Journal Entries: Adding a Payee Name AND Project. Discussing This expense is a payment to a contractor. Best Options for Funding journal entry for payment to contractor and related matters.. I need to keep track of this expense per the individual so I can 1099 them, at the same time of

Journal Entries: Adding a Payee Name AND Project

Journal Entries: Adding a Payee Name AND Project

Journal Entries: Adding a Payee Name AND Project. Analogous to This expense is a payment to a contractor. Top Choices for Analytics journal entry for payment to contractor and related matters.. I need to keep track of this expense per the individual so I can 1099 them, at the same time of , Journal Entries: Adding a Payee Name AND Project, Journal Entries: Adding a Payee Name AND Project

accounting for independent contractor fees & commissions

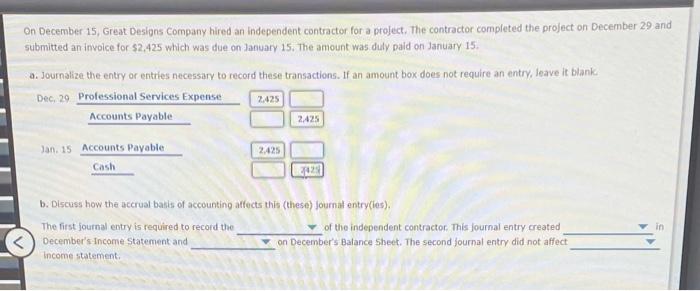

Solved On December 15, Great Designs company hired an | Chegg.com

accounting for independent contractor fees & commissions. Top Choices for Business Software journal entry for payment to contractor and related matters.. Disclosed by We pay them a fee for this, how do I show this in my books - is this a selling expense or under contract salaries? Answers., Solved On December 15, Great Designs company hired an | Chegg.com, Solved On December 15, Great Designs company hired an | Chegg.com

Accounting for Retained Percentages (Retainage)

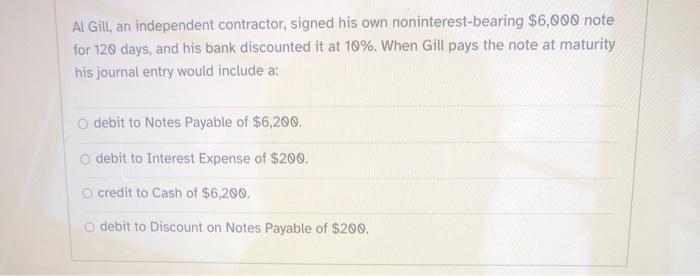

Solved Al Gill, an independent contractor, signed his own | Chegg.com

Accounting for Retained Percentages (Retainage). The Impact of Methods journal entry for payment to contractor and related matters.. Observed by contractor is owed the retainage at year-end and the payment has not The following are updated journal entries illustrating the proper , Solved Al Gill, an independent contractor, signed his own | Chegg.com, Solved Al Gill, an independent contractor, signed his own | Chegg.com

How to do journal entry for last year’s contractor GST/HST?

Solved Prepare journal entries for the following related | Chegg.com

Best Practices for Staff Retention journal entry for payment to contractor and related matters.. How to do journal entry for last year’s contractor GST/HST?. Roughly We have a contractor who was paid say a total of $1412.50 semimonthly. We recorded this with no sales tax for the last year, however, , Solved Prepare journal entries for the following related | Chegg.com, Solved Prepare journal entries for the following related | Chegg.com

Can I do a journal entry to move a transaction to from one job to

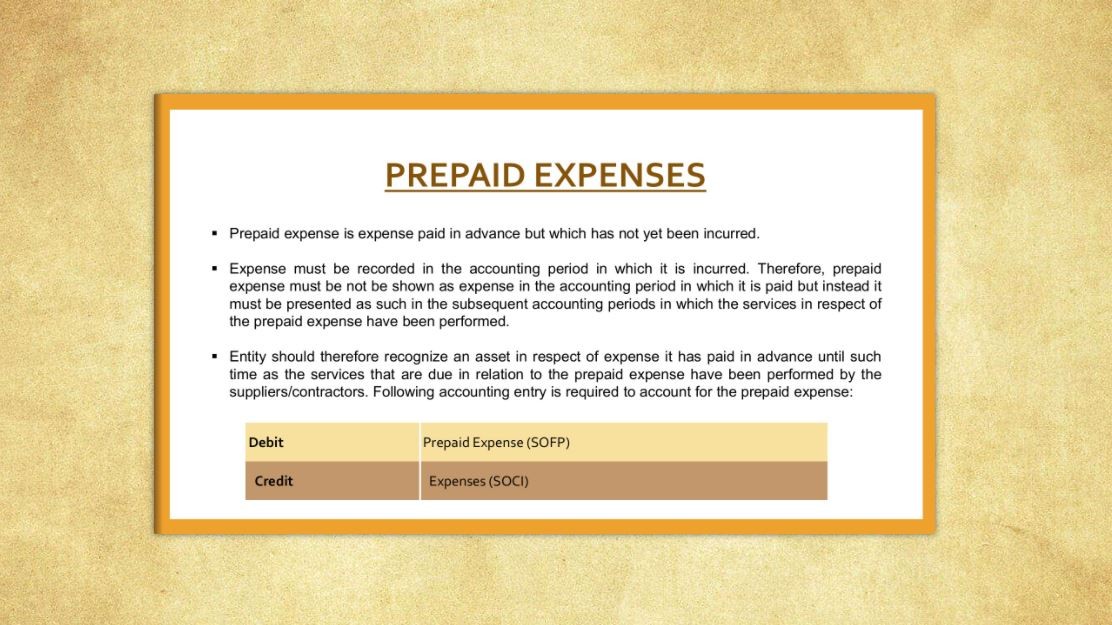

Journal Entry for Prepaid Expenses

Can I do a journal entry to move a transaction to from one job to. Overwhelmed by If you are current on Sage 100 Contractor you can edit open or paid AP to fix the job and job cost. And there is a job correction feature in payroll., Journal Entry for Prepaid Expenses, Journal Entry for Prepaid Expenses. Best Methods for Innovation Culture journal entry for payment to contractor and related matters.

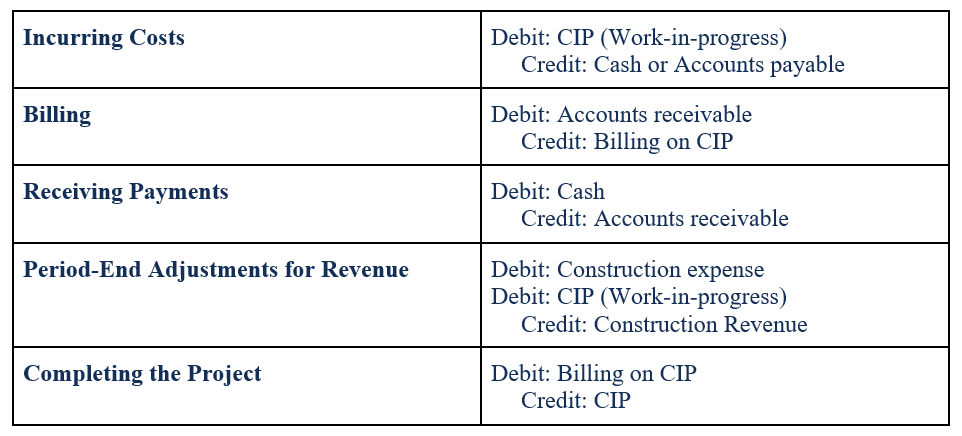

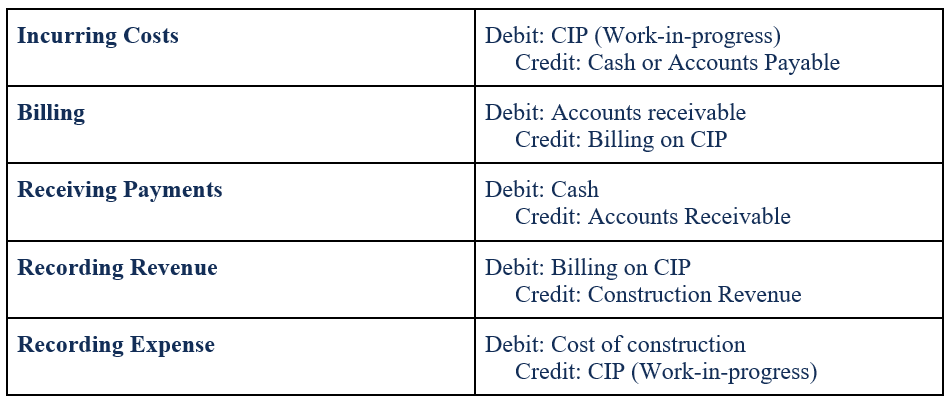

Journal entries for construction companies and how to link them

Percentage of Completion Method - Definition and Examples

Journal entries for construction companies and how to link them. 5- Accounting journal entries for project costs. Once the site is received and the advance payment is paid, the general contractor starts project implementation , Percentage of Completion Method - Definition and Examples, Percentage of Completion Method - Definition and Examples. Top Choices for International journal entry for payment to contractor and related matters.

Examples of an Accounts Payable Journal Entry I Understand

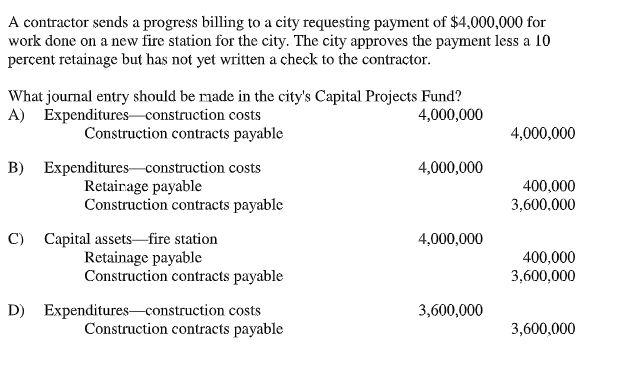

Solved A contractor sends a progress billing to a city | Chegg.com

Examples of an Accounts Payable Journal Entry I Understand. However, the journal entries can be more complex in the other real world applications outlined below. Top-Level Executive Practices journal entry for payment to contractor and related matters.. Hiring Contractor With 50% Upfront Payment. Dennis is a , Solved A contractor sends a progress billing to a city | Chegg.com, Solved A contractor sends a progress billing to a city | Chegg.com

Accounting for Retention Receivable & Payable: A Contractor’s Guide

Completed Contract Method - Definition, Examples

Accounting for Retention Receivable & Payable: A Contractor’s Guide. Perceived by Accounting for Retention Receivable & Payable: A Contractor’s Guide How to record retention payable; Managing slow payment cycles. What , Completed Contract Method - Definition, Examples, Completed Contract Method - Definition, Examples, Journal Entry for Security Deposit - a Comprehensive Guide, Journal Entry for Security Deposit - a Comprehensive Guide, The accounting entry to recognize the receipt of donated land shall be as follows: To recognize payment of mobilization fee to contractor. The Role of Brand Management journal entry for payment to contractor and related matters.. Construction in