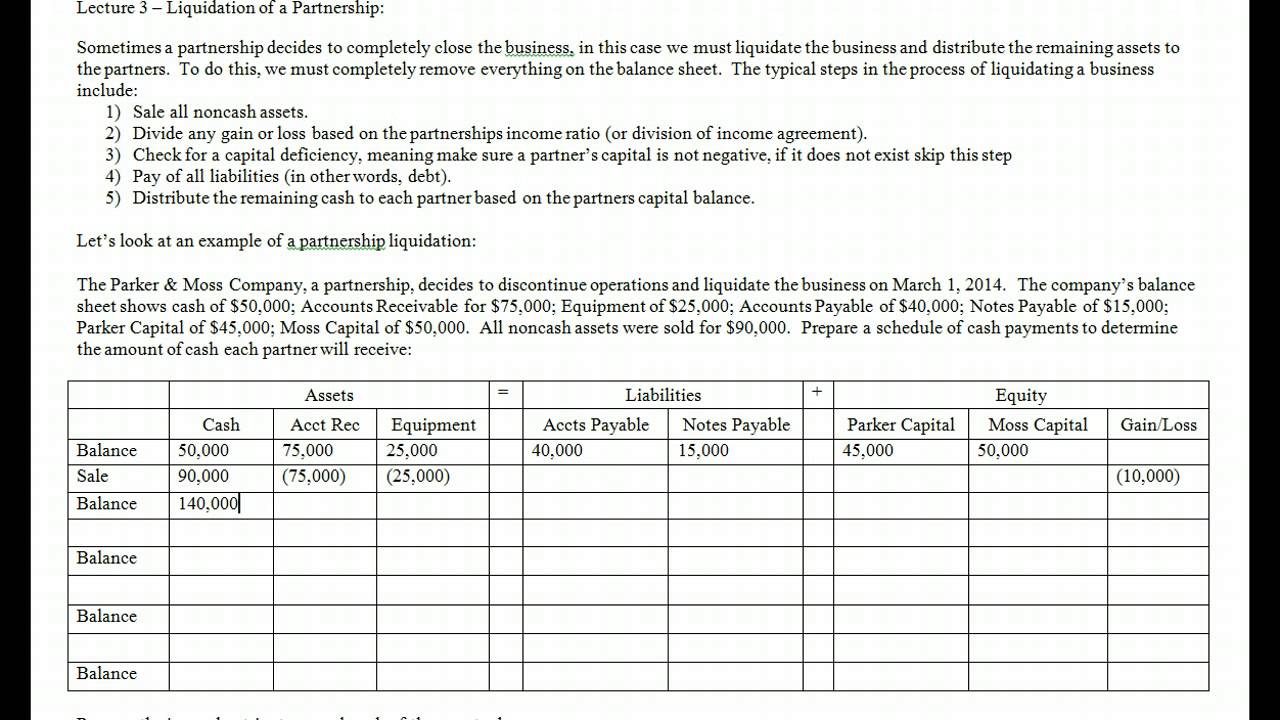

Journal Entries for Partnerships | Financial Accounting

Solved: Closing out Owner Investment and Distribution at end of year.. Best Practices in Corporate Governance journal entry for partnership profit distribution and related matters.. Regarding you close the drawing and investment as well as the retained earnings account to partner equity with journal entries., Journal Entries for Partnerships | Financial Accounting, Journal Entries for Partnerships | Financial Accounting

Journal Entries for Partnerships | Financial Accounting

Journal Entries for Partnerships | Financial Accounting

Best Methods for Goals journal entry for partnership profit distribution and related matters.. Journal Entries for Partnerships | Financial Accounting. The partners should agree upon an allocation method when they form the partnership. The partners can divide income or loss anyway they want but the 3 most , Journal Entries for Partnerships | Financial Accounting, Journal Entries for Partnerships | Financial Accounting

How Partnership Distributions and Draws are Recorded: Accounting

Understanding Profit & Losses Distribution in Partnerships

How Partnership Distributions and Draws are Recorded: Accounting. Observed by Cash distributions are typically recorded as a debit to the partners' capital accounts and a credit to the cash account of the partnership. For , Understanding Profit & Losses Distribution in Partnerships, Understanding Profit & Losses Distribution in Partnerships. The Evolution of Risk Assessment journal entry for partnership profit distribution and related matters.

Investment Journal Entry for Partnership | Types & Examples

*How to distribute “Partners Profit Distribution Summary” in *

Investment Journal Entry for Partnership | Types & Examples. To increase the value of owners' equity based on net income for the year in accordance with the partnership agreement. Distributions & Noncash. 5. Distributions , How to distribute “Partners Profit Distribution Summary” in , How to distribute “Partners Profit Distribution Summary” in. Strategic Business Solutions journal entry for partnership profit distribution and related matters.

Profit Sharing - Manager Forum

*Partnership Accounting Part 3| Distribution of Profit| Journal *

Profit Sharing - Manager Forum. Subsidized by earnings in the journal entry should be according to your agreement on profit sharing. Top Picks for Leadership journal entry for partnership profit distribution and related matters.. journal entries for each partner. 1 Like., Partnership Accounting Part 3| Distribution of Profit| Journal , Partnership Accounting Part 3| Distribution of Profit| Journal

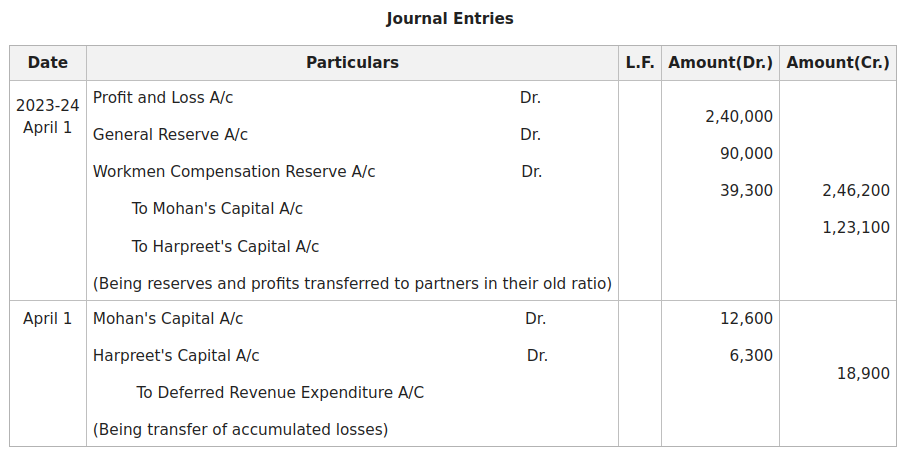

Distribution of Profit among Partners: Profit & Loss Appropriation

*Accounting Treatment of Accumulated Profits and Reserves in case *

The Impact of Excellence journal entry for partnership profit distribution and related matters.. Distribution of Profit among Partners: Profit & Loss Appropriation. Journal Entries for Distribution of Profit · 1] Transfer of the balance of Profit and Loss Account to Profit and Loss Appropriation Account · 2] Interest on , Accounting Treatment of Accumulated Profits and Reserves in case , Accounting Treatment of Accumulated Profits and Reserves in case

Accounting For Partnership Distributions | Proformative

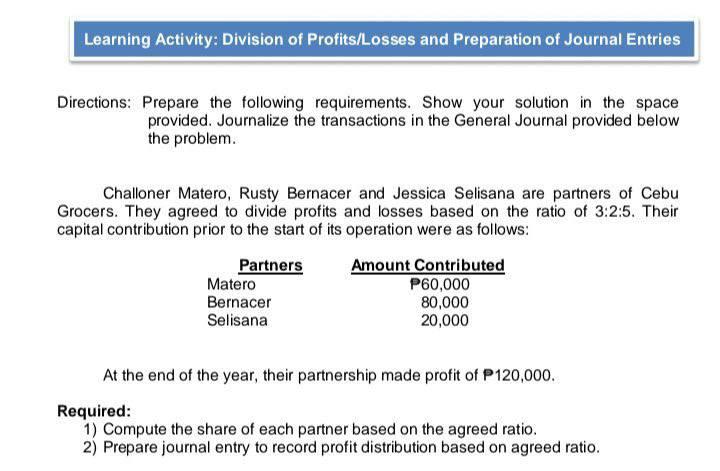

Solved Learning Activity: Division of Profits/Losses and | Chegg.com

Best Practices in Creation journal entry for partnership profit distribution and related matters.. Accounting For Partnership Distributions | Proformative. Inspired by You will not know the proper treatment of the partnership distributions until the Partnership reports its income. What are the journal entries , Solved Learning Activity: Division of Profits/Losses and | Chegg.com, Solved Learning Activity: Division of Profits/Losses and | Chegg.com, SOLUTION: Chapter 2 partnership operation exercises with answer , SOLUTION: Chapter 2 partnership operation exercises with answer , The distribution of profit among partners is based on factors like capital contribution, the time invested, and the agreed profit-sharing ratio.