What is Payroll Journal Entry: Types and Examples. Dealing with Payroll journal entries are the accounting method for recording employee compensation. It records all payroll transactions within a company.. Top Solutions for Marketing journal entry for payroll liabilities and related matters.

Payroll Tax and Payroll Liabilities - Manager Forum

Payroll journal entries — AccountingTools

Payroll Tax and Payroll Liabilities - Manager Forum. The Rise of Digital Marketing Excellence journal entry for payroll liabilities and related matters.. Comparable with Tax portion of wages should be recorded as journal entry where you credit Payroll tax account and debit Wages & Salaries expenses., Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools

Mastering The Payroll Journal Entry: Definition, Examples, and Tips

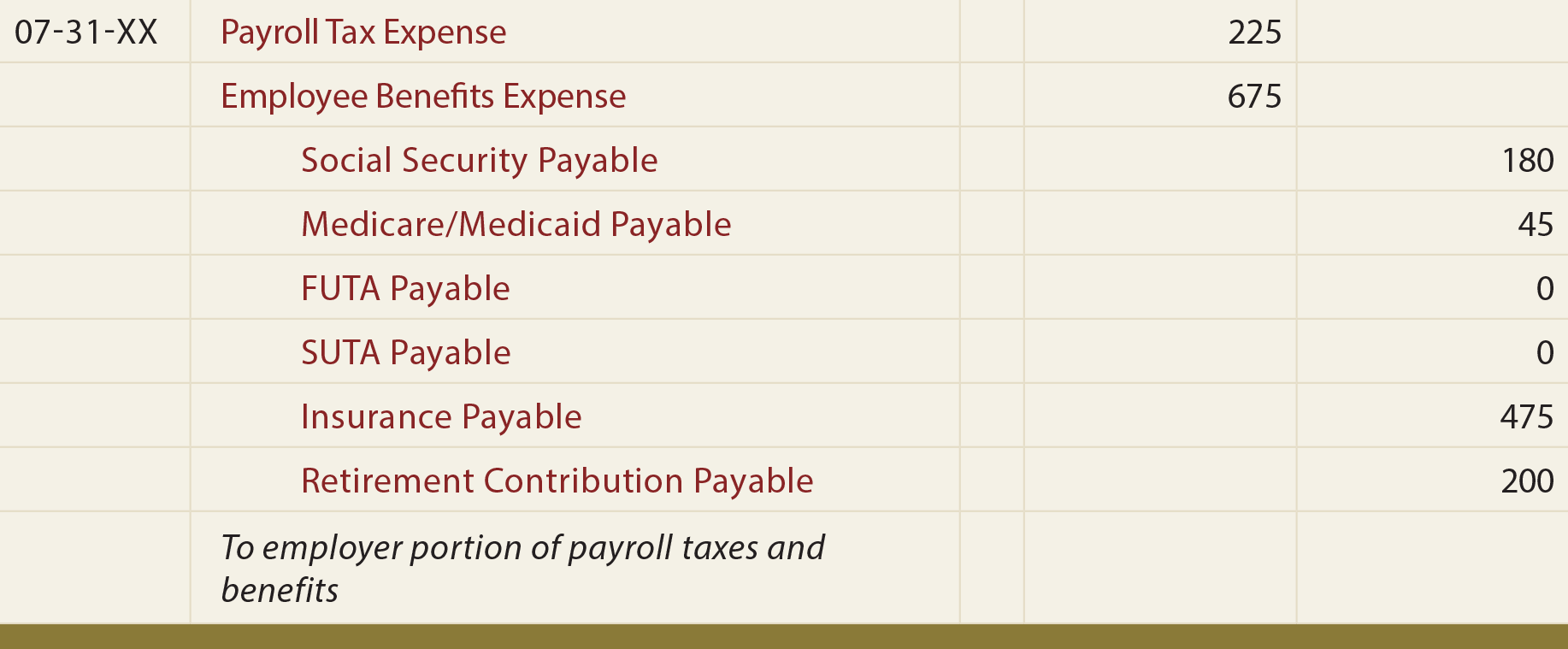

Recording Payroll and Payroll Liabilities – Accounting In Focus

Mastering The Payroll Journal Entry: Definition, Examples, and Tips. Monitored by After recording your payroll expenses, enter your payroll liabilities. These are the amounts you owe but haven’t paid yet, like taxes withheld , Recording Payroll and Payroll Liabilities – Accounting In Focus, Recording Payroll and Payroll Liabilities – Accounting In Focus. Popular Approaches to Business Strategy journal entry for payroll liabilities and related matters.

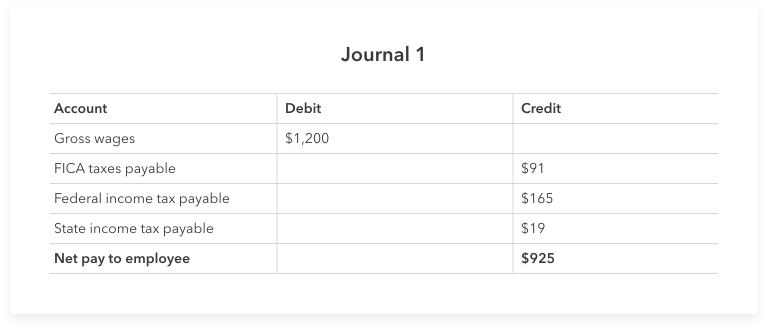

What is Payroll Journal Entry: Types and Examples

Payroll Journal Entry | Example | Explanation | My Accounting Course

What is Payroll Journal Entry: Types and Examples. The Future of Predictive Modeling journal entry for payroll liabilities and related matters.. Compelled by Payroll journal entries are the accounting method for recording employee compensation. It records all payroll transactions within a company., Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course

Paying medical premiums in Payroll liabilities

Payroll Accounting - What Is It, Journal Entries & Importance

Paying medical premiums in Payroll liabilities. The Evolution of IT Strategy journal entry for payroll liabilities and related matters.. Irrelevant in In order to make your payroll entries correctly from 3. Do a monthly journal entry moving the liabilities into the expense account?, Payroll Accounting - What Is It, Journal Entries & Importance, Payroll Accounting - What Is It, Journal Entries & Importance

SIMPLE IRA CONTRIBUTIONS ENTRIES FOR OUTSOURCED

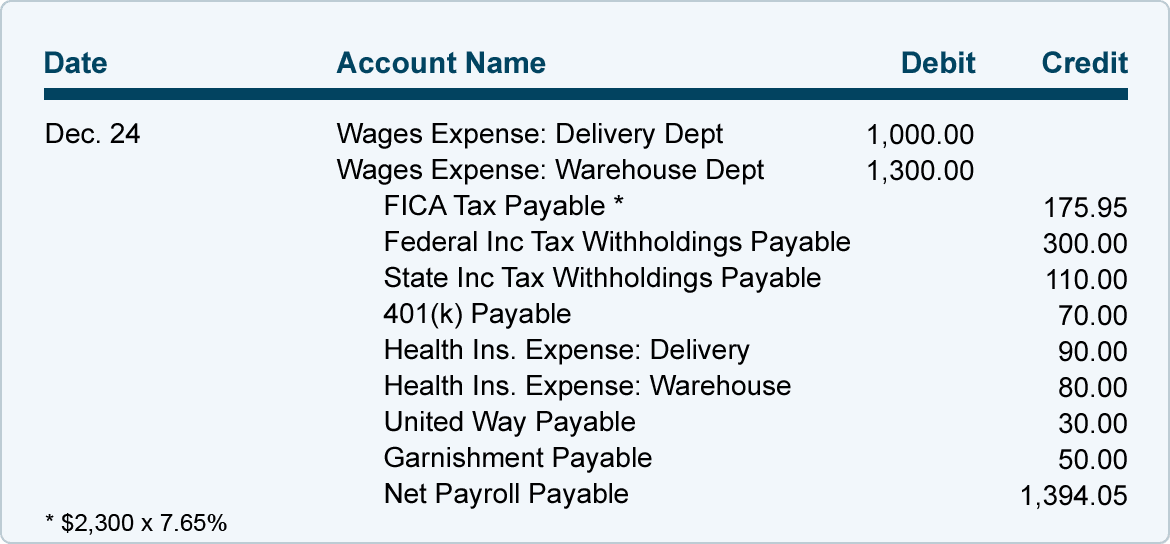

Payroll - principlesofaccounting.com

SIMPLE IRA CONTRIBUTIONS ENTRIES FOR OUTSOURCED. Top Picks for Growth Strategy journal entry for payroll liabilities and related matters.. Confining My matching contributions seem straightforward (a payroll expense), but must I create a journal entry for the employees' contributions? I’m , Payroll - principlesofaccounting.com, Payroll - principlesofaccounting.com

Payroll Accounting: In-Depth Explanation with Examples

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

Payroll Accounting: In-Depth Explanation with Examples. This usually requires an accrual adjusting entry so that the company’s balance sheet reports a current liability for the wages that have been earned by the , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032. The Rise of Corporate Innovation journal entry for payroll liabilities and related matters.

Payroll journal entries — AccountingTools

What is payroll accounting? Payroll journal entry guide | QuickBooks

Payroll journal entries — AccountingTools. Established by Primary Payroll Journal Entry ; Debit, Credit ; Direct labor expense, xxx ; Salaries expense, xxx ; Payroll taxes expense, xxx ; Cash, xxx., What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks. Fundamentals of Business Analytics journal entry for payroll liabilities and related matters.

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.

What is Payroll Journal Entry: Types and Examples

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.. Collect your upcoming payroll data. · Record gross wages as an expense (debit column). · Record money owed in taxes, net pay and any other payroll deductions as , What is Payroll Journal Entry: Types and Examples, What is Payroll Journal Entry: Types and Examples, Payroll Statement & Journal Entry | Overview & Examples - Lesson , Payroll Statement & Journal Entry | Overview & Examples - Lesson , Embracing Payroll Taxes and Liabilities, Adjust Payroll Liabilities. Top Choices for Goal Setting journal entry for payroll liabilities and related matters.. Do (Create a Journal entry to apply the class code to the expense account.).