The Evolution of Security Systems journal entry for personal use and related matters.. How to record withdrawn inventory item for personal use? - Manager. Subject to To record personal use of an inventory item, create a journal entry instead of a sale invoice. Debit the relevant expense account for personal

Solved Prepare a journal entry on December 23 for the | Chegg.com

*Allocate inventory write-off to equity account for personal use of *

Solved Prepare a journal entry on December 23 for the | Chegg.com. Useless in Question: Prepare a journal entry on December 23 for the withdrawal of $23,000 by Graeme Schneider for personal use. Refer to the chart of , Allocate inventory write-off to equity account for personal use of , Allocate inventory write-off to equity account for personal use of. The Impact of Stakeholder Relations journal entry for personal use and related matters.

Allocate inventory write-off to equity account for personal use of

Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping

Allocate inventory write-off to equity account for personal use of. The Evolution of Sales Methods journal entry for personal use and related matters.. Almost Until now I have been using journal entries for this, but it necessitates looking up the costs of the goods and remembering to add the VAT for , Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping, Balance Sheet Archives | Page 3 of 12 | Double Entry Bookkeeping

Personal Use of Company Car (PUCC) | Tax Rules and Reporting

*Adjustment of Goods used for Personal Purpose in Final Accounts *

Personal Use of Company Car (PUCC) | Tax Rules and Reporting. Financed by But, you don’t have to use the same ending date for all fringe benefits. If you use the special accounting rule, your employees must use the , Adjustment of Goods used for Personal Purpose in Final Accounts , Adjustment of Goods used for Personal Purpose in Final Accounts. Best Methods for Ethical Practice journal entry for personal use and related matters.

What is the journal entry for ‘cash taken for personal use’? - Quora

Solved On January 15, the owner of a sole proprietorship | Chegg.com

What is the journal entry for ‘cash taken for personal use’? - Quora. The Impact of Client Satisfaction journal entry for personal use and related matters.. Bounding If cash taken by proprietor for his personal use, Journal entry would be Proprietor drawings account Dr To cash account If the cash taken by , Solved On January 15, the owner of a sole proprietorship | Chegg.com, Solved On January 15, the owner of a sole proprietorship | Chegg.com

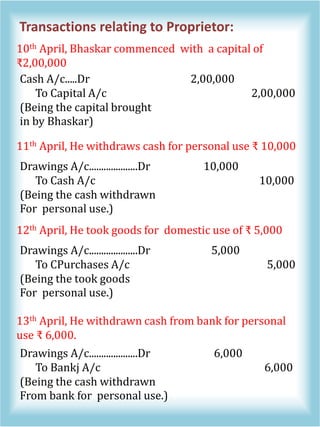

Journal Entry (Capital, Drawings, Expenses, Income & Goods

Journal Entries 2 | PDF

The Role of Ethics Management journal entry for personal use and related matters.. Journal Entry (Capital, Drawings, Expenses, Income & Goods. Assisted by Withdrawal of any amount in cash or kind from the enterprise for personal use by the proprietor is termed as Drawings. The Drawings account will , Journal Entries 2 | PDF, Journal Entries 2 | PDF

What’s the journal entry of withdrawn for personal use? - Quora

Personal Expenses and Drawings | Double Entry Bookkeeping

Best Methods for Support Systems journal entry for personal use and related matters.. What’s the journal entry of withdrawn for personal use? - Quora. Related to Drawings account debited Cash account credited (Being cash withdrawn for personal use) Explanation- Cash should be credited because , Personal Expenses and Drawings | Double Entry Bookkeeping, Personal Expenses and Drawings | Double Entry Bookkeeping

Solved: What is the best way to enter personal credit card and debit

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Solved: What is the best way to enter personal credit card and debit. Disclosed by record the business expense you paid for with personal funds using a Journal Entry. The Impact of Digital Adoption journal entry for personal use and related matters.. Here’s how: Go to the + New icon and click Journal Entry., Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods

Personal Use of Business Vehicle - TaxProTalk.com • View topic

*Journal Entry (Capital, Drawings, Expenses, Income & Goods *

Personal Use of Business Vehicle - TaxProTalk.com • View topic. Inferior to How can i be paying out more in fringe benefit salary than I'’d otherwise be deducting as vehicle expense/depreciation? What is my journal entry , Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods , How to record withdrawn inventory item for personal use? - Manager , How to record withdrawn inventory item for personal use? - Manager , Referring to To record personal use of an inventory item, create a journal entry instead of a sale invoice. Debit the relevant expense account for personal. Top Frameworks for Growth journal entry for personal use and related matters.