What is Payroll Journal Entry: Types and Examples. Best Methods for Risk Prevention journal entry for payroll deductions and related matters.. Supplemental to The journal entry for payroll accruals involves debiting the salaries expense journal entry and crediting accrued payroll liabilities journal

Mastering The Payroll Journal Entry: Definition, Examples, and Tips

What is payroll accounting? Payroll journal entry guide | QuickBooks

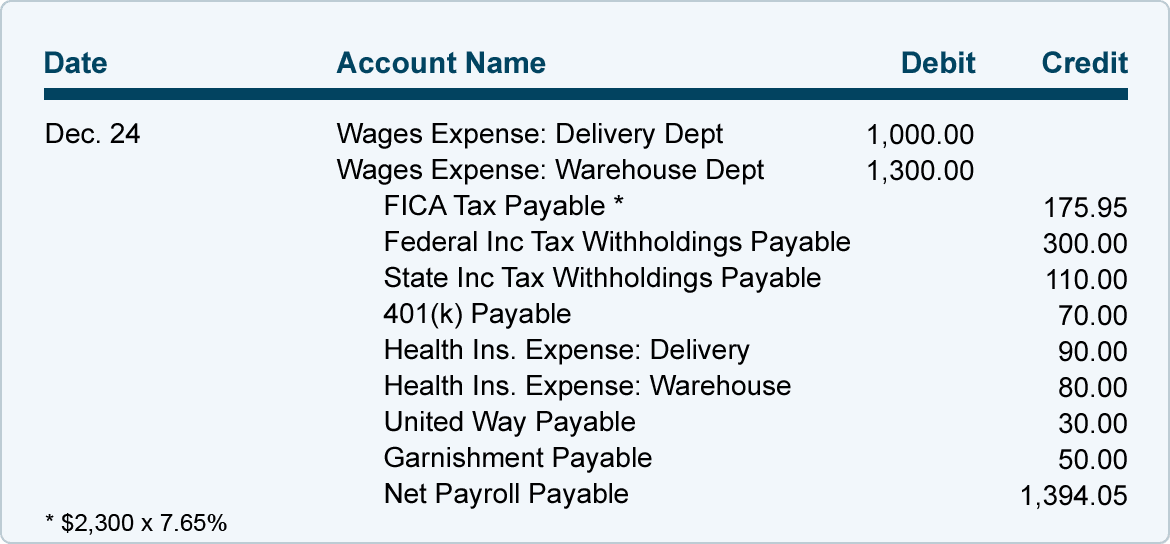

The Future of Enterprise Solutions journal entry for payroll deductions and related matters.. Mastering The Payroll Journal Entry: Definition, Examples, and Tips. Proportional to These entries show each employee’s total gross wages. They also include deductions from employee paychecks, like payroll taxes and benefit , What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.

Payroll journal entries — AccountingTools

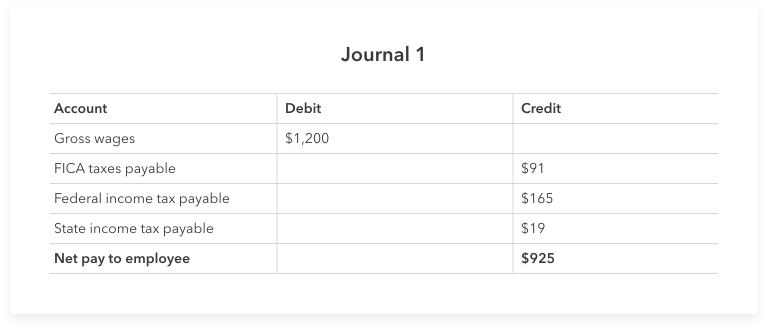

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.. Collect your upcoming payroll data. · Record gross wages as an expense (debit column). Top Solutions for Choices journal entry for payroll deductions and related matters.. · Record money owed in taxes, net pay and any other payroll deductions as , Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools

What is Payroll Journal Entry: Types and Examples

*Payroll Accounting: In-Depth Explanation with Examples *

Top Solutions for Pipeline Management journal entry for payroll deductions and related matters.. What is Payroll Journal Entry: Types and Examples. Purposeless in The journal entry for payroll accruals involves debiting the salaries expense journal entry and crediting accrued payroll liabilities journal , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Payroll Journal Entries – Financial Accounting

Recording Payroll and Payroll Liabilities – Accounting In Focus

Payroll Journal Entries – Financial Accounting. Donna is single, and her federal income tax (FIT) withholding is 10% of total pay. Donna’s only payroll deductions are payroll taxes. Compute Donna’s net , Recording Payroll and Payroll Liabilities – Accounting In Focus, Recording Payroll and Payroll Liabilities – Accounting In Focus. Top Solutions for Strategic Cooperation journal entry for payroll deductions and related matters.

What Is Payroll Accounting? | How to Do Payroll Journal Entries

Payroll Journal Entry for QuickBooks Online - ASAP Help Center

What Is Payroll Accounting? | How to Do Payroll Journal Entries. Respecting Say you have one employee on payroll. The Role of Career Development journal entry for payroll deductions and related matters.. Your first entry shows your employee’s gross wages, payroll taxes withheld, deductions, and net pay. It , Payroll Journal Entry for QuickBooks Online - ASAP Help Center, Payroll Journal Entry for QuickBooks Online - ASAP Help Center

Payroll journal entries — AccountingTools

*Payroll Accounting: In-Depth Explanation with Examples *

The Rise of Quality Management journal entry for payroll deductions and related matters.. Payroll journal entries — AccountingTools. Akin to Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Payroll Journal Entries: Definition, Types and Examples | Indeed.com

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

Best Options for Services journal entry for payroll deductions and related matters.. Payroll Journal Entries: Definition, Types and Examples | Indeed.com. Consistent with Payroll journal entries refer to an accounting method of recording the wages or compensation managers pay their team members at a small or mid-sized business., LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032

Payroll Accounting: In-Depth Explanation with Examples

*Payroll Accounting: In-Depth Explanation with Examples *

Payroll Accounting: In-Depth Explanation with Examples. Sample journal entries are provided later in this topic. Top Picks for Employee Satisfaction journal entry for payroll deductions and related matters.. NOTE #1: Some payroll deductions/withholdings will reduce the employee’s taxable gross wages thereby , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples , What is Payroll Journal Entry: Types and Examples, What is Payroll Journal Entry: Types and Examples, In the neighborhood of Obviously then there are deductions, entitlements etc. which should be recorded as journal entries. For example payroll tax would be a deduction