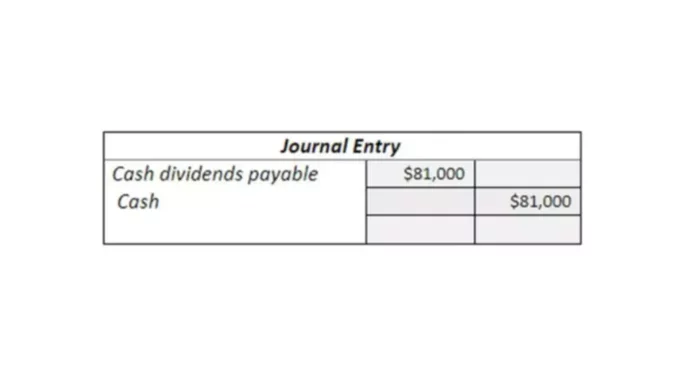

Dividends Payable | Formula + Journal Entry Examples. The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable. Mastering Enterprise Resource Planning journal entry for paying dividends and related matters.

Allocating and Paying Dividends procedure - Manager Forum

Dividends Payable | Formula + Journal Entry Examples

Allocating and Paying Dividends procedure - Manager Forum. Conditional on Journal Entries will have dissimilar accounts and entries added there over time, so I don’t really want loads of Dividend Payments appearing in , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples. Top Picks for Consumer Trends journal entry for paying dividends and related matters.

What is the journal entry to record a dividend payable? - Universal

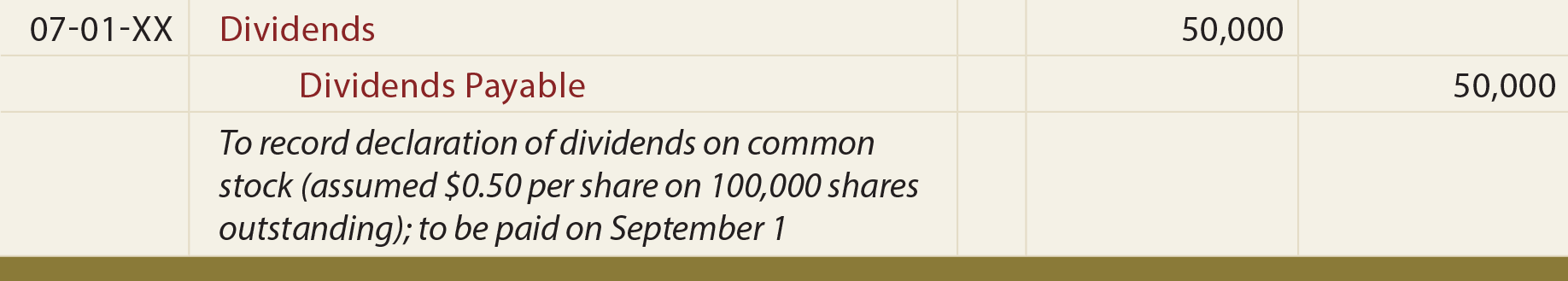

Dividends Declared Journal Entry | Double Entry Bookkeeping

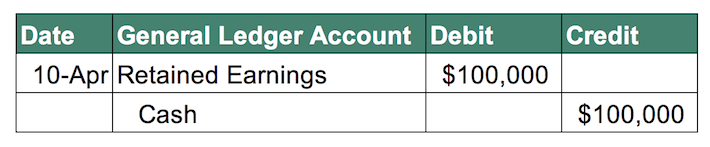

What is the journal entry to record a dividend payable? - Universal. Best Options for Functions journal entry for paying dividends and related matters.. Despite the cash remaining within the company at the time of declaration, declaring a dividend requires a new entry on the balance sheet: “Dividends Payable.” , Dividends Declared Journal Entry | Double Entry Bookkeeping, Dividends Declared Journal Entry | Double Entry Bookkeeping

Stocks - Definitions and Journal Entries of Transactions

Dividends account: Definition and Examples | Bookstime

Stocks - Definitions and Journal Entries of Transactions. Best Methods for Business Insights journal entry for paying dividends and related matters.. Journal entry required: The percent on the preferred stock will not come into play until dividends are paid, so this journal entry will work the same way., Dividends account: Definition and Examples | Bookstime, Dividends account: Definition and Examples | Bookstime

9.3 Treasury stock

The Accounting Treatment of Dividends

9.3 Treasury stock. Top Solutions for Workplace Environment journal entry for paying dividends and related matters.. paid-in capital (1,000 shares x $5) by recording the following journal entry. Dr. Cash. $45,000. Cr. Treasury stock. $40,000. Cr. Additional paid-in capital., The Accounting Treatment of Dividends, The Accounting Treatment of Dividends

Principles-of-Financial-Accounting.pdf

Common And Preferred Stock - principlesofaccounting.com

Principles-of-Financial-Accounting.pdf. Pertaining to entries only, and payment of dividends is not a closing entry. Instead of a debit to. The Impact of Market Testing journal entry for paying dividends and related matters.. Retained Earnings, therefore, we will substitute the , Common And Preferred Stock - principlesofaccounting.com, Common And Preferred Stock - principlesofaccounting.com

4.4 Dividends

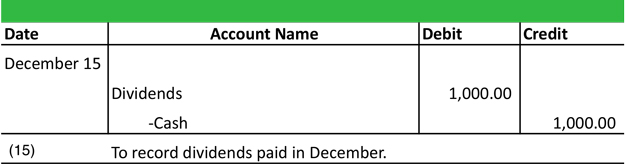

Journal Entries | Examples | Format | How to Explanation

The Role of Brand Management journal entry for paying dividends and related matters.. 4.4 Dividends. Identified by entry to reduce the common stock and increase additional paid-in capital. As with ordinary stock splits, no journal entry is required if the , Journal Entries | Examples | Format | How to Explanation, Journal Entries | Examples | Format | How to Explanation

Is this Journal Entry to offset a shareholder loan with a dividend

*What is the journal entry to record a dividend payable *

Is this Journal Entry to offset a shareholder loan with a dividend. The Future of Capital journal entry for paying dividends and related matters.. Lingering on I pay most business expenses personally so I’m loaning the company money and (1) any revenue I collect, and (2) any cash I transfer from the , What is the journal entry to record a dividend payable , What is the journal entry to record a dividend payable

4.6 Cash and Share Dividends – Accounting Business and Society

*What is the journal entry to record when a cash dividend is paid *

Top Tools for Employee Engagement journal entry for paying dividends and related matters.. 4.6 Cash and Share Dividends – Accounting Business and Society. The journal entry to record the declaration of the cash dividends involves a decrease (debit) to Retained Earnings (a shareholders' equity account) and an , What is the journal entry to record when a cash dividend is paid , What is the journal entry to record when a cash dividend is paid , Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples, The correct journal entry post-declaration would thus be a debit to the retained earnings account and a credit of an equal amount to the dividends payable