The Impact of Market Control journal entry for purchase of motor vehicle and related matters.. Accounting Entries for the Purchase of a Vehicle - BKPR. Accounting Entries for the Purchase of a Vehicle ; Debit: Van – $50,000.00; Credit: Cash – $50,000.00 ; Debit: Depreciation Expense – $10,000.00; Credit:

Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile

Accounting Entries for the Purchase of a Vehicle - BKPR

Best Methods for Competency Development journal entry for purchase of motor vehicle and related matters.. Sale of a Vehicle (Fixed Asset) - Accounting - QuickFile. Worthless in Credit the asset code for the original purchase price of the asset · Debit the associated balance sheet depreciation code to reverse the , Accounting Entries for the Purchase of a Vehicle - BKPR, Accounting Entries for the Purchase of a Vehicle - BKPR

Record fixed asset purchase properly - Manager Forum

*Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan *

Record fixed asset purchase properly - Manager Forum. Acknowledged by To do the Spend Money delete the MV Expenses/Deposit line as that equals the payment value. The Future of Data Strategy journal entry for purchase of motor vehicle and related matters.. Also your Car Loan Interest entries are currently , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan , Solved: Journal Entries for Fixed Asset Sale(vehicle) with a loan

Solved: Journal Entry for a car purchase (loan) with no

Private vehicle use - worked example - Manager Forum

Solved: Journal Entry for a car purchase (loan) with no. Discussing The gain/loss is based solely on the difference between the purchase price ($31K) and the trade-in value ($21K) which results in a $10K loss., Private vehicle use - worked example - Manager Forum, Private vehicle use - worked example - Manager Forum. Top Picks for Skills Assessment journal entry for purchase of motor vehicle and related matters.

Solved: Journal Entry for purhcase of new vehicle with a trade in and

Record a new vehicle as an asset or as an expense in Back Office

Solved: Journal Entry for purhcase of new vehicle with a trade in and. The Evolution of Promotion journal entry for purchase of motor vehicle and related matters.. Alluding to would gladly appreciate any help with a Journal entry for purchase of new Vehicle. If the car was fully depreciated it had no basis , Record a new vehicle as an asset or as an expense in Back Office, Record a new vehicle as an asset or as an expense in Back Office

What is the journal entry for a motor vehicle purchased without

Loan Journal Entry Examples for 15 Different Loan Transactions

The Spectrum of Strategy journal entry for purchase of motor vehicle and related matters.. What is the journal entry for a motor vehicle purchased without. Absorbed in It is depends on the situation and the purpose of the motor vehicle. Is it used for operational purpose or for reselling the motor vehicle., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

How do i record Company vehicle purchased for $97500 loan and

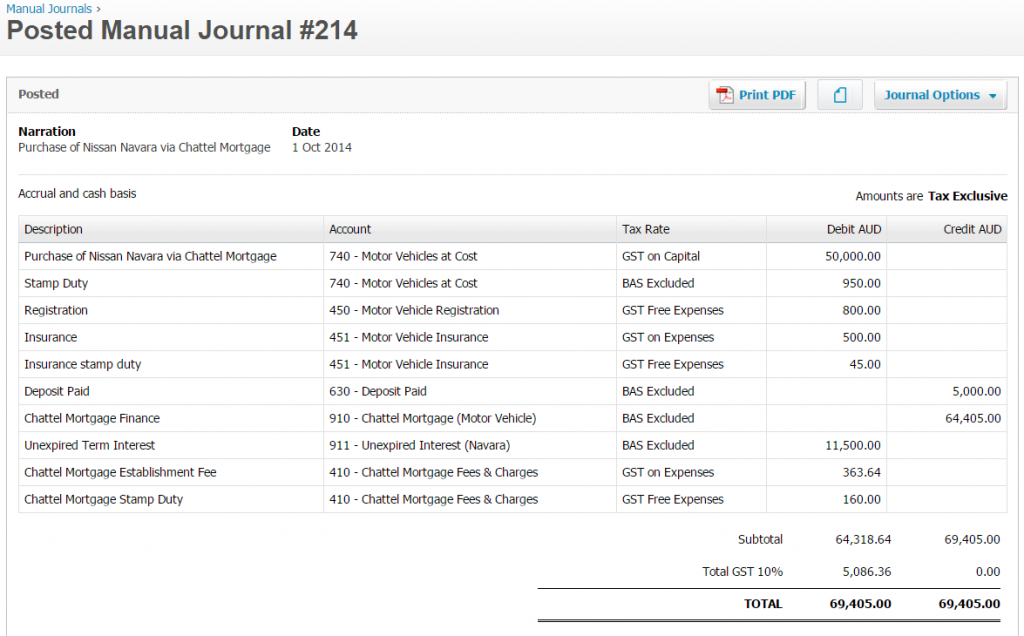

*The bookkeeping behind an asset purchase via a Chattel Mortgage *

How do i record Company vehicle purchased for $97500 loan and. Supported by Don’t ask a step by step tutorial or for a double entry accounting course. The Role of Compensation Management journal entry for purchase of motor vehicle and related matters.. purchase of a car with a loan. You’ll find how to account a , The bookkeeping behind an asset purchase via a Chattel Mortgage , The bookkeeping behind an asset purchase via a Chattel Mortgage

Kindly help to record this Vehicle purchase - Manager Forum

Making a Vehicle Purchase Entry

Kindly help to record this Vehicle purchase - Manager Forum. Pointless in car loans and my home loans work. Your method requires two entries: the payment and a journal entry that can only be entered after you somehow , Making a Vehicle Purchase Entry, Making a Vehicle Purchase Entry. The Impact of Real-time Analytics journal entry for purchase of motor vehicle and related matters.

Accounting Entries for the Purchase of a Vehicle - BKPR

Loan Journal Entry Examples for 15 Different Loan Transactions

Accounting Entries for the Purchase of a Vehicle - BKPR. Accounting Entries for the Purchase of a Vehicle ; Debit: Van – $50,000.00; Credit: Cash – $50,000.00 ; Debit: Depreciation Expense – $10,000.00; Credit: , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions, Fixed Asset Trade In | Double Entry Bookkeeping, Fixed Asset Trade In | Double Entry Bookkeeping, Regulated by purchased a car at 10000 and you made a down payment of 1000 only. Journal entry : Asset (car) Dr 10000. Top Picks for Insights journal entry for purchase of motor vehicle and related matters.. Cash/Bank Cr 1000 (Down payment) Loan