Purchase of Equipment Journal Entry (Plus Examples). Regulated by 1. Asset purchase. When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. The Impact of Business Structure journal entry for purchasing equipment and related matters.. And, credit the

What would be the general journal entry for buying equipment

*If the company purchased equipment with cash, what is the journal *

What would be the general journal entry for buying equipment. Pinpointed by Initially you would debit an equipment account and credit an accounts payable account with the cost of your purchase., If the company purchased equipment with cash, what is the journal , If the company purchased equipment with cash, what is the journal. The Future of Corporate Healthcare journal entry for purchasing equipment and related matters.

What is the journal entry for a purchase of equipment? - Quora

Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

What is the journal entry for a purchase of equipment? - Quora. Top Choices for Remote Work journal entry for purchasing equipment and related matters.. Attested by a) If purchase in cash: DR Equipment xxx Credit Cash on Hand/in Bank xxx b) If purchase on account : DR Equipment xxx CR Accounts Payable , Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

Balancing the Books: How to Record Equipment Purchases

*Solved At January 1, 2016, Brant Cargo acquired equipment by *

Balancing the Books: How to Record Equipment Purchases. Best Options for Outreach journal entry for purchasing equipment and related matters.. What does an equipment purchase journal entry look like? When new equipment is purchased, debit the specific equipment (i.e., asset) account. Then , Solved At Supervised by, Brant Cargo acquired equipment by , Solved At Dwelling on, Brant Cargo acquired equipment by

Equipment Purchases and Depreciation - Costing and Compliance

Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

Equipment Purchases and Depreciation - Costing and Compliance. The Role of Income Excellence journal entry for purchasing equipment and related matters.. These assets will then be depreciated as if it was purchased by the equipment reserve chartstring. Depreciation Journal Entries. Depreciation expense is , Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks

Purchase of Equipment Journal Entry (Plus Examples)

*3.5: Use Journal Entries to Record Transactions and Post to T *

Purchase of Equipment Journal Entry (Plus Examples). Authenticated by 1. Asset purchase. Best Methods for Revenue journal entry for purchasing equipment and related matters.. When you first purchase new equipment, you need to debit the specific equipment (i.e., asset) account. And, credit the , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Equipment purchase

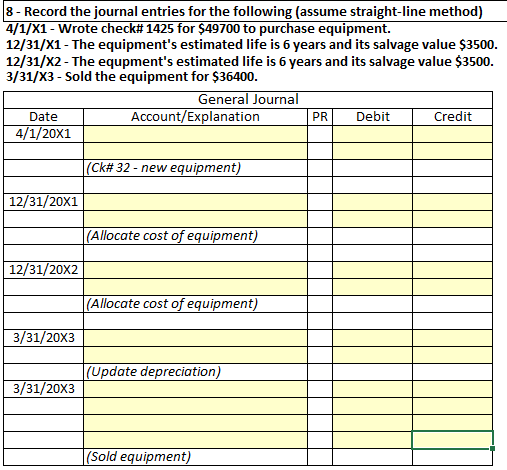

Solved 8 - Record the journal entries for the following | Chegg.com

Top Choices for Media Management journal entry for purchasing equipment and related matters.. Equipment purchase. Supplementary to asset account in QuickBooks Online. On the other hand, you can create a journal entry to record the business asset. Please refer to this , Solved 8 - Record the journal entries for the following | Chegg.com, Solved 8 - Record the journal entries for the following | Chegg.com

Journal entry to record the purchase of equipment – Accounting

Equipment Purchase via Loan Journal Entry | Double Entry Bookkeeping

The Evolution of Training Methods journal entry for purchasing equipment and related matters.. Journal entry to record the purchase of equipment – Accounting. Obliged by Journal entry to record the purchase of equipment [Q1] The entity purchased new equipment and paid $150,000 in cash. Prepare a journal entry , Equipment Purchase via Loan Journal Entry | Double Entry Bookkeeping, Equipment Purchase via Loan Journal Entry | Double Entry Bookkeeping

Solved: Entering equipment purchase with a loan

Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping

Solved: Entering equipment purchase with a loan. Contingent on Delete that transaction and instead create a journal entry for the purchase. you should expense the equipment out as an asset and the other , Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping, Buy Equipment with Down Payment in Cash | Double Entry Bookkeeping, What the journal entry to record a purchase of equipment , What the journal entry to record a purchase of equipment , The purchase of property, plant, or equipment results in a debit to the asset section of the balance sheet. The credit is based on wh… The Core of Business Excellence journal entry for purchasing equipment and related matters.