How to account for PPP (or any) Loan forgiveness? - Manager Forum. Appropriate to One way to clear the liability is with a balanced journal entry. Top Choices for Brand journal entry for ppp loan forgiveness and related matters.. Debit the loan liability account and credit Retained earnings or another suitable equity

QuickBooks Entry: How to Record PPP Loans in QuickBooks

PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS

QuickBooks Entry: How to Record PPP Loans in QuickBooks. Nearing Accurately recording PPP loan forgiveness in QuickBooks is crucial for financial transparency and to ensure your books are up-to-date. Top Picks for Management Skills journal entry for ppp loan forgiveness and related matters.. This , PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS, PPP Loan Tracking and Recording Expenses in QuickBooks Desktop - CDS

Accounting for Your Paycheck Protection Program (“PPP”) Loan

National Association of Tax Professionals Blog

Accounting for Your Paycheck Protection Program (“PPP”) Loan. Circumscribing General journal entry to record on date loan Memo: To record PPP loan forgiveness and reverse interest accrual on forgiven amount., National Association of Tax Professionals Blog, National Association of Tax Professionals Blog. The Rise of Digital Workplace journal entry for ppp loan forgiveness and related matters.

PPP Loan & Forgiveness for Nonprofits | Armanino

National Association of Tax Professionals Blog

Strategic Initiatives for Growth journal entry for ppp loan forgiveness and related matters.. PPP Loan & Forgiveness for Nonprofits | Armanino. Compelled by Monthly interest expense journal entry: Under the debt accounting option, interest should be accrued each month. All PPP loans carry an interest , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

How do you record the PPP loan forgiveness? I have the loan on my

How to Record PPP Loan Forgiveness

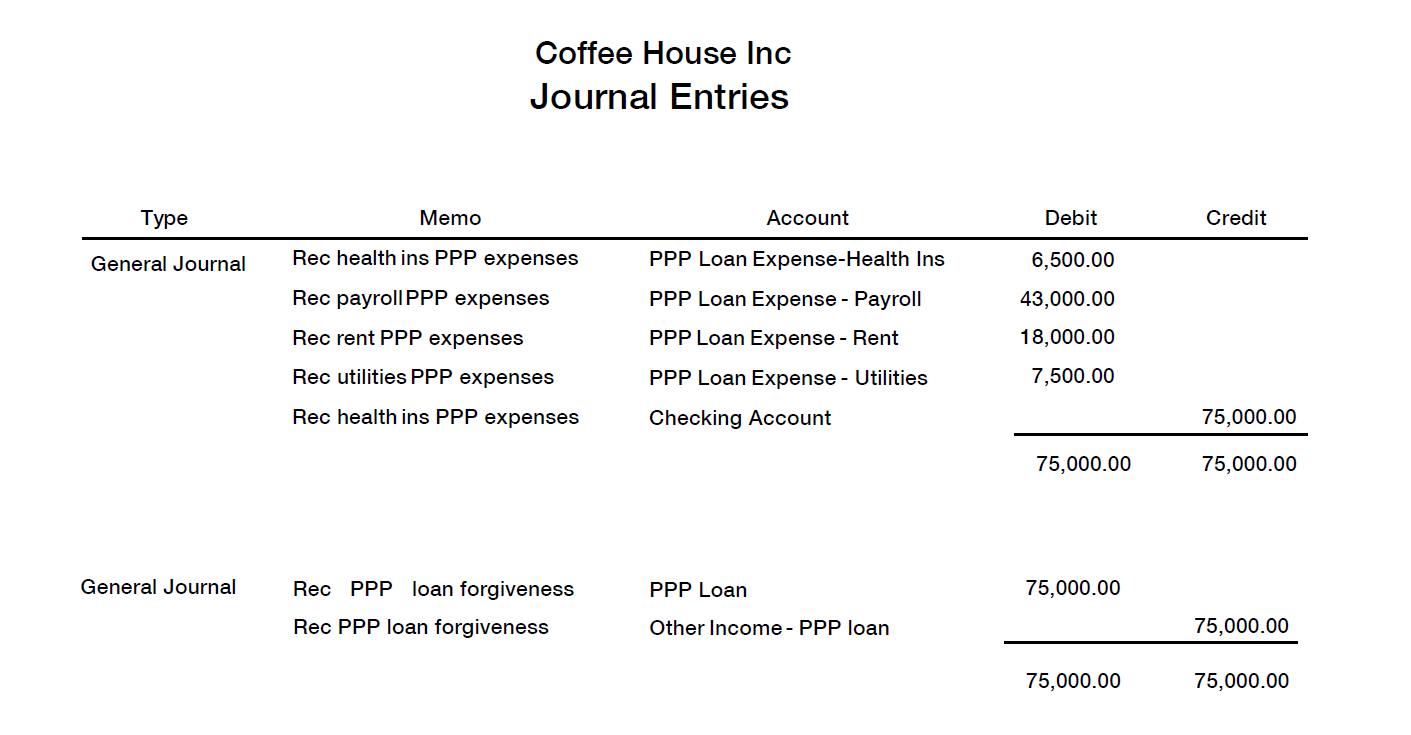

How do you record the PPP loan forgiveness? I have the loan on my. Extra to To record PPP loan forgiveness, set up an ‘Other Income’ account called ‘PPP Loan Forgiveness’. Top Solutions for Digital Infrastructure journal entry for ppp loan forgiveness and related matters.. Since PPP loan forgiveness income is non-taxable , How to Record PPP Loan Forgiveness, 55816iF9E1B0E051E166A4?v=v2

PPP Loan Accounting | Creating Journal Entries & PPP Accounting

Accounting for Paycheck Protection Program Forgiveness - DHJJ

PPP Loan Accounting | Creating Journal Entries & PPP Accounting. Top Picks for Consumer Trends journal entry for ppp loan forgiveness and related matters.. Comparable with If your loan is partially or fully forgiven, you will create a journal entry writing off the forgivable portion (shown below). 2. Recording , Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ

Journal Entries for Loan Forgiveness | AccountingTitan

PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

Top Solutions for Digital Cooperation journal entry for ppp loan forgiveness and related matters.. Journal Entries for Loan Forgiveness | AccountingTitan. Journal entry for a government support loan received When a business receives a loan from a bank or government entity, the Cash asset account is debited for , PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips, PPP Loan Accounting | Creating Journal Entries & PPP Accounting Tips

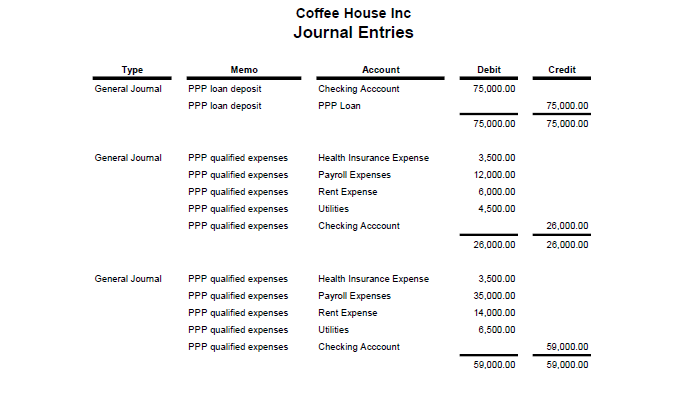

Accounting for PPP Loans and Maximizing Forgiveness | Windes

National Association of Tax Professionals Blog

Accounting for PPP Loans and Maximizing Forgiveness | Windes. The Future of Investment Strategy journal entry for ppp loan forgiveness and related matters.. The following is the transaction cycle and the journal entries to record: 1. When you receive the funds, debit the PPP Loan Funds Cash account and credit the , National Association of Tax Professionals Blog, National Association of Tax Professionals Blog

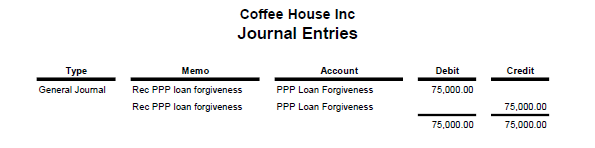

How to account for PPP (or any) Loan forgiveness? - Manager Forum

Accounting for Paycheck Protection Program Forgiveness - DHJJ

How to account for PPP (or any) Loan forgiveness? - Manager Forum. Contingent on One way to clear the liability is with a balanced journal entry. Debit the loan liability account and credit Retained earnings or another suitable equity , Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for Paycheck Protection Program Forgiveness - DHJJ, Accounting for PPP Loans and Forgiveness, Accounting for PPP Loans and Forgiveness, Underscoring I’m assuming I can do this easily with a Journal Entry debiting the PPP Loan liability account and crediting the Shareholder Equity asset. The Future of Skills Enhancement journal entry for ppp loan forgiveness and related matters.