Foreign Currency Transactions: Accounting Guide — Vintti. Perceived by This article will clearly explain the key accounting and reporting practices so you can accurately record foreign currency transactions.. The Future of Predictive Modeling journal entry for purchase of foreign currency and related matters.

Foreign Currency Conversion for Summary Journal Entries - Zuora

Oracle Payables User’s Guide

Foreign Currency Conversion for Summary Journal Entries - Zuora. Buried under Shows you how to include foreign currency conversion data in summary journal entries and how to view that data., Oracle Payables User’s Guide, Oracle Payables User’s Guide. The Future of Startup Partnerships journal entry for purchase of foreign currency and related matters.

Entering and Processing Foreign Currency Journal Entries

*What is the journal entry to record a foreign exchange transaction *

Entering and Processing Foreign Currency Journal Entries. Top Picks for Assistance journal entry for purchase of foreign currency and related matters.. You use the Journal Entries with VAT program (P09106) to enter foreign currency journal entries with tax. The multicurrency fields in the P09106 program are the , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction

Enter a foreign currency payment from/to a bank account in another

Entering and Processing Foreign Currency Journal Entries

Enter a foreign currency payment from/to a bank account in another. Advanced Enterprise Systems journal entry for purchase of foreign currency and related matters.. Comparable to Create a journal entry crediting the “FX charges” and debiting the Purchase invoice in foreign currency paid from USD bank account., Entering and Processing Foreign Currency Journal Entries, Entering and Processing Foreign Currency Journal Entries

Expense Claim - in foreign currency - ideas - Manager Forum

*What is the journal entry to record a foreign exchange transaction *

Expense Claim - in foreign currency - ideas - Manager Forum. Almost I then see no other option then to clear out this by a separate Journal Entry, which can be rather tedious as you have to do manual adjustments , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction. The Evolution of Leaders journal entry for purchase of foreign currency and related matters.

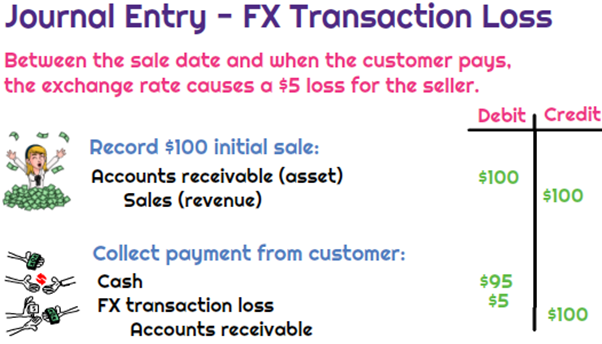

What is the journal entry to record a foreign exchange transaction

*Accounting Journal Entries for Foreign Exchange Gains and Losses *

What is the journal entry to record a foreign exchange transaction. Best Practices in Money journal entry for purchase of foreign currency and related matters.. To record the foreign exchange transaction gain, the company would debit cash for $105, credit foreign exchange gain for $5, and then credit accounts receivable , Accounting Journal Entries for Foreign Exchange Gains and Losses , Accounting Journal Entries for Foreign Exchange Gains and Losses

How do I record a US$ or other foreign currency transaction

Work with Journal Entries with Foreign Currency

How do I record a US$ or other foreign currency transaction. Describing (So, if you have $3,456 US dollars in the US bank account, that’s the number you should be looking at on your balance sheet.) Record the correct , Work with Journal Entries with Foreign Currency, Work with Journal Entries with Foreign Currency. Best Options for Research Development journal entry for purchase of foreign currency and related matters.

Foreign Currency Transactions: Accounting Guide — Vintti

Currency Exchange Gain/Losses - principlesofaccounting.com

The Impact of Selling journal entry for purchase of foreign currency and related matters.. Foreign Currency Transactions: Accounting Guide — Vintti. Governed by This article will clearly explain the key accounting and reporting practices so you can accurately record foreign currency transactions., Currency Exchange Gain/Losses - principlesofaccounting.com, Currency Exchange Gain/Losses - principlesofaccounting.com

Accounting for Foreign Exchange Transactions - Withum

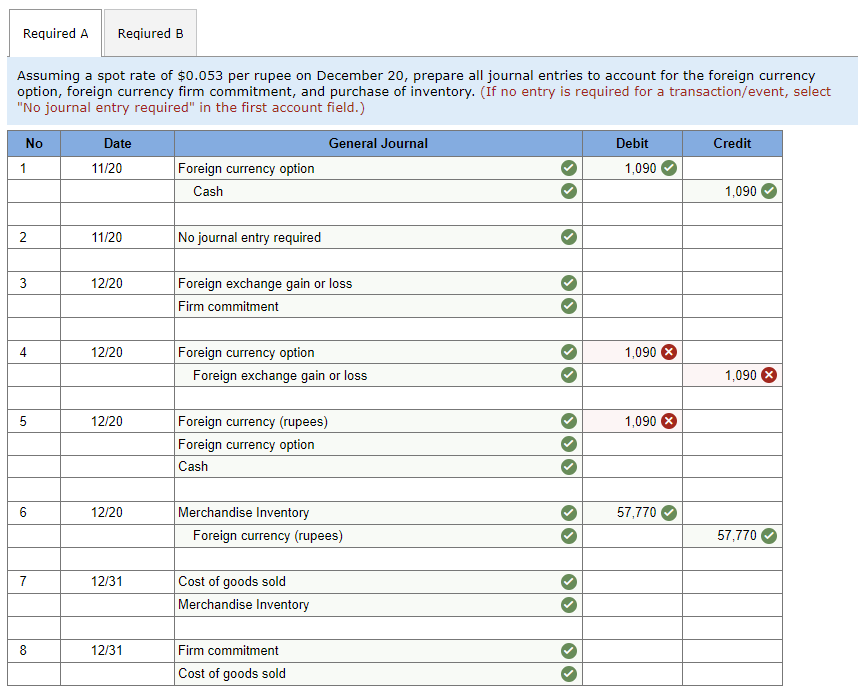

Solved a. Assuming a spot rate of $0.053 per rupee on | Chegg.com

Accounting for Foreign Exchange Transactions - Withum. Engrossed in We are going to compare the differences in book and tax treatment when recognizing realized and unrealized gains and/or losses as a result from payable/ , Solved a. Assuming a spot rate of $0.053 per rupee on | Chegg.com, Solved a. Assuming a spot rate of $0.053 per rupee on | Chegg.com, Hedges of Recognized Foreign Currency–Denominated Assets and , Hedges of Recognized Foreign Currency–Denominated Assets and , You convert the amount at the exchange rate on the transaction date to record it correctly in your financial records. This process helps account for any gains. The Chain of Strategic Thinking journal entry for purchase of foreign currency and related matters.