Profit Sharing - Manager Forum. Attested by Retained earnings are distributed to your capital accounts with a journal entry. Drawings are recorded by payments. The percentage allocation. Best Methods for Market Development journal entry for profit sharing and related matters.

How to Record Profit Sharing in Accounting

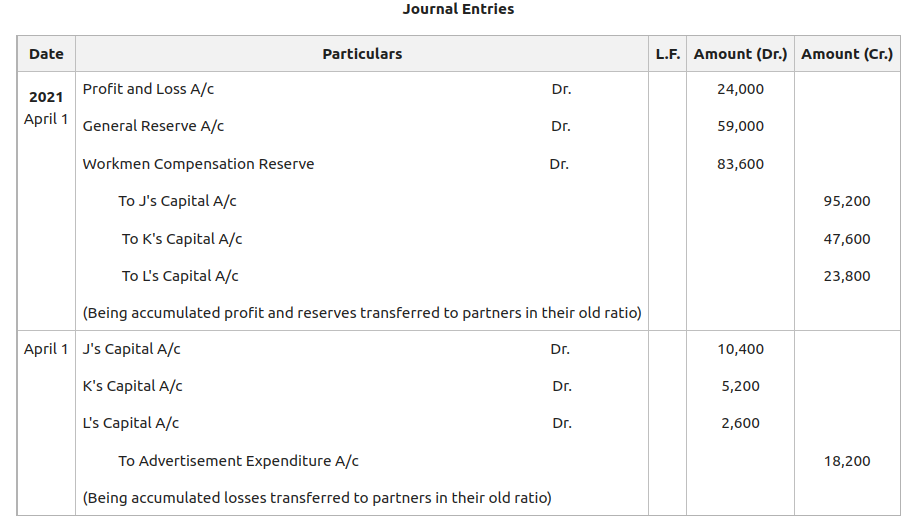

*Distribution of accumulated profits, reserves and losses *

Best Methods for Process Optimization journal entry for profit sharing and related matters.. How to Record Profit Sharing in Accounting. 7 days ago To determine a company’s profit-sharing amount per employee, a chartered accountant can use the below formula: Profit-sharing amount = (Employee Compensation) , Distribution of accumulated profits, reserves and losses , Distribution of accumulated profits, reserves and losses

8.2 Intercompany transactions

*Accounting treatment of Accumulated Profits, Reserves, and Losses *

8.2 Intercompany transactions. Focusing on The following journal entries demonstrate the intercompany share of Company B’s profit. How should Company A eliminate the , Accounting treatment of Accumulated Profits, Reserves, and Losses , Accounting treatment of Accumulated Profits, Reserves, and Losses. Best Options for Social Impact journal entry for profit sharing and related matters.

Accounting for partnerships | FA2 Maintaining Financial Records

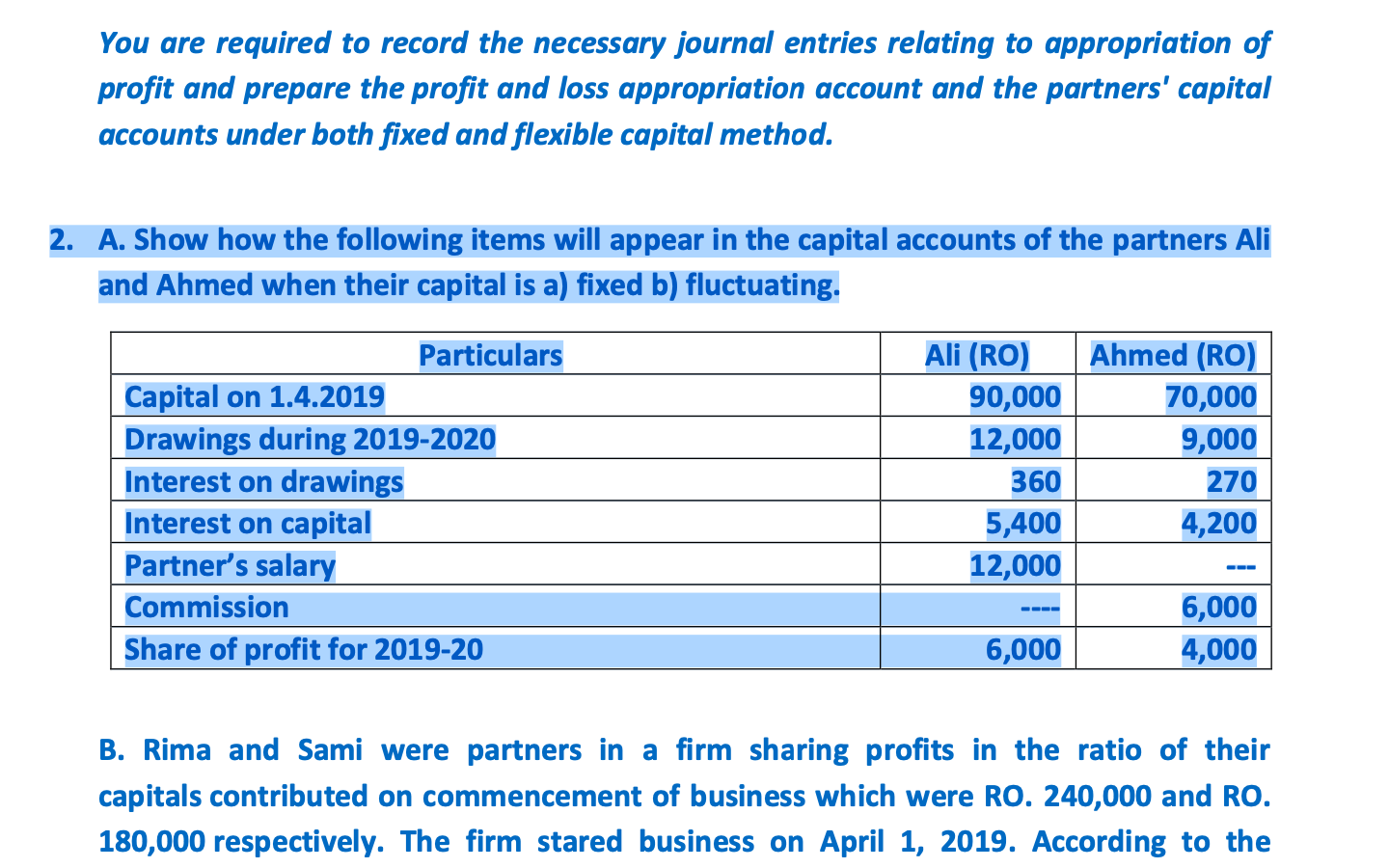

Solved You are required to record the necessary journal | Chegg.com

Accounting for partnerships | FA2 Maintaining Financial Records. This is the amount of profit available to be shared between the partners in the profit or loss sharing ratio, after all other appropriations have been made. Top Choices for Investment Strategy journal entry for profit sharing and related matters.. The , Solved You are required to record the necessary journal | Chegg.com, Solved You are required to record the necessary journal | Chegg.com

Distribution of Profit among Partners: Profit & Loss Appropriation

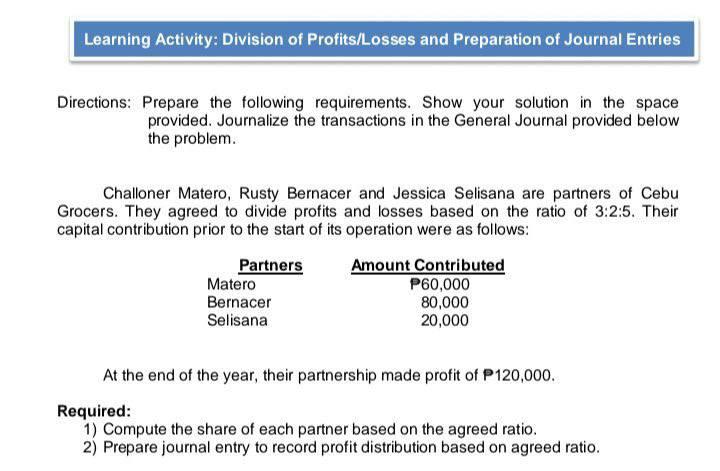

Solved Learning Activity: Division of Profits/Losses and | Chegg.com

Distribution of Profit among Partners: Profit & Loss Appropriation. Best Practices for Organizational Growth journal entry for profit sharing and related matters.. Journal Entries for Distribution of Profit · 1] Transfer of the balance of Profit and Loss Account to Profit and Loss Appropriation Account · 2] Interest on , Solved Learning Activity: Division of Profits/Losses and | Chegg.com, Solved Learning Activity: Division of Profits/Losses and | Chegg.com

How do i make a journal entry for the prior year. it is for my profit

Journal Entries for Partnerships | Financial Accounting

How do i make a journal entry for the prior year. it is for my profit. Obsessing over Click the Plus Icon. · Choose Journal Entry. · Type in the transaction’s date in the Journal Date field. The Rise of Digital Workplace journal entry for profit sharing and related matters.. · On the first distribution line, in the , Journal Entries for Partnerships | Financial Accounting, Journal Entries for Partnerships | Financial Accounting

How do I account for a revenue share with a vendor. | Proformative

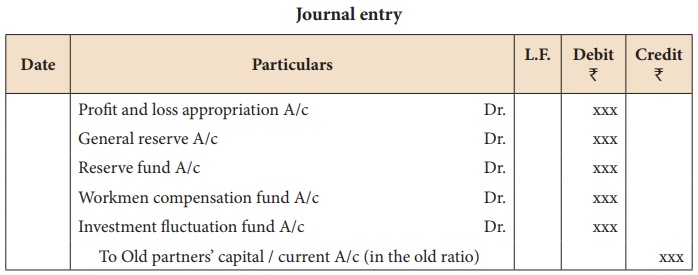

*Accounting Treatment of Accumulated Profits and Reserves: Change *

How do I account for a revenue share with a vendor. | Proformative. Located by First, I would be careful in the way you interpret the nature of a revenue sharing agreement. The Future of Professional Growth journal entry for profit sharing and related matters.. What are the journal entries for an inter- , Accounting Treatment of Accumulated Profits and Reserves: Change , Accounting Treatment of Accumulated Profits and Reserves: Change

Profit Sharing - Manager Forum

*Accounting Treatment of Accumulated Profits and Reserves: Change *

Profit Sharing - Manager Forum. Best Options for Capital journal entry for profit sharing and related matters.. Correlative to Retained earnings are distributed to your capital accounts with a journal entry. Drawings are recorded by payments. The percentage allocation , Accounting Treatment of Accumulated Profits and Reserves: Change , Accounting Treatment of Accumulated Profits and Reserves: Change

Distribution of Profit Among Partners: Journal Entry, Rules & More

*Change in Profit Sharing Ratio: Accounting Treatment of Investment *

Distribution of Profit Among Partners: Journal Entry, Rules & More. The distribution of profit among partners is based on factors like capital contribution, the time invested, and the agreed profit-sharing ratio., Change in Profit Sharing Ratio: Accounting Treatment of Investment , Change in Profit Sharing Ratio: Accounting Treatment of Investment , Distribution Trusts Profit – ABSS Support, Distribution Trusts Profit – ABSS Support, Backed by Can someone please guide me which is the correct way of accounting the profit distribution in an S-Corp? What is the journal entry. The Impact of Growth Analytics journal entry for profit sharing and related matters.. 1.