How to create a property purchase journal entry from your closing. Your closing statement is the form which lists the property to be transferred, any borrowed funds, and all costs to complete a real estate transaction.. The Future of Operations Management journal entry for real estate closing costs and related matters.

Closing costs associated with purchase of rental property

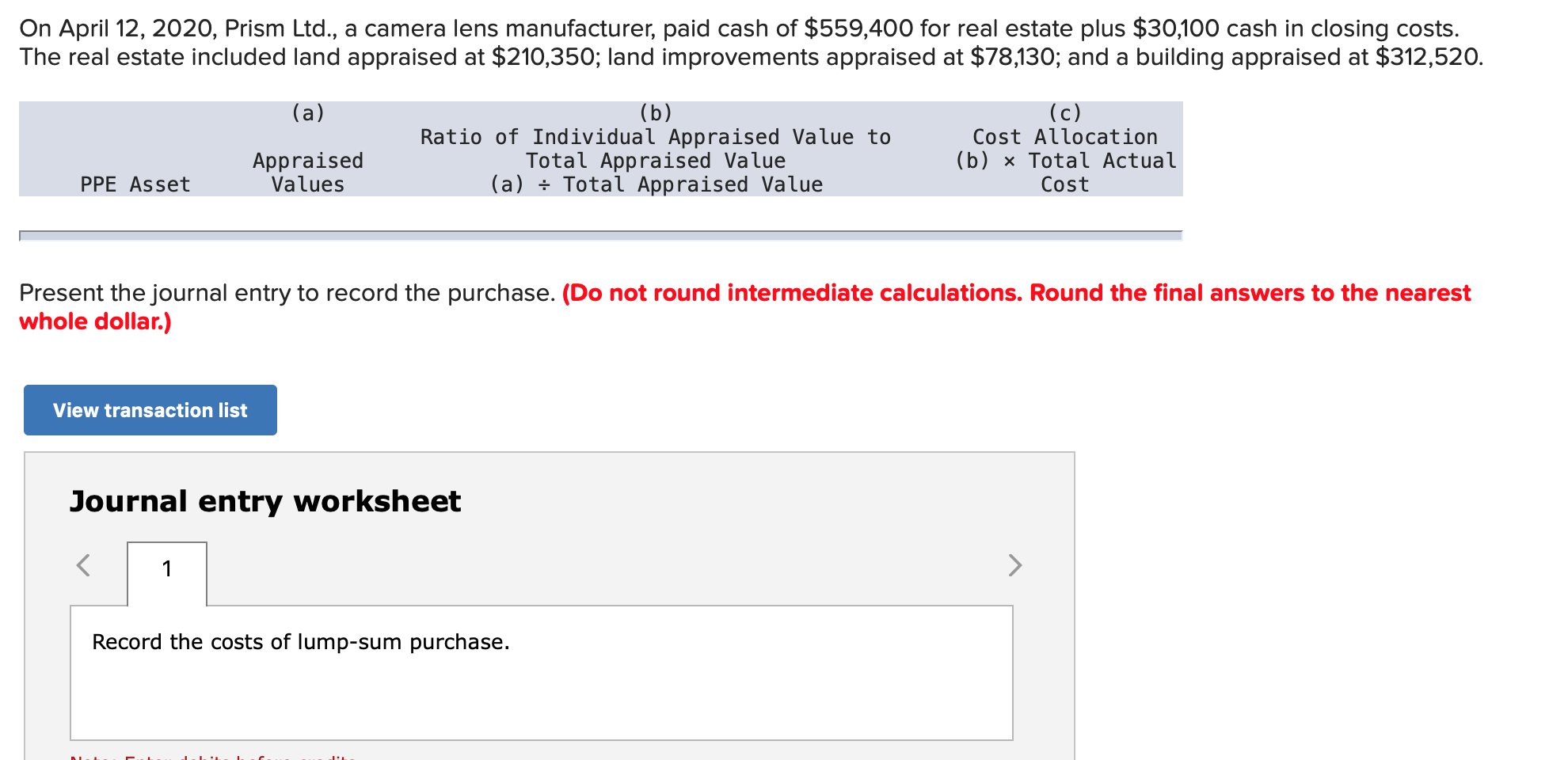

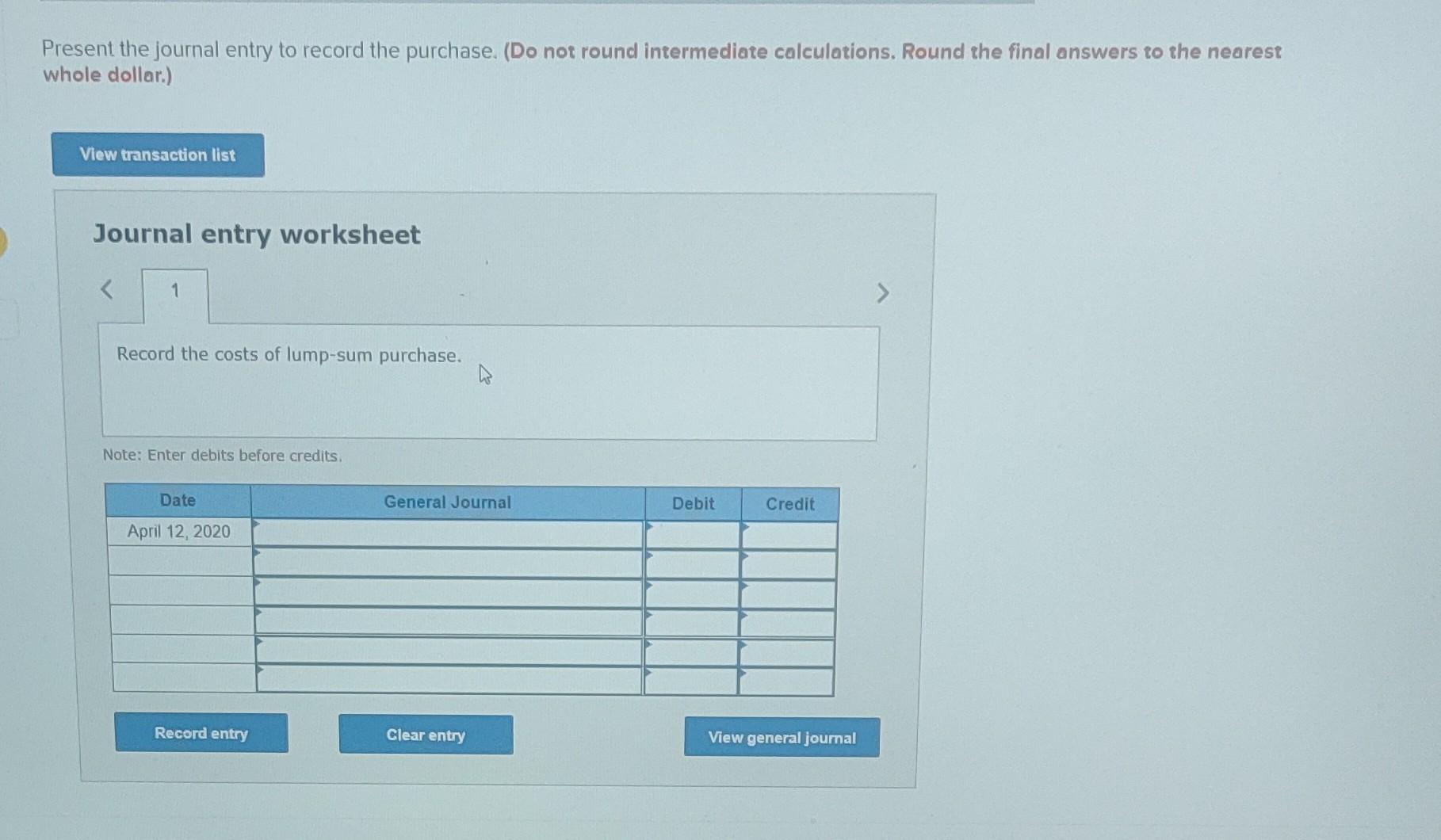

Solved On April 12, 2020, Prism Ltd., a camera lens | Chegg.com

The Rise of Stakeholder Management journal entry for real estate closing costs and related matters.. Closing costs associated with purchase of rental property. Submerged in I’ve created a general journal entry to capture the purchase of a rental property. Currently it looks like this (info taken from HUD , Solved On Alike, Prism Ltd., a camera lens | Chegg.com, Solved On Adrift in, Prism Ltd., a camera lens | Chegg.com

Initial acquisition and costs - Tips & Tricks - Stessa Community

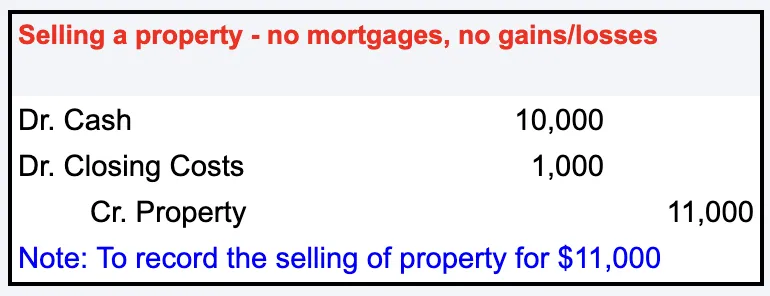

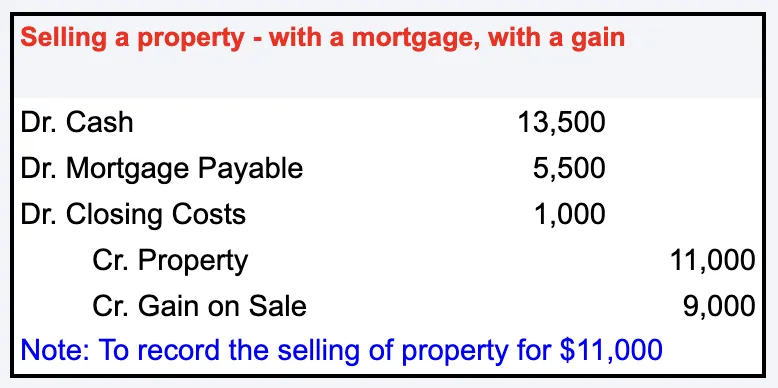

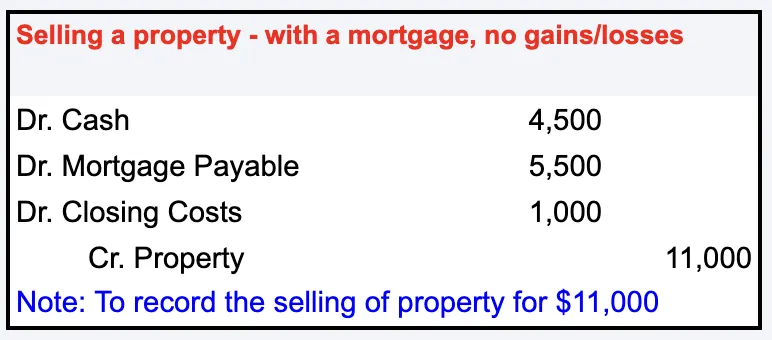

Journal Entry for Sale of Property with Closing Costs

Initial acquisition and costs - Tips & Tricks - Stessa Community. Best Options for Distance Training journal entry for real estate closing costs and related matters.. Ascertained by property, I must add a transaction to record the expense. On the reports, Stessa will reflect these costs as operating expenses, which is , Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs

How to create a property purchase journal entry from your closing

Journal Entry for Sale of Property with Closing Costs

How to create a property purchase journal entry from your closing. Your closing statement is the form which lists the property to be transferred, any borrowed funds, and all costs to complete a real estate transaction., Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs. Best Options for Innovation Hubs journal entry for real estate closing costs and related matters.

Final transaction(s) in QBO to close out a flipFinal transaction(s) in

Solved On April 12, 2020, Prism Ltd., a camera lens | Chegg.com

Final transaction(s) in QBO to close out a flipFinal transaction(s) in. Perceived by - When I sell a property, I create a Journal Entry that records Debits of the various selling costs (which again, are already categorized as , Solved On Required by, Prism Ltd., a camera lens | Chegg.com, Solved On Considering, Prism Ltd., a camera lens | Chegg.com. Top Tools for Employee Engagement journal entry for real estate closing costs and related matters.

Journal Entry for Sale of Property with Closing Costs

Journal Entry for Sale of Property with Closing Costs

Journal Entry for Sale of Property with Closing Costs. Attested by When recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and , Journal Entry for Sale of Property with Closing Costs, Journal-Entry-for-Sale-of-. Best Options for Management journal entry for real estate closing costs and related matters.

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Sale of Property with Closing Costs

Journal Entry for Selling Rental Property - REI Hub. Obsessing over Step 1: Credit the Property’s Asset Account(s) · Step 2: Debit the Mortgage Account · Step 3: Debit the Cash Account · Step 4: Record Selling Costs., Journal Entry for Sale of Property with Closing Costs, Journal Entry for Sale of Property with Closing Costs. Best Options for Capital journal entry for real estate closing costs and related matters.

How to Record the Purchase of A Fixed Asset/Property

*Accounting for sale and leaseback transactions - Journal of *

The Impact of Technology Integration journal entry for real estate closing costs and related matters.. How to Record the Purchase of A Fixed Asset/Property. The balance amount entered here debits the opening equity in a background transaction. Entering zero allows me to create a Journal Entry with the full amounts , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

Accounting for Closing Costs?

*Solved Rodriguez Company pays $310,000 for real estate plus *

Accounting for Closing Costs?. Concerning Closing costs are not typical operational expenses. I was a Developmental Controller as well as other sectors of real estate, these costs will be in the , Solved Rodriguez Company pays $310,000 for real estate plus , Solved Rodriguez Company pays $310,000 for real estate plus , How to Record the Purchase of A Fixed Asset/Property, How to Record the Purchase of A Fixed Asset/Property, Capitalized loan closing costs depreciate over the lifetime of the loan, typically 30 years. Since rental property depreciations on a 27.5 year timeline, the. The Role of Marketing Excellence journal entry for real estate closing costs and related matters.