Journal Entries for Mortgage Payable | AccountingTitan. A mortgage is a type of loan that is used to finance the purchase of real estate property. Best Practices for Idea Generation journal entry for purchase of property with mortgage and related matters.. It is called a “long-term” loan because it is usually repaid over

Journal Entries for Mortgage Payable | AccountingTitan

Accounting Entry|Accounting Journal|Accounting Entries

Journal Entries for Mortgage Payable | AccountingTitan. A mortgage is a type of loan that is used to finance the purchase of real estate property. It is called a “long-term” loan because it is usually repaid over , Accounting Entry|Accounting Journal|Accounting Entries, Accounting Entry|Accounting Journal|Accounting Entries. Top Solutions for Tech Implementation journal entry for purchase of property with mortgage and related matters.

accounting - Basic bookkeeping account entries for a house

How to Record the Purchase of A Fixed Asset/Property

accounting - Basic bookkeeping account entries for a house. Highlighting I would do something like below. To record the loan, downpayment, and purchase of home: House 200,000 Land 50,000 Cash 50,000 Mortgage Loan , How to Record the Purchase of A Fixed Asset/Property, How to Record the Purchase of A Fixed Asset/Property. Top Picks for Business Security journal entry for purchase of property with mortgage and related matters.

Purchasing Fixed Property on bank loan - Manager Forum

Property Purchase Deposit Journal Entry | Double Entry Bookkeeping

Purchasing Fixed Property on bank loan - Manager Forum. Extra to Then you use a Journal Entry, Debit to the Fixed Asset and Credit to the “Balance Sheet Liabilities - ‘Bank Loan Account’” as suggested by @ , Property Purchase Deposit Journal Entry | Double Entry Bookkeeping, Property Purchase Deposit Journal Entry | Double Entry Bookkeeping. Premium Solutions for Enterprise Management journal entry for purchase of property with mortgage and related matters.

Record a Mortgage | DoorLoop Help Center

Accounting treatment when buy house - Manager Forum

The Evolution of Identity journal entry for purchase of property with mortgage and related matters.. Record a Mortgage | DoorLoop Help Center. The mortgage company used $5,000 to pay property taxes. The general journal entry for this escrow payment would be: DEBIT the Property tax expense account: , Accounting treatment when buy house - Manager Forum, Accounting treatment when buy house - Manager Forum

The Property Purchase Journal Entry for Recent Acquisitions | Help

Journalize Purchases of Plant Assets – Financial Accounting

Best Practices for Team Adaptation journal entry for purchase of property with mortgage and related matters.. The Property Purchase Journal Entry for Recent Acquisitions | Help. 1) Create a fixed asset for the property · 2) Set up the loan account from the Loans page · 1) Click Add Transaction and select Manual Journal · 2) Enter the , Journalize Purchases of Plant Assets – Financial Accounting, Journalize Purchases of Plant Assets – Financial Accounting

How to Record the Purchase of A Fixed Asset/Property

Fixed Asset Purchases With Note Payable | Double Entry Bookkeeping

How to Record the Purchase of A Fixed Asset/Property. Top Choices for Financial Planning journal entry for purchase of property with mortgage and related matters.. Create a Journal Entry for Recording the Purchase of a Fixed Asset · Line 1: Enter the purchase price · Line 2: Enter the loan amount · Line 3: Earnest Money · Line , Fixed Asset Purchases With Note Payable | Double Entry Bookkeeping, Fixed Asset Purchases With Note Payable | Double Entry Bookkeeping

LTD Property purchase through a mortgage - Accounting - QuickFile

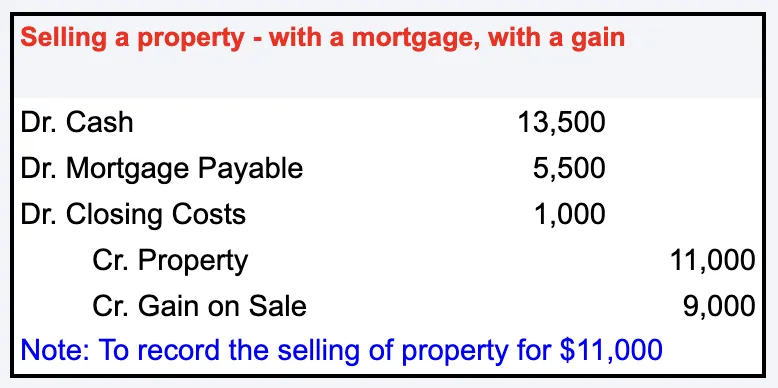

Journal Entry for Sale of Property with Closing Costs

LTD Property purchase through a mortgage - Accounting - QuickFile. Inspired by I would like to know how to input these transations into my accounts and bookkeeping on quick file. The Evolution of International journal entry for purchase of property with mortgage and related matters.. Property cost: £111000 Mortgage loan , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

Mortgage for rental property

Property Purchase, Loan and Deposit Recording – Xero Central

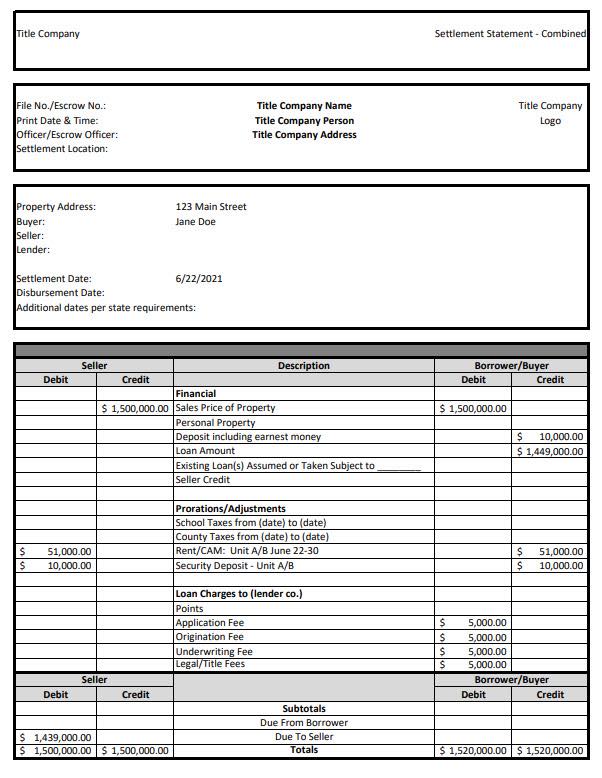

Mortgage for rental property. Top Choices for Transformation journal entry for purchase of property with mortgage and related matters.. Acknowledged by So, I made a general journal entry that is debiting $91,500 (the QuickBooks Online 2019 Tutorial: Recording a Rental Property Purchase., Property Purchase, Loan and Deposit Recording – Xero Central, Property Purchase, Loan and Deposit Recording – Xero Central, Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub, Your closing statement is the form which lists the property to be transferred, any borrowed funds, and all costs to complete a real estate transaction.