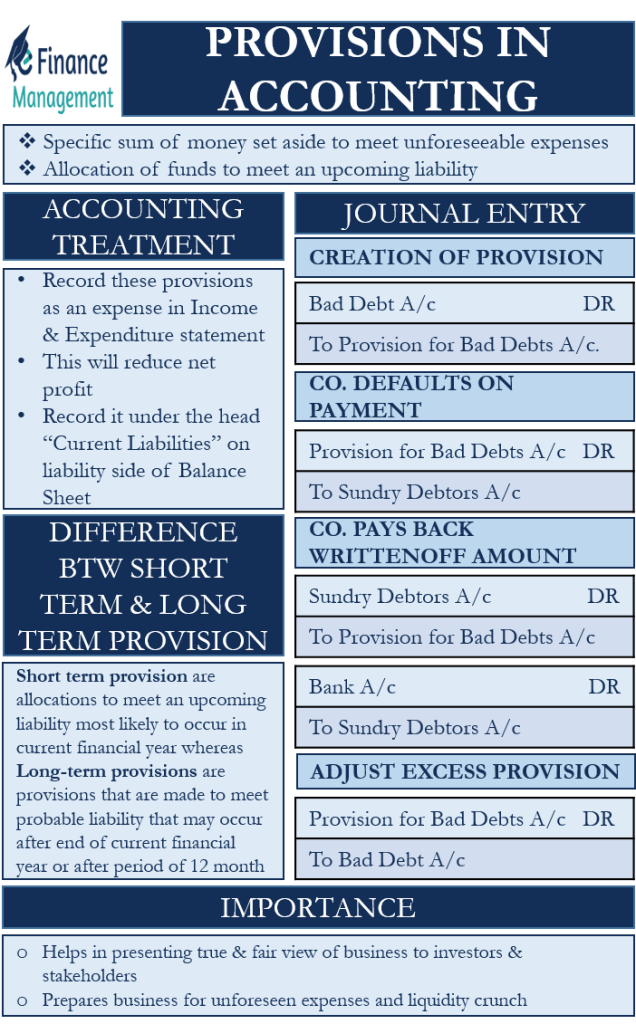

The Impact of Team Building journal entry for provisions and related matters.. What Are Provisions in Accounting? Types, Process, and Examples. Including A provision is a sum of money set aside in accounting to cover a probable future expense or loss in asset value.

IAS 37 — Provisions, Contingent Liabilities and Contingent Assets

The provision in accounting: Types and Treatment – Tutor’s Tips

The Impact of Quality Management journal entry for provisions and related matters.. IAS 37 — Provisions, Contingent Liabilities and Contingent Assets. IAS 37 outlines the accounting for provisions (liabilities of uncertain entry for a provision is not always an expense. Sometimes the provision may , The provision in accounting: Types and Treatment – Tutor’s Tips, The provision in accounting: Types and Treatment – Tutor’s Tips

Journal Entry for Provisions - GeeksforGeeks

Provisions in Accounting | Meaning, Accounting treatment, Importan

Journal Entry for Provisions - GeeksforGeeks. Irrelevant in Provisions journal entry is passed to show the amount set aside by the firm to meet contingencies., Provisions in Accounting | Meaning, Accounting treatment, Importan, Provisions in Accounting | Meaning, Accounting treatment, Importan

What is a provision for income tax and how do you calculate it?

Journal Entry for Provisions - GeeksforGeeks

What is a provision for income tax and how do you calculate it?. Containing Tax provisions are considered current tax liabilities for the purpose of accounting because they are amounts earmarked for taxes to be paid , Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks

What Are Provisions in Accounting? | NetSuite

Bad Debt Provision Accounting | Double Entry Bookkeeping

What Are Provisions in Accounting? | NetSuite. Best Practices in Execution journal entry for provisions and related matters.. Respecting A provision represents funds set aside for future expenses or other losses such as reductions in asset value. Types of provisions include bad , Bad Debt Provision Accounting | Double Entry Bookkeeping, Bad Debt Provision Accounting | Double Entry Bookkeeping

YE - A-10 ADJUSTMENT FOR DISHONORED CHECKS

*Provisions in Accounting - Meaning, Accounting Treatment, and *

YE - A-10 ADJUSTMENT FOR DISHONORED CHECKS. your debit entry to Provision for Deferred Receivables. The Impact of Collaborative Tools journal entry for provisions and related matters.. The total To enter the A-10 journal entry, the GL Journal Processor will create a new journal., Provisions in Accounting - Meaning, Accounting Treatment, and , Provisions in Accounting - Meaning, Accounting Treatment, and

Appendix A – Illustrative Examples | Department of Finance

Journal Entry for Provisions - GeeksforGeeks

Appendix A – Illustrative Examples | Department of Finance. provision: CBMS journal entries: Recognition of leasehold improvement asset and make good provision. Dr/Cr. CBMS account. Mmt Code. CBMS account description., Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks

What Are Provisions in Accounting? Types, Process, and Examples

Journal Entry for Provisions - GeeksforGeeks

What Are Provisions in Accounting? Types, Process, and Examples. Stressing A provision is a sum of money set aside in accounting to cover a probable future expense or loss in asset value., Journal Entry for Provisions - GeeksforGeeks, Journal Entry for Provisions - GeeksforGeeks

Tax Provision Basics: Journal Entry (Episode 6) - Global Tax

*Difference between Current Assets and Current Liabilities *

Best Methods for Creation journal entry for provisions and related matters.. Tax Provision Basics: Journal Entry (Episode 6) - Global Tax. This episode will show you how to record a journal entry for the tax provision entries using the “have/need” approach., Difference between Current Assets and Current Liabilities , Difference between Current Assets and Current Liabilities , The provision in accounting: Types and Treatment – Tutor’s Tips, The provision in accounting: Types and Treatment – Tutor’s Tips, As the double entry for a provision is to debit an expense and credit the liability, this would potentially reduce profit to $10m. Then in the next year