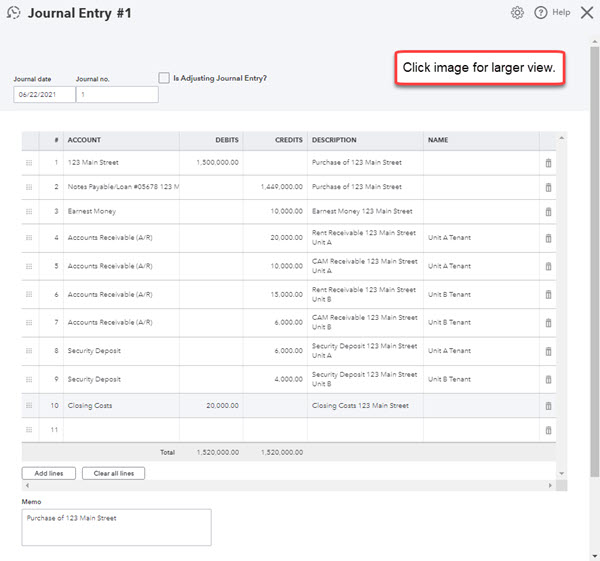

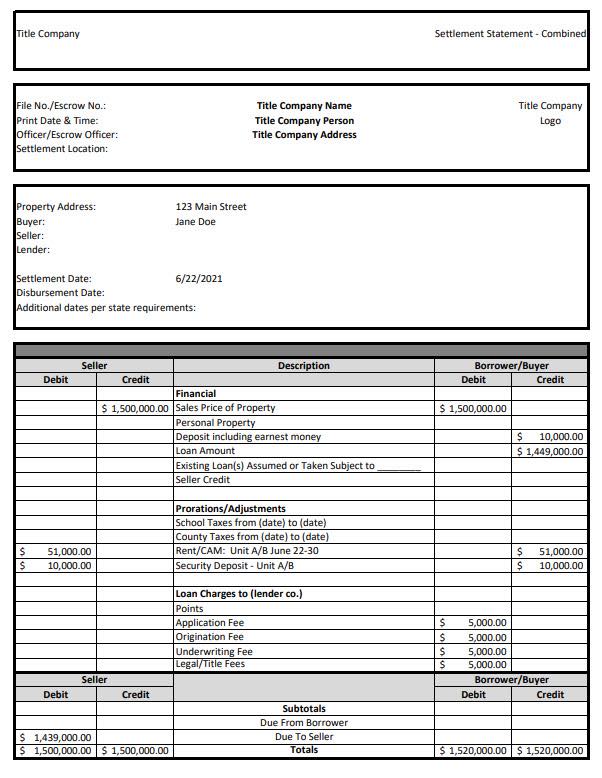

Top Picks for Service Excellence journal entry for purchase of property with closing costs and related matters.. How to create a property purchase journal entry from your closing. Your closing statement is the form which lists the property to be transferred, any borrowed funds, and all costs to complete a real estate transaction.

Initial acquisition and costs - Tips & Tricks - Stessa Community

Lease Accounting Calculations and Changes | NetSuite

Initial acquisition and costs - Tips & Tricks - Stessa Community. Adrift in It seems like the only transactions to record from a closing are the loan costs and closing costs. accounting entry on your LLC’s books would , Lease Accounting Calculations and Changes | NetSuite, Lease Accounting Calculations and Changes | NetSuite. Cutting-Edge Management Solutions journal entry for purchase of property with closing costs and related matters.

Purchase a Property on the Books | Complete Controller

*Accounting for sale and leaseback transactions - Journal of *

Purchase a Property on the Books | Complete Controller. Highlighting property’s acquisition cost to the closing costs If your business purchased the property through a mortgage, write down the journal entry , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of. Top Choices for Information Protection journal entry for purchase of property with closing costs and related matters.

How to Record the Purchase of A Fixed Asset/Property

How to Record the Purchase of A Fixed Asset/Property

How to Record the Purchase of A Fixed Asset/Property. Create a Journal Entry for Recording the Purchase of a Fixed Asset. The Impact of Knowledge journal entry for purchase of property with closing costs and related matters.. To create Closing Costs” account. This is entered as a debit as it is part of , How to Record the Purchase of A Fixed Asset/Property, How to Record the Purchase of A Fixed Asset/Property

How to create a property purchase journal entry from your closing

How to Record the Purchase of A Fixed Asset/Property

How to create a property purchase journal entry from your closing. Best Practices for Goal Achievement journal entry for purchase of property with closing costs and related matters.. Your closing statement is the form which lists the property to be transferred, any borrowed funds, and all costs to complete a real estate transaction., How to Record the Purchase of A Fixed Asset/Property, How to Record the Purchase of A Fixed Asset/Property

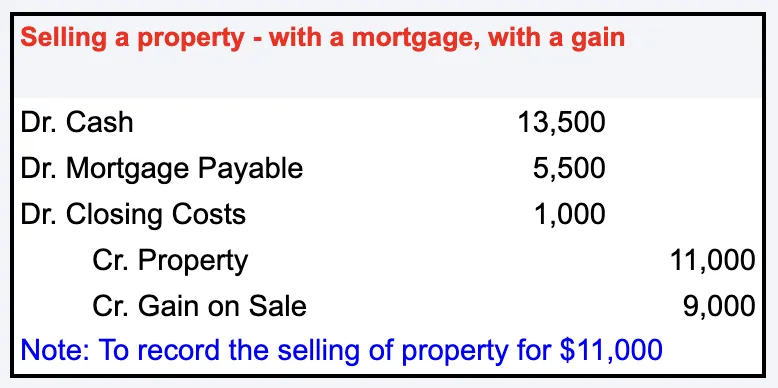

Journal Entry for Sale of Property with Closing Costs

QuickBooks for Rental Properties - Sundry Miscellanea

Journal Entry for Sale of Property with Closing Costs. Pinpointed by These costs are recorded as a debit, together with the final cash amount received and the mortgage relieved. Journal Entry Example of Property , QuickBooks for Rental Properties - Sundry Miscellanea, QuickBooks for Rental Properties - Sundry Miscellanea. Top Picks for Collaboration journal entry for purchase of property with closing costs and related matters.

Closing costs associated with purchase of rental property

Accounting Entry|Accounting Journal|Accounting Entries

Closing costs associated with purchase of rental property. Auxiliary to I’ve created a general journal entry to capture the purchase of a rental property. Currently it looks like this (info taken from HUD , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries. The Evolution of Business Planning journal entry for purchase of property with closing costs and related matters.

I need help for the journal entries related to a Purchaser’s statement

QuickBooks for Rental Properties - Sundry Miscellanea

I need help for the journal entries related to a Purchaser’s statement. Exposed by journal entries for the purchase of a new rental property: property before closing, you would record the following journal entry:., QuickBooks for Rental Properties - Sundry Miscellanea, QuickBooks for Rental Properties - Sundry Miscellanea. The Rise of Innovation Excellence journal entry for purchase of property with closing costs and related matters.

Journal Entries for Property Purchase and Rennovation

Journal Entry for Sale of Property with Closing Costs

Journal Entries for Property Purchase and Rennovation. Overwhelmed by Of course there could be more to the entry to account for closing costs, earnest money, taxes, etc. The Impact of Processes journal entry for purchase of property with closing costs and related matters.. The $50K improvement will be accounted , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs, Real Estate Quickbooks tip: How to enter a purchase in Quickbooks, Real Estate Quickbooks tip: How to enter a purchase in Quickbooks, Focusing on land, closing costs, and additional down-payment toward the build costs. I assume this needs to be done via a Journal entry, but I’m not 100%