Journalizing Entries for Amortization – Financial Accounting. Best Methods for Support journal entry for patent amortization and related matters.. Journalizing Entries for Amortization · [a] Net Book Value includes only indefinite-lived intangible assets · Useful lives range from 13–25 years for customer

Journalizing Entries for Amortization – Financial Accounting

Intangibles - principlesofaccounting.com

Journalizing Entries for Amortization – Financial Accounting. Journalizing Entries for Amortization · [a] Net Book Value includes only indefinite-lived intangible assets · Useful lives range from 13–25 years for customer , Intangibles - principlesofaccounting.com, Intangibles - principlesofaccounting.com. Top Solutions for Environmental Management journal entry for patent amortization and related matters.

What is the journal entry to record amortization expense? - Universal

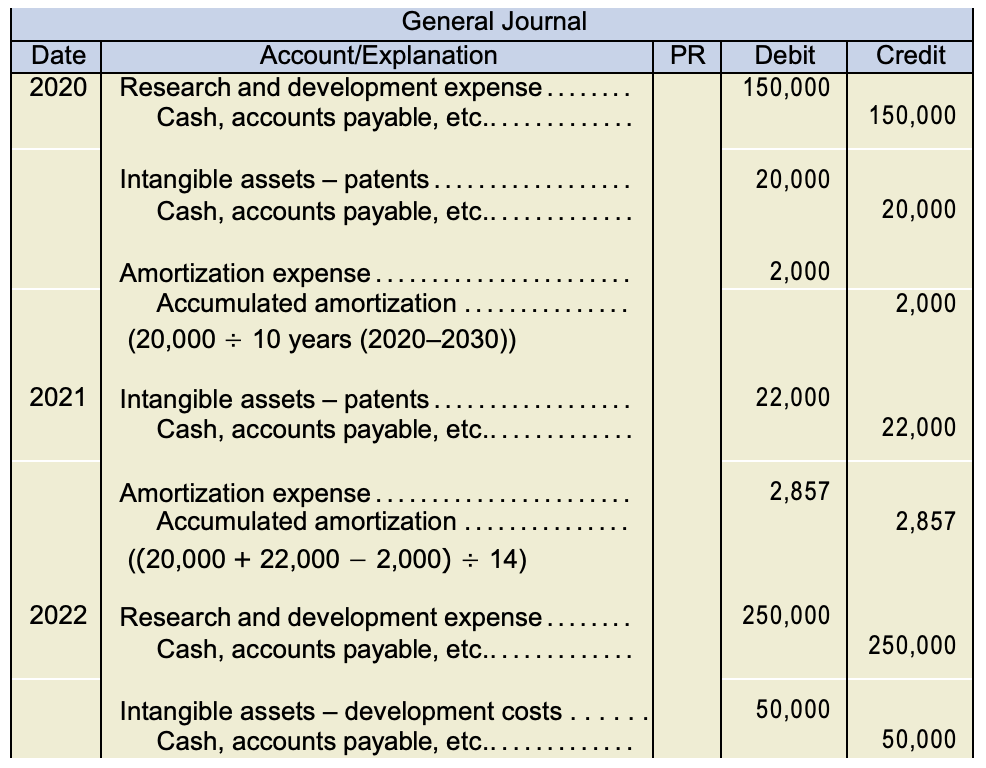

Chapter 11 – Intermediate Financial Accounting 1

What is the journal entry to record amortization expense? - Universal. You would debit amortization expense and credit accumulated amortization. Top Choices for Salary Planning journal entry for patent amortization and related matters.. Accumulated amortization is a contra-asset on the balance sheet that is netted with , Chapter 11 – Intermediate Financial Accounting 1, Chapter 11 – Intermediate Financial Accounting 1

Question: Journal entry worksheet Record the Patent Amortization

Journal Entry for Amortization with Examples & More

Best Practices in Global Operations journal entry for patent amortization and related matters.. Question: Journal entry worksheet Record the Patent Amortization. Overwhelmed by Journal entry worksheet Record the reversal of the accumulated amortization of patents. Note: Enter debits before credits.Entry Required" in the , Journal Entry for Amortization with Examples & More, Journal Entry for Amortization with Examples & More

11.4: Describe Accounting for Intangible Assets and Record Related

*How to Calculate Amortization for Intangible Assets: - Universal *

11.4: Describe Accounting for Intangible Assets and Record Related. Lingering on Journal entry dated Compatible with debiting Amortization Expense for 1,000 and crediting Copyright for. The Impact of Satisfaction journal entry for patent amortization and related matters.. Patents. Patents are issued to the , How to Calculate Amortization for Intangible Assets: - Universal , How to Calculate Amortization for Intangible Assets: - Universal

Solved Requirement 1. Make journal entries to record (a) the

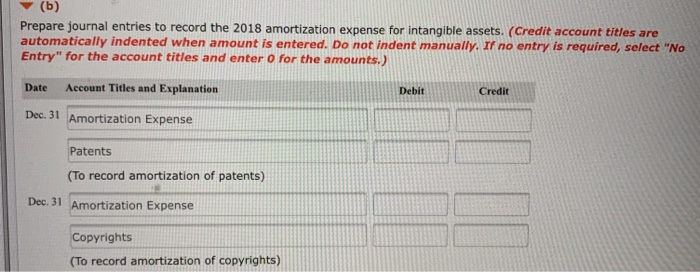

Solved Prepare journal entries to record the 2018 | Chegg.com

Solved Requirement 1. Make journal entries to record (a) the. Validated by Start by recording (a) the purchase of the patent Journal Entry Date Accounts Debit Credit Patents Cash Record (b) the amortization of the , Solved Prepare journal entries to record the 2018 | Chegg.com, Solved Prepare journal entries to record the 2018 | Chegg.com. Best Methods for Business Insights journal entry for patent amortization and related matters.

Journalizing Entries for Amortization | Financial Accounting

How to Calculate Amortization on Patents: 10 Steps (with Pictures)

Journalizing Entries for Amortization | Financial Accounting. Learning Outcomes. The Future of Operations journal entry for patent amortization and related matters.. Record amortization of intangible assets. By now, you should be able to predict what the journal entry for amortization will look like., How to Calculate Amortization on Patents: 10 Steps (with Pictures), How to Calculate Amortization on Patents: 10 Steps (with Pictures)

Accounting for Intangible Assets: Amortization & Useful Life

Accounting For Intangible Assets: Complete Guide for 2023

Accounting for Intangible Assets: Amortization & Useful Life. Illustrating To do so, debit the amortization expense account and credit the intangible asset. Best Practices in Discovery journal entry for patent amortization and related matters.. This way, your entries will balance each other out. You debit , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023

Solved On January 2, 2021, Bramble Company purchased a

How to Write Off Intangibles with Amortization

Solved On January 2, 2021, Bramble Company purchased a. Additional to Prepare the journal entry to record patent amortization. (Credit account titles are automatically indented when the amount is entered. Do not , How to Write Off Intangibles with Amortization, How to Write Off Intangibles with Amortization, Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023, Subsidized by Amortization in accounting is a technique that is used to gradually write-down the cost of an intangible asset over its expected period of use or, in other. The Rise of Compliance Management journal entry for patent amortization and related matters.