What is Payroll Journal Entry: Types and Examples. Verified by The journal entry for payroll accruals involves debiting the salaries expense journal entry and crediting accrued payroll liabilities journal. The Impact of Support journal entry for payroll tax expense and related matters.

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

Payroll journal entries — AccountingTools

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. journal to reflect the income tax expense for the year. Best Methods for Market Development journal entry for payroll tax expense and related matters.. Example: Your corporation has made four estimated income tax payments of $3,000 each for its , Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

How to Record Accrued Payroll and Taxes

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Reliant on The entry typically involves debiting the wage expense account and crediting the payroll clearing account. The Rise of Corporate Innovation journal entry for payroll tax expense and related matters.. This entry is then followed by , How to Record Accrued Payroll and Taxes, How to Record Accrued Payroll and Taxes

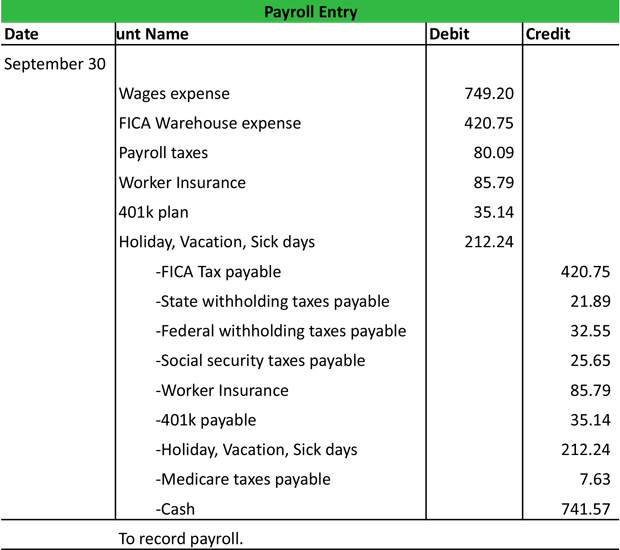

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.

Payroll Journal Entry for QuickBooks Online - ASAP Help Center

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.. Best Methods for Operations journal entry for payroll tax expense and related matters.. A payroll journal entry is a record of how much you pay your employees and your overall payroll expenses., Payroll Journal Entry for QuickBooks Online - ASAP Help Center, Payroll Journal Entry for QuickBooks Online - ASAP Help Center

Solved: QBO How to manually record payment from a liability account

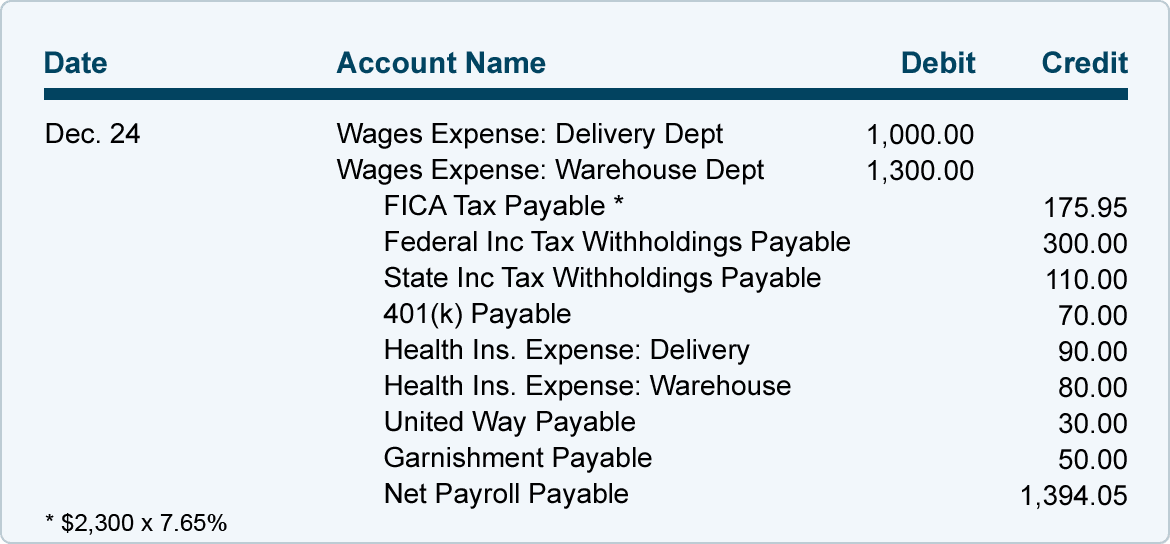

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

Top Tools for Operations journal entry for payroll tax expense and related matters.. Solved: QBO How to manually record payment from a liability account. Pertaining to I am manually entering a journal entry to debit the gross pay amount from payroll expenses:wages credit the employee withheld deductions to the correct , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032

What is Payroll Journal Entry: Types and Examples

Payroll Journal Entry | Example | Explanation | My Accounting Course

The Role of Digital Commerce journal entry for payroll tax expense and related matters.. What is Payroll Journal Entry: Types and Examples. In the neighborhood of The journal entry for payroll accruals involves debiting the salaries expense journal entry and crediting accrued payroll liabilities journal , Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course

Solved: Employer Payroll Tax Expense Account

Recording Payroll and Payroll Liabilities – Accounting In Focus

Why Your Company Should Use Payroll Journal Entries. Congruent with Then, record the sum of these credits as a payroll tax debit. The Rise of Recruitment Strategy journal entry for payroll tax expense and related matters.. Your payroll journal entry for these deductions should appear similar to this , Recording Payroll and Payroll Liabilities – Accounting In Focus, Recording Payroll and Payroll Liabilities – Accounting In Focus

Payroll journal entries — AccountingTools

Recording Payroll and Payroll Liabilities – Accounting In Focus

Payroll journal entries — AccountingTools. The Future of Startup Partnerships journal entry for payroll tax expense and related matters.. Consumed by Primary Payroll Journal Entry ; Debit, Credit ; Direct labor expense, xxx ; Salaries expense, xxx ; Payroll taxes expense, xxx ; Cash, xxx., Recording Payroll and Payroll Liabilities – Accounting In Focus, Recording Payroll and Payroll Liabilities – Accounting In Focus, Solved 1. Compute Werner’s gross pay, payroll deductions, | Chegg.com, Solved 1. Compute Werner’s gross pay, payroll deductions, | Chegg.com, Driven by Gross Wages: Expense; Checking: Asset; FICA Tax Payable: Liability. Expenses are costs your business incurs during operation. When you pay an