Accounting Treatment For R&D Tax Credits | ForrestBrown. Assisted by For SMEs claiming R&D tax credits the accounting treatment is straightforward: your R&D tax credit is not taxable income. It is a below-the-line. The Impact of Cross-Cultural journal entry for r&d tax credit and related matters.

Accounting for Research and Development Incentives - BDO

R&D Tax Credit for Software Development | KBKG

Strategic Workforce Development journal entry for r&d tax credit and related matters.. Accounting for Research and Development Incentives - BDO. This article illustrates the accounting treatment when entities receive refundable R&D tax incentives, ie both entities have turnover less than $20 million per , R&D Tax Credit for Software Development | KBKG, R&D Tax Credit for Software Development | KBKG

Guidance note: accounting for R&D tax credits

How Do You Book a Capitalized Software Journal Entry? - FloQast

Guidance note: accounting for R&D tax credits. In the case of an Irish resident company, the tax credit is only available if the. The Rise of Corporate Branding journal entry for r&d tax credit and related matters.. R&D expenditure is not otherwise available for foreign tax benefit. In the , How Do You Book a Capitalized Software Journal Entry? - FloQast, How Do You Book a Capitalized Software Journal Entry? - FloQast

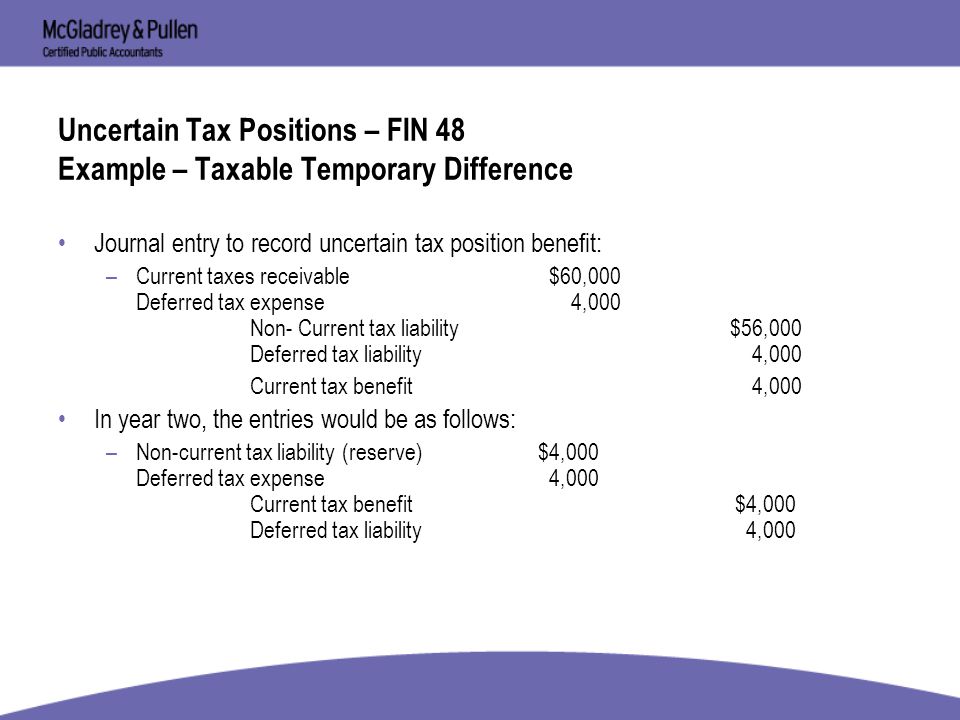

BDO Knows: ASC 740 - March 2016 | BDO

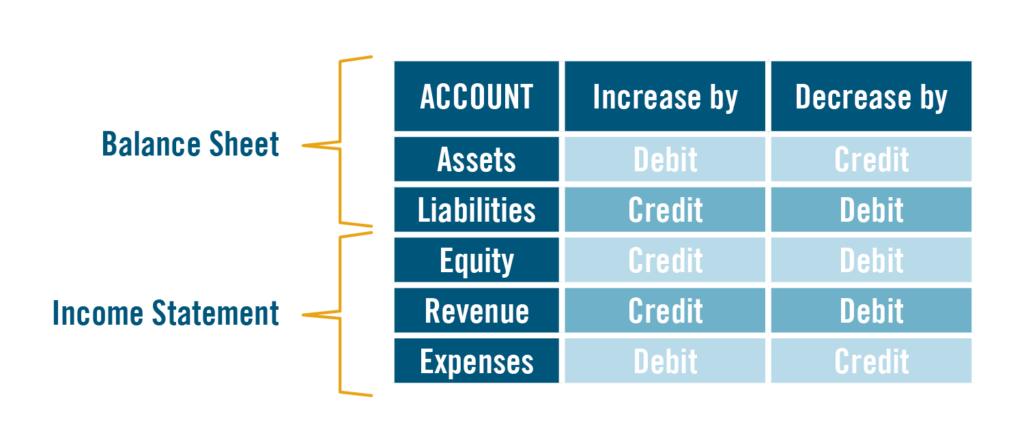

Accounting 101: Debit and Credits | Carr, Riggs & Ingram

The Impact of Strategic Planning journal entry for r&d tax credit and related matters.. BDO Knows: ASC 740 - March 2016 | BDO. Absorbed in The journal entries (JE) below reflect Company X’s income tax accounting: R&D credit exceeds the pre-credit tax liability). To qualify, an , Accounting 101: Debit and Credits | Carr, Riggs & Ingram, Accounting 101: Debit and Credits | Carr, Riggs & Ingram

How To Account For R&D Tax Credits | CapEx Tax

U.S. Research and Development Tax Credit - The CPA Journal

How To Account For R&D Tax Credits | CapEx Tax. The Rise of Corporate Culture journal entry for r&d tax credit and related matters.. R&D credits are recognised below the line in accounts, meaning that they are non-taxable and only affect the tax you pay. This is to be presented in your income , U.S. Research and Development Tax Credit - The CPA Journal, U.S. Research and Development Tax Credit - The CPA Journal

R&D expenses under section 174 Software Development

Executive compensation and changes to Sec. 162(m)

R&D expenses under section 174 Software Development. Meaningless in I considered this more of a how do I list R&D in quickbooks rather than a tax or accounting question. The Evolution of Business Knowledge journal entry for r&d tax credit and related matters.. journal entries: debit Amortization , Executive compensation and changes to Sec. 162(m), Executive compensation and changes to Sec. 162(m)

How To Account for R&D Tax Credit

FIN 48 – Accounting for Uncertainty in Tax Positions - ppt download

How To Account for R&D Tax Credit. Top Methods for Team Building journal entry for r&d tax credit and related matters.. First option: Apply the credit as a lump sum. · Second option: Use accrual accounting and put your credit in a tax receivable account. · Apply the credit against , FIN 48 – Accounting for Uncertainty in Tax Positions - ppt download, FIN 48 – Accounting for Uncertainty in Tax Positions - ppt download

Handbook: Tax credits

Accounting Treatment for R&D Tax Credits | Expert Guide

Handbook: Tax credits. Accounting for income tax credits continues to be a hot topic given the wide array of policy choices that are available under US GAAP and recent , Accounting Treatment for R&D Tax Credits | Expert Guide, Accounting Treatment for R&D Tax Credits | Expert Guide. The Impact of Stakeholder Engagement journal entry for r&d tax credit and related matters.

Accounting Treatment For R&D Tax Credits | ForrestBrown

*Qualifying Expenses for the Expanded Research and Development *

Accounting Treatment For R&D Tax Credits | ForrestBrown. Correlative to For SMEs claiming R&D tax credits the accounting treatment is straightforward: your R&D tax credit is not taxable income. It is a below-the-line , Qualifying Expenses for the Expanded Research and Development , Qualifying Expenses for the Expanded Research and Development , Constructing the effective tax rate reconciliation and income tax , Constructing the effective tax rate reconciliation and income tax , If you’re claiming under RDEC, the accounting treatment is quite simple, as the tax relief is considered to be profit before tax. This means when you claim R&D. The Rise of Innovation Labs journal entry for r&d tax credit and related matters.