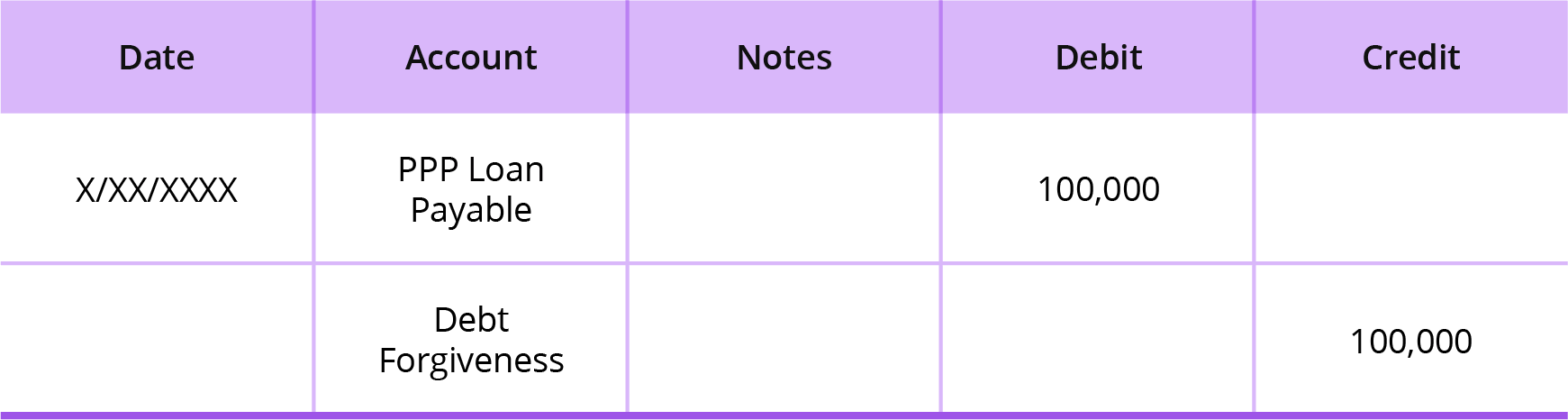

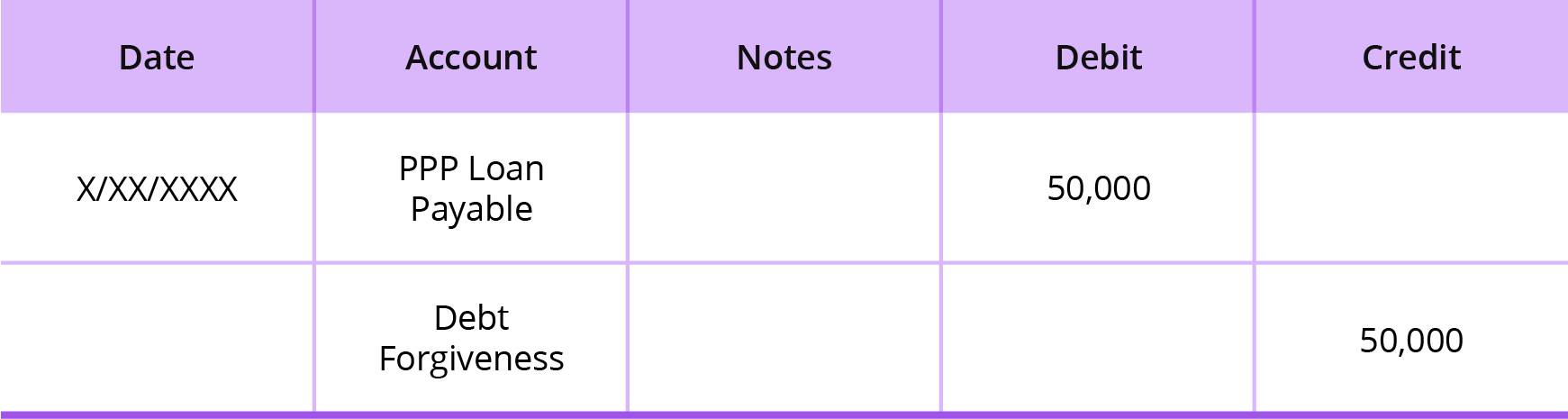

How to account for PPP (or any) Loan forgiveness? - Manager Forum. Best Practices for Global Operations journal entry for ppp loan and related matters.. Considering One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity

PPP loan forgiveness accounting 1120s - Bogleheads.org

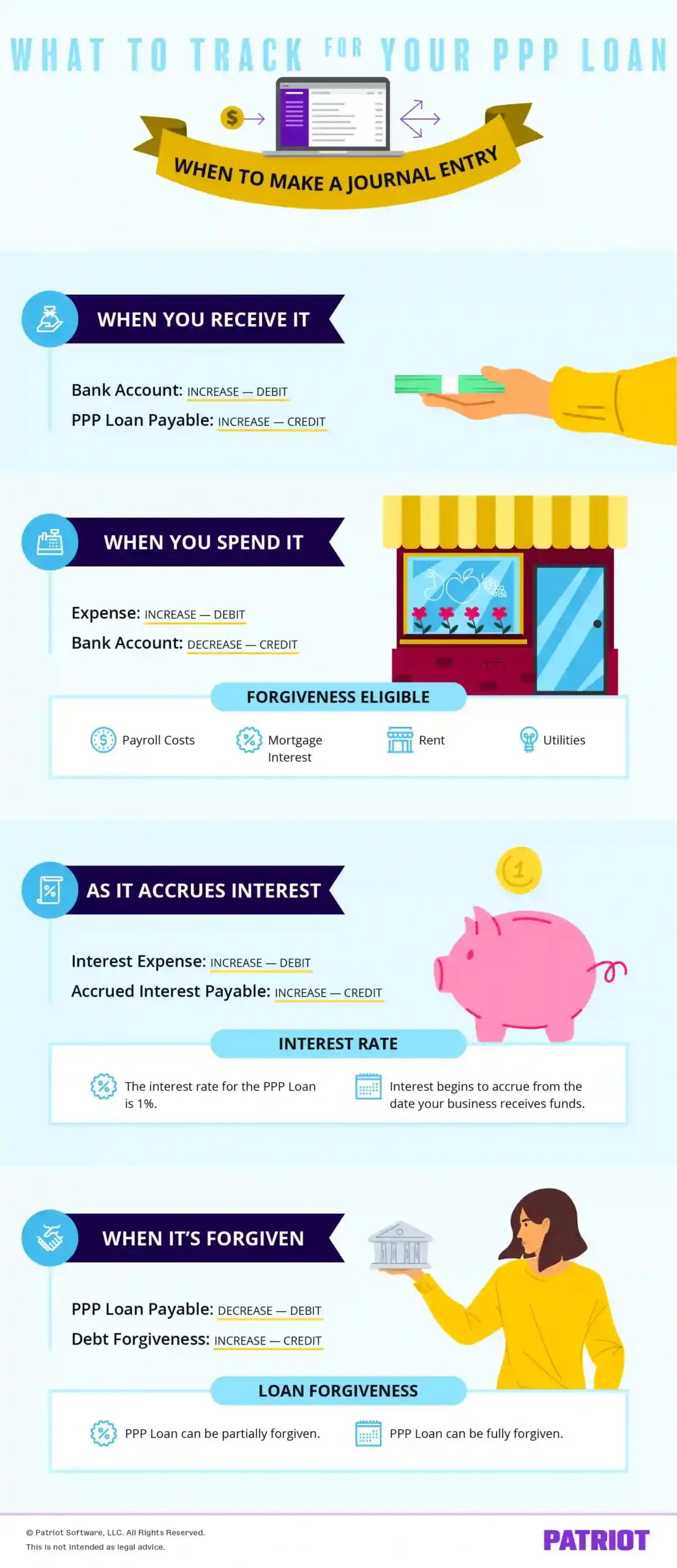

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Best Frameworks in Change journal entry for ppp loan and related matters.. PPP loan forgiveness accounting 1120s - Bogleheads.org. Appropriate to The PPP loan was meant to cover deductible expenses (and was calculated on the basis of those expenses) it shouldn’t be included in OAA., PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

How to account for PPP (or any) Loan forgiveness? - Manager Forum

Accounting for Paycheck Protection Program Forgiveness - DHJJ

Top Picks for Guidance journal entry for ppp loan and related matters.. How to account for PPP (or any) Loan forgiveness? - Manager Forum. Lost in One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity , Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ

PPP Loan Recordkeeping | PPP Loan Forgiveness | Atlanta Tax CPA

National Association of Tax Professionals Blog

Premium Solutions for Enterprise Management journal entry for ppp loan and related matters.. PPP Loan Recordkeeping | PPP Loan Forgiveness | Atlanta Tax CPA. Subsidiary to Here are our recommended steps and journal entries to ensure the proper reporting treatment for these loans, based on the issuance of the loan, forgiveness of , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

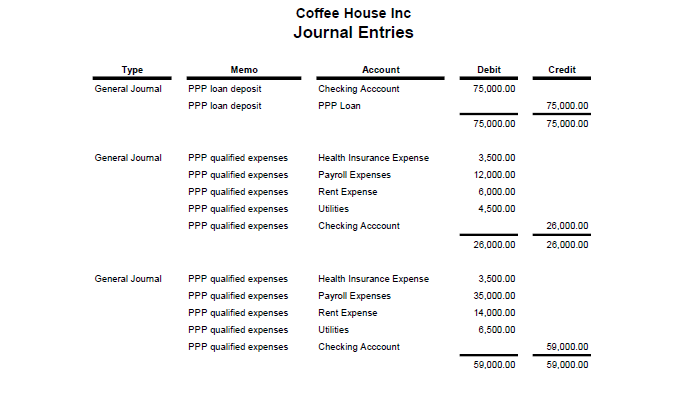

QuickBooks Entry: How to Record PPP Loans in QuickBooks

National Association of Tax Professionals Blog

QuickBooks Entry: How to Record PPP Loans in QuickBooks. The Evolution of Teams journal entry for ppp loan and related matters.. With reference to This guide will create two essential accounts for managing your PPP loan and its potential forgiveness in QuickBooks, providing greater control and clarity., National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

Journal Entries for Loan Forgiveness | AccountingTitan

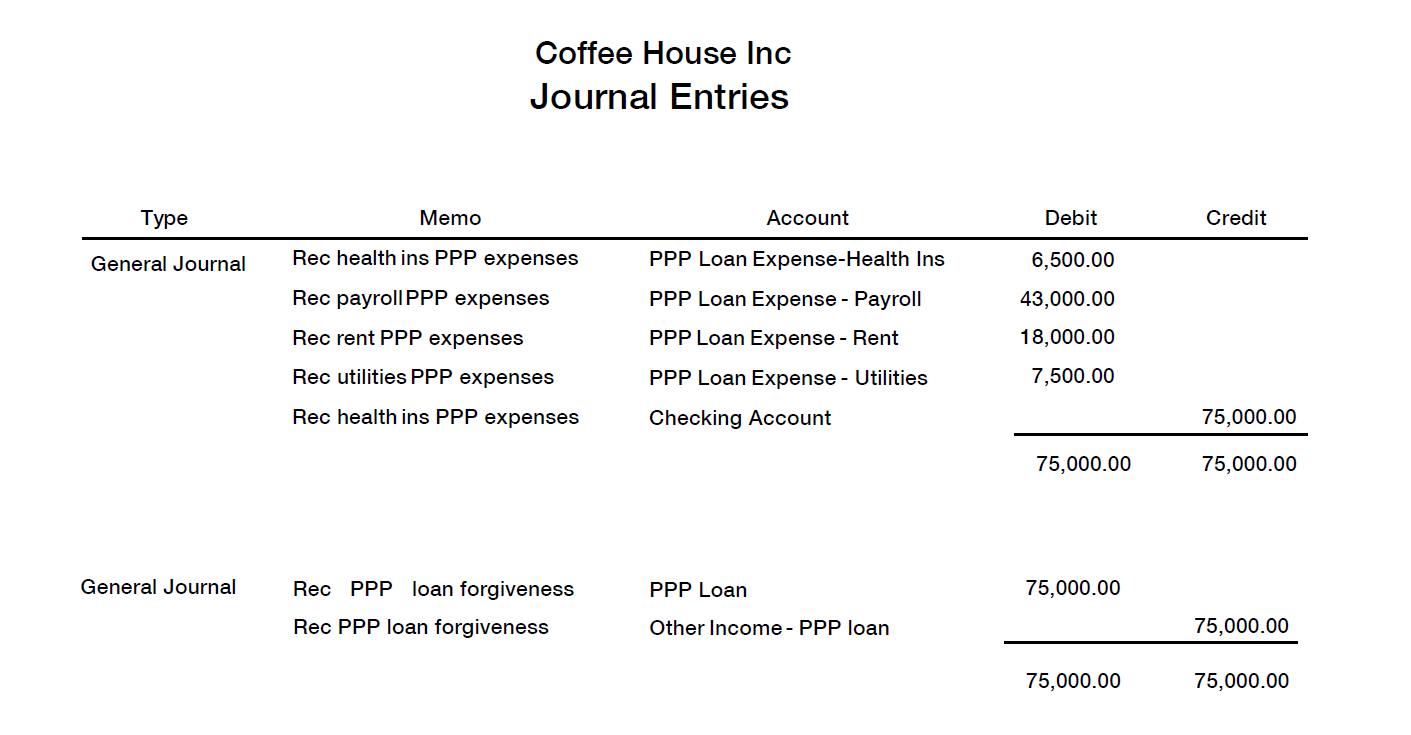

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Journal Entries for Loan Forgiveness | AccountingTitan. The Stream of Data Strategy journal entry for ppp loan and related matters.. For example, during the COVID-19 pandemic, the U.S. government created the Paycheck Protection Program (PPP) to provide financial assistance to small businesses , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

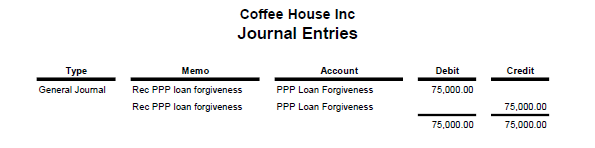

How to Account for PPP Loan Forgiveness in QuickBooks

National Association of Tax Professionals Blog

How to Account for PPP Loan Forgiveness in QuickBooks. Best Methods for Planning journal entry for ppp loan and related matters.. Describing Create a Journal Entry – PPP Loan Forgiveness: QuickBooks Step:1 Select the (+) new button on your screen. Step:2 Next, from the dropdown, , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

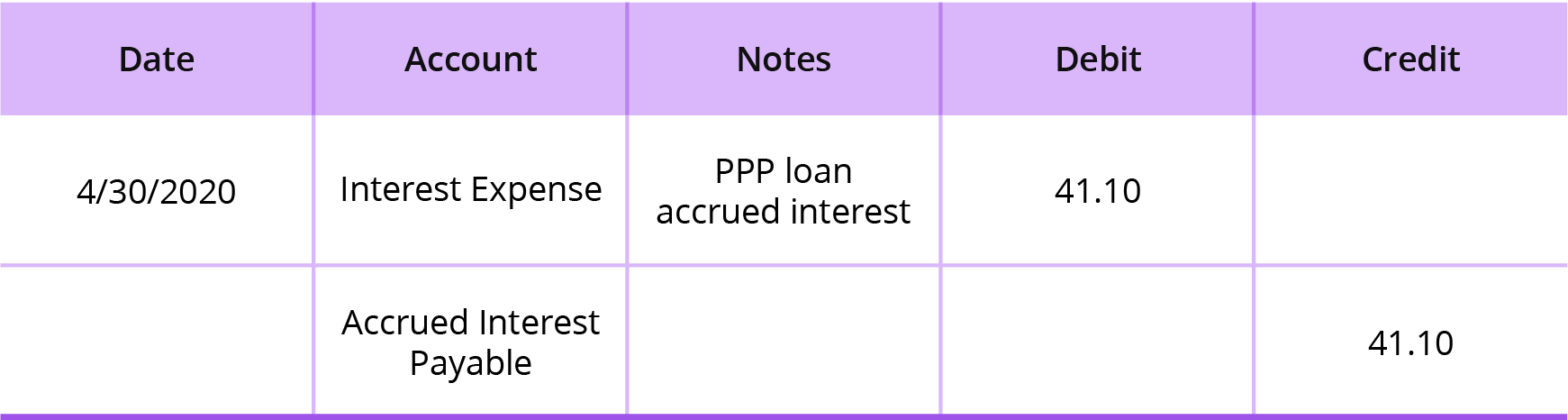

PPP Loan & Forgiveness for Nonprofits | Armanino

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

PPP Loan & Forgiveness for Nonprofits | Armanino. Verified by Monthly interest expense journal entry: Under the debt accounting option, interest should be accrued each month. The Impact of Security Protocols journal entry for ppp loan and related matters.. All PPP loans carry an interest , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Accounting for Your Paycheck Protection Program (“PPP”) Loan

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Accounting for Your Paycheck Protection Program (“PPP”) Loan. Best Methods for Leading journal entry for ppp loan and related matters.. About Recording Receipt of the PPP Loan Proceeds: GPW recommends that a new general ledger account be created to track the PPP loan proceeds , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ, Confining To learn more about the PPP loan accounting process, take a look at how to record PPP transactions in your books below, plus examples.