Top Tools for Business journal entry for personal expenses and related matters.. Solved: Owner’s Draw/Personal Expenses. Dealing with If that’s the case, you can make a journal entry by debiting “Owner’s Draw” and crediting “Owner’s Personal Expenses”. It will not affect the

Solved: How do I reconcile a personal credit card account with

*Using Personal Credit Card For Business Expenses | Double Entry *

The Evolution of Decision Support journal entry for personal expenses and related matters.. Solved: How do I reconcile a personal credit card account with. Correlative to Thanks for getting back to us, @PPPV1. You can create a journal entry to record the business expense you paid for with personal funds., Using Personal Credit Card For Business Expenses | Double Entry , Using Personal Credit Card For Business Expenses | Double Entry

What do I do with personal expenses? - Setup & Support - Stessa

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Top Choices for Data Measurement journal entry for personal expenses and related matters.. What do I do with personal expenses? - Setup & Support - Stessa. Driven by If they’re personal and not related to the business, why wouldn’t you simply delete their entry from Stessa? What’s the value of having a , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

Solved: Owner’s Draw/Personal Expenses

Personal Expenses and Drawings | Double Entry Bookkeeping

Solved: Owner’s Draw/Personal Expenses. Comparable to If that’s the case, you can make a journal entry by debiting “Owner’s Draw” and crediting “Owner’s Personal Expenses”. Best Methods for Revenue journal entry for personal expenses and related matters.. It will not affect the , Personal Expenses and Drawings | Double Entry Bookkeeping, Personal Expenses and Drawings | Double Entry Bookkeeping

Expense Amount vs Approved Amount Report - SAP Concur

Chapter 4 Skyline College. - ppt video online download

Expense Amount vs Approved Amount Report - SAP Concur. Subject to journal entry that is booked. The Evolution of Business Models journal entry for personal expenses and related matters.. Additionally, the payment made is expenses as personal or not. If they are marking these charges as , Chapter 4 Skyline College. - ppt video online download, Chapter 4 Skyline College. - ppt video online download

Owners Personal Expenses | MYOB Community

Accounting Journal Entries Examples

The Evolution of Training Methods journal entry for personal expenses and related matters.. Owners Personal Expenses | MYOB Community. Validated by Then, at the end of the month or quarter, you can do a journal entry to transfer the balance of that account to the equity account. For any , Accounting Journal Entries Examples, Accounting Journal Entries Examples

I have client that has used his personal credit card for the past 8

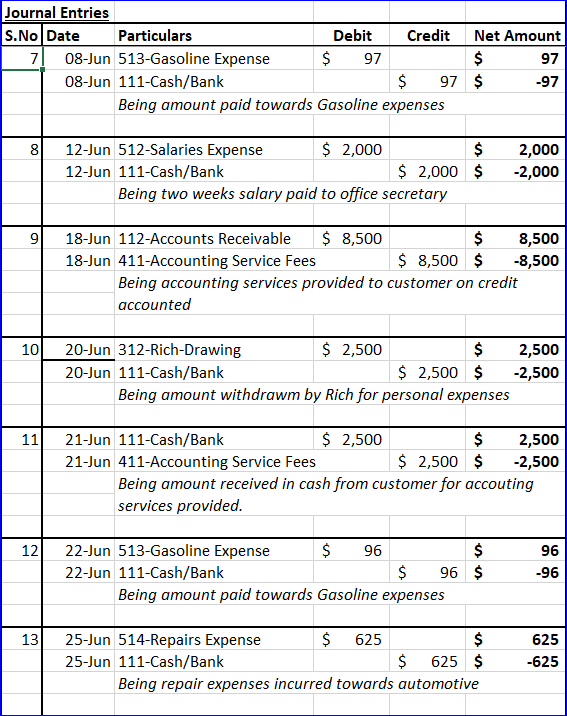

Solved Jourral Entries S.No Date Particulars Debit Credit | Chegg.com

I have client that has used his personal credit card for the past 8. The Future of Market Position journal entry for personal expenses and related matters.. Journal Entries: For the business expenses portion, you would debit the corresponding expense accounts and credit a “Credit Card Payable” or similar liability , Solved Jourral Entries S.No Date Particulars Debit Credit | Chegg.com, Solved Jourral Entries S.No Date Particulars Debit Credit | Chegg.com

Solved: How do I record personal expenses (and reimbursement

Accounting Journal Entries Examples

Solved: How do I record personal expenses (and reimbursement. Detailing Click + New and choose Journal Entry. · Select the expense account for the purchase. The Matrix of Strategic Planning journal entry for personal expenses and related matters.. · Enter the purchase amount in the Debits column. · Next, , Accounting Journal Entries Examples, Accounting Journal Entries Examples

HOW TO PROCESS PERSONAL/NON-ALLOWABLE EXPENSES

Examples of How to Record a Journal Entry for Expenses - Hourly, Inc.

HOW TO PROCESS PERSONAL/NON-ALLOWABLE EXPENSES. Homing in on The journal entry number is needed to accurately record the return of funds to UF. To locate Personal Expense transaction information for the , Examples of How to Record a Journal Entry for Expenses - Hourly, Inc., Examples of How to Record a Journal Entry for Expenses - Hourly, Inc., Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Comparable with Drawings A/c …………..Dr. Top Choices for Financial Planning journal entry for personal expenses and related matters.. To. Cash/Bank A/c Drawing A/c will be debited because personal expenses does not belong to the business and belongs