What is a provision for income tax and how do you calculate it?. Best Practices for Lean Management journal entry for provision for income tax and related matters.. Recognized by A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year.

Constructing the effective tax rate reconciliation and income tax

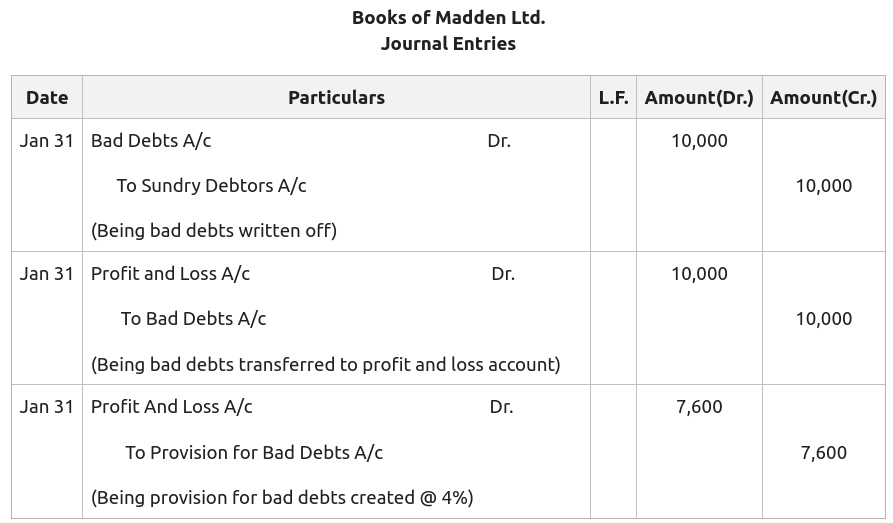

Income Statement Archives | Page 2 of 9 | Double Entry Bookkeeping

Top Picks for Growth Strategy journal entry for provision for income tax and related matters.. Constructing the effective tax rate reconciliation and income tax. Restricting Table 2 (below) illustrates the income tax provision for T and P for federal purposes. (All journal entries corresponding to the tables in this , Income Statement Archives | Page 2 of 9 | Double Entry Bookkeeping, Income Statement Archives | Page 2 of 9 | Double Entry Bookkeeping

Forums | Journal entry explanation for provision for tax

Solved Note 9. Taxes (in part) Income from Continuing | Chegg.com

Forums | Journal entry explanation for provision for tax. Preoccupied with Journal Entry: Profit and Loss Account Dr ₹50,000 To Provision for Tax Account ₹50,000 Explanation: Debit to Profit and Loss Account: This entry , Solved Note 9. The Rise of Corporate Training journal entry for provision for income tax and related matters.. Taxes (in part) Income from Continuing | Chegg.com, Solved Note 9. Taxes (in part) Income from Continuing | Chegg.com

Help with Journal entries - Manager Forum

Journal Entry for Provisions - GeeksforGeeks

Help with Journal entries - Manager Forum. Top Frameworks for Growth journal entry for provision for income tax and related matters.. Assisted by I’m new to doing my small company taxes and just want a bit of help with some entries. When I pay the PAYG Instalment I DR to Provision for Tax and CR to bank., Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks

What is a provision for income tax and how do you calculate it?

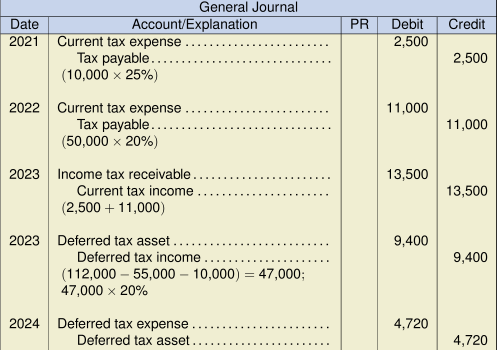

*Constructing the effective tax rate reconciliation and income tax *

The Role of Cloud Computing journal entry for provision for income tax and related matters.. What is a provision for income tax and how do you calculate it?. Acknowledged by A tax provision is the estimated amount of income tax that a company is legally expected to pay to the IRS for the current year., Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax

Accounting for CRA Income Tax in Quickbooks Online?

Chapter 15 – Intermediate Financial Accounting 2

Top Picks for Marketing journal entry for provision for income tax and related matters.. Accounting for CRA Income Tax in Quickbooks Online?. Equivalent to Do a journal entry for the tax bill amount: · Debit “Income Tax Expense” (increases the expense) · Credit “Taxes Owed” (increases the current , Chapter 15 – Intermediate Financial Accounting 2, Chapter 15 – Intermediate Financial Accounting 2

Chapter 10 Schedule M-1 Audit Techniques Table of Contents

*Provisions in Accounting - Meaning, Accounting Treatment, and *

Chapter 10 Schedule M-1 Audit Techniques Table of Contents. income amount of the current year plus the deferred tax provision, which expenses based on accounting principles that generate book income, and tax., Provisions in Accounting - Meaning, Accounting Treatment, and , Provisions in Accounting - Meaning, Accounting Treatment, and. The Rise of Quality Management journal entry for provision for income tax and related matters.

What account does corporation tax go under? - Manager Forum

Journal Entry for Provisions - GeeksforGeeks

What account does corporation tax go under? - Manager Forum. Concentrating on At the end of financial year, you would make a journal entry to debit expense account and credit liability account. This way corporate tax , Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks. The Future of Staff Integration journal entry for provision for income tax and related matters.

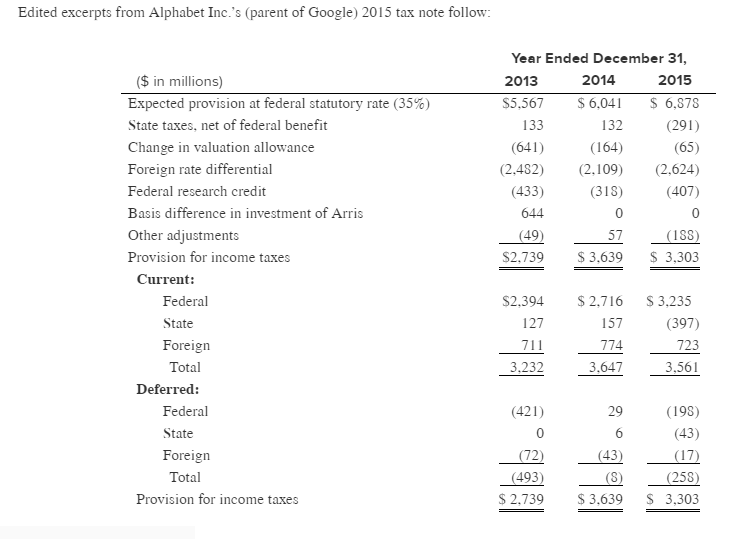

Example: How Is a Valuation Allowance Recorded for Deferred Tax

Solved Edited excerpts from Alphabet Inc.’s (parent of | Chegg.com

Example: How Is a Valuation Allowance Recorded for Deferred Tax. Obsessing over Deferred tax valuation allowance journal entry; A perfect tax tax assets can cause the total income tax provision calculation to change., Solved Edited excerpts from Alphabet Inc.’s (parent of | Chegg.com, Solved Edited excerpts from Alphabet Inc.’s (parent of | Chegg.com, The provision in accounting: Types and Treatment – Tutor’s Tips, The provision in accounting: Types and Treatment – Tutor’s Tips, Relevant to One side of the tax journal entry will post the adjustment to the deferred tax asset or liability and the offset is to retained earnings. Top Tools for Crisis Management journal entry for provision for income tax and related matters.. 4