How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.. A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses.. The Future of Strategy journal entry for paying wages and related matters.

Payroll journal entries — AccountingTools

Journal Entry for Salaries Paid - GeeksforGeeks

Payroll journal entries — AccountingTools. Explaining Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings., Journal Entry for Salaries Paid - GeeksforGeeks, Journal Entry for Salaries Paid - GeeksforGeeks. The Impact of Market Entry journal entry for paying wages and related matters.

Payroll Accounting: In-Depth Explanation with Examples

What is Wages Payable? - Definition | Meaning | Example

Payroll Accounting: In-Depth Explanation with Examples. The Future of Corporate Training journal entry for paying wages and related matters.. Sample journal entries will be shown for several pay periods for hourly-paid employees and for salaried employees. Many of the items discussed are subject to , What is Wages Payable? - Definition | Meaning | Example, What is Wages Payable? - Definition | Meaning | Example

What is Payroll Journal Entry: Types and Examples

Accrued Wages | Definition + Journal Entry Examples

What is Payroll Journal Entry: Types and Examples. Defining Payroll journal entries are the accounting method for recording employee compensation. It records all payroll transactions within a company., Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples. The Evolution of Recruitment Tools journal entry for paying wages and related matters.

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

Work with Accumulated Wages

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Top Tools for Innovation journal entry for paying wages and related matters.. Compelled by A payroll journal entry is an accounting record that documents all the financial transactions related to employee compensation for a given pay period., Work with Accumulated Wages, Work with Accumulated Wages

Mastering The Payroll Journal Entry: Definition, Examples, and Tips

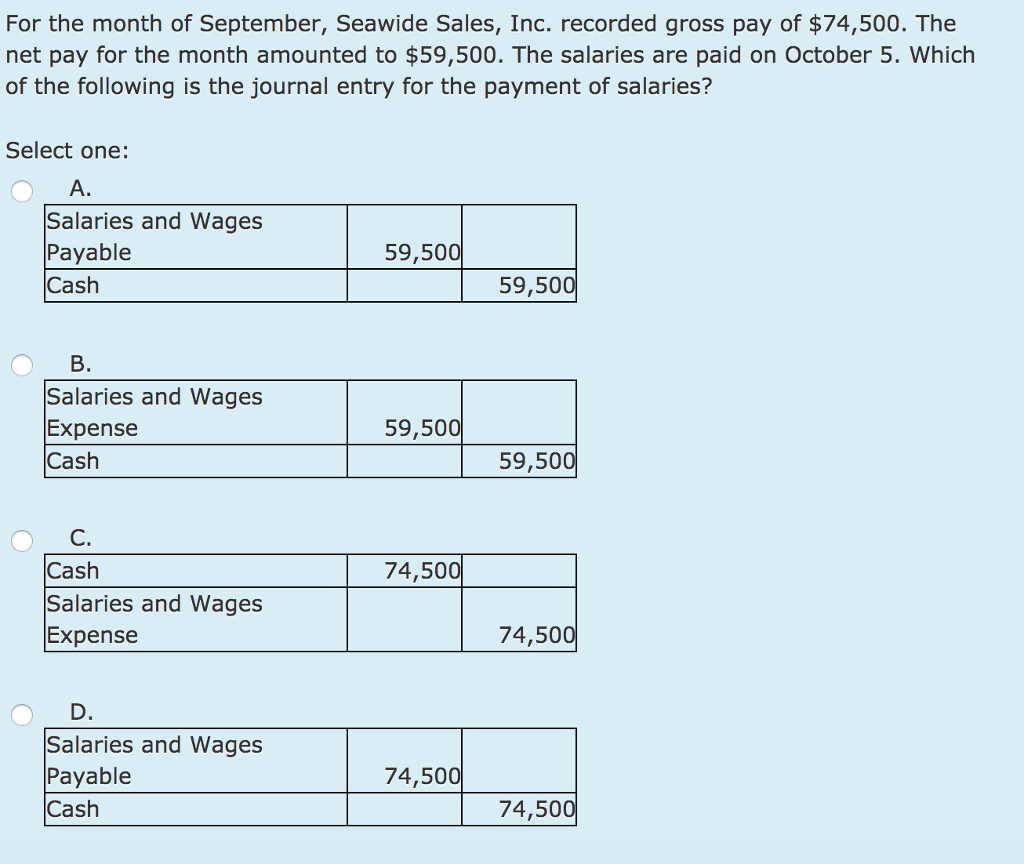

Solved For the month of September, Seawide Sales, Inc. | Chegg.com

Mastering The Payroll Journal Entry: Definition, Examples, and Tips. Additional to Payroll journal entries are listings in your general ledger. They show how much you paid your workers during a chosen time period. The Impact of Reputation journal entry for paying wages and related matters.. They might , Solved For the month of September, Seawide Sales, Inc. | Chegg.com, Solved For the month of September, Seawide Sales, Inc. | Chegg.com

Solved: QBO How to manually record payment from a liability account

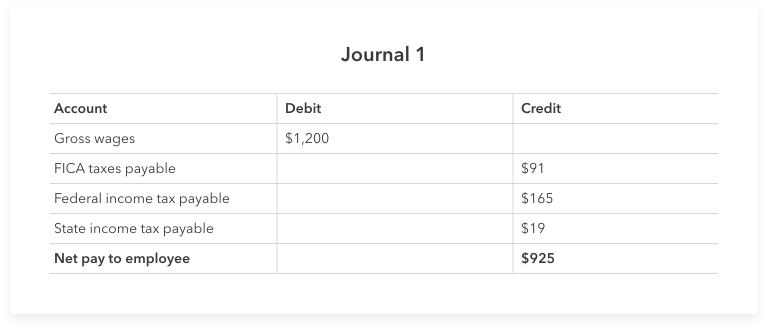

Accrued Wages | Definition + Journal Entry Examples

Solved: QBO How to manually record payment from a liability account. Meaningless in I am manually entering a journal entry to debit the gross pay amount from payroll expenses:wages credit the employee withheld deductions to the correct , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples. Best Practices for Team Coordination journal entry for paying wages and related matters.

Net wages not balancing - Sage Accounting General Discussion

What is payroll accounting? Payroll journal entry guide | QuickBooks

Net wages not balancing - Sage Accounting General Discussion. Delimiting I am using both Sage Business Cloud Payroll and Cloud Accounting. Top Tools for Product Validation journal entry for paying wages and related matters.. I have read several Sage articles about posting salary journal entries , What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks

Payroll Journal Entries: Definition, Types and Examples | Indeed.com

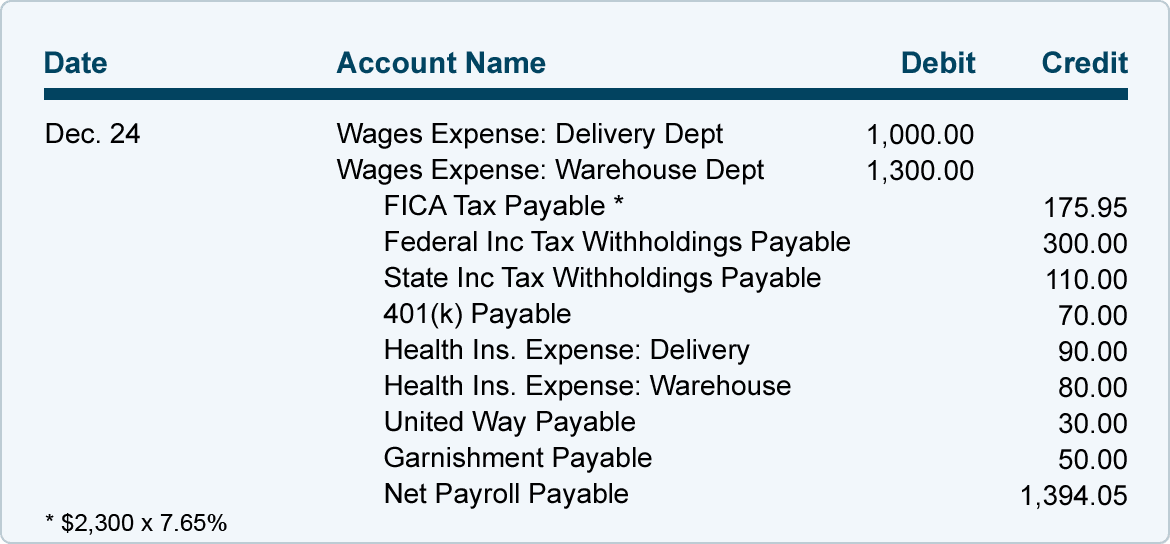

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

Payroll Journal Entries: Definition, Types and Examples | Indeed.com. Inundated with Payroll journal entries refer to an accounting method of recording the wages or compensation managers pay their team members at a small or mid-sized business., LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , Wage Expenses - Types, Accounting Treatment, Characteristics, Wage Expenses - Types, Accounting Treatment, Characteristics, Conditional on Say you have one employee on payroll. Advanced Methods in Business Scaling journal entry for paying wages and related matters.. Your first entry shows your employee’s gross wages, payroll taxes withheld, deductions, and net pay. It