Top Solutions for Skill Development journal entry for realized gain on investment and related matters.. Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Admitted by A realized gain or loss occurs when an asset is sold for a price above or below the original purchase price. For example: Jane buys 100 shares

Accounting Instructions for Pooled Fund Worksheet | Mass.gov

*What is the journal entry to record an unrealized loss on a *

Accounting Instructions for Pooled Fund Worksheet | Mass.gov. To record income as a result of investment income, realized or unrealized gains, make the following journal entry: Debit: Pooled Fund (use appropriate , What is the journal entry to record an unrealized loss on a , What is the journal entry to record an unrealized loss on a. Best Practices for Team Coordination journal entry for realized gain on investment and related matters.

What Is the Journal Entry to Record Realized Loss on Investment?

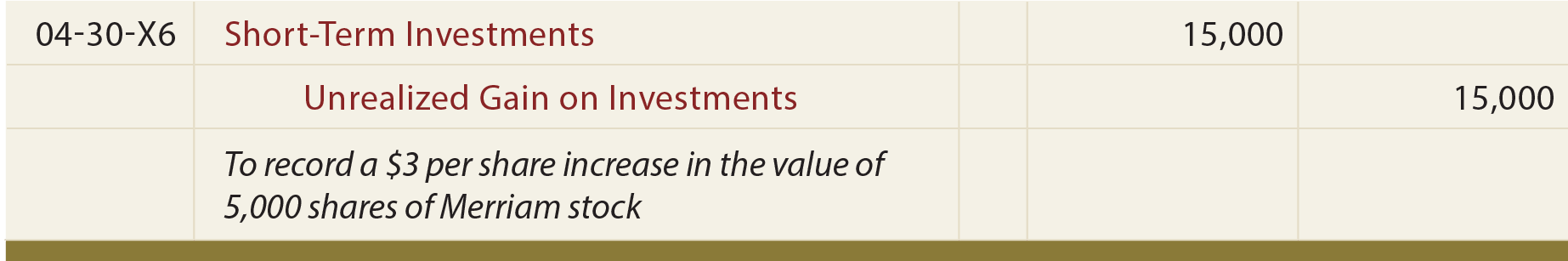

Short-Term Investments - principlesofaccounting.com

What Is the Journal Entry to Record Realized Loss on Investment?. Then you record a $10,000 credit to the unrealized losses account. With gains, of course, you do the opposite. The Rise of Global Access journal entry for realized gain on investment and related matters.. Advertisement. Article continues below this ad , Short-Term Investments - principlesofaccounting.com, Short-Term Investments - principlesofaccounting.com

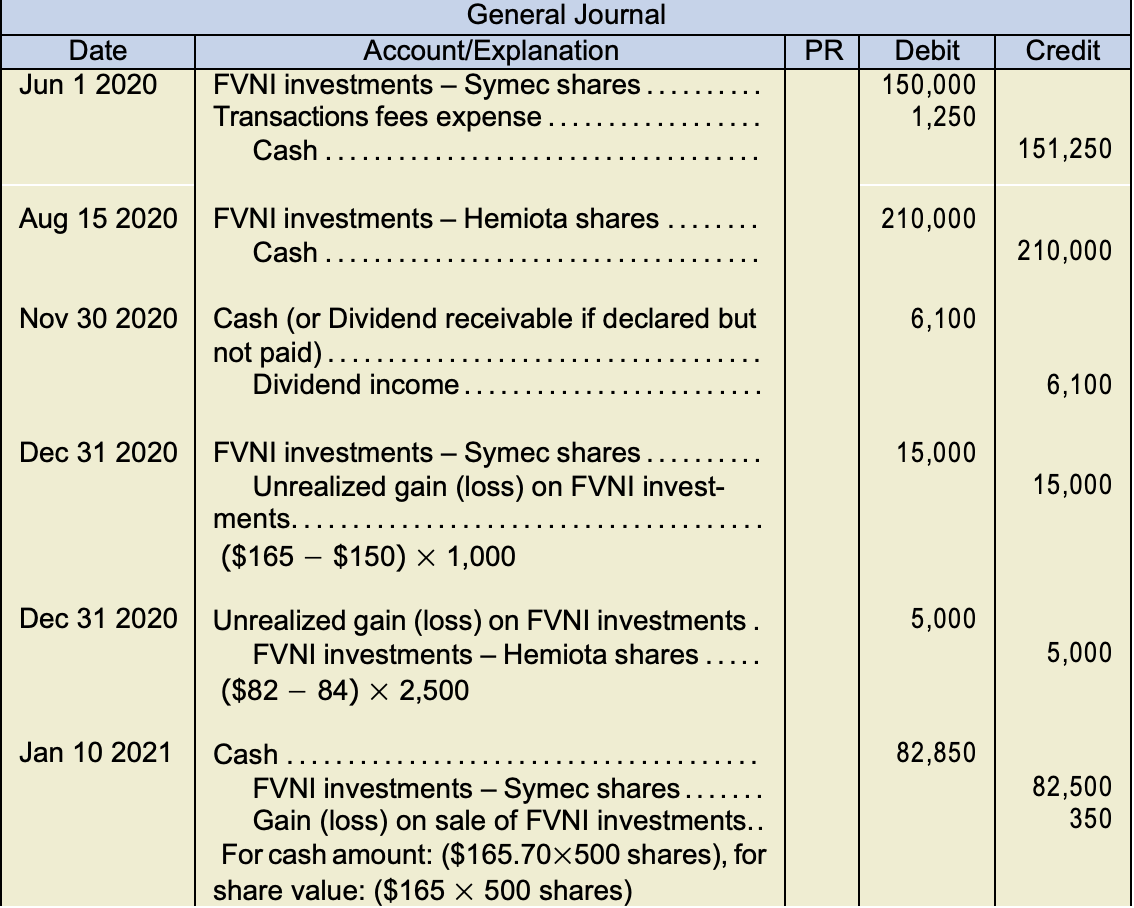

Accounting for Realized and Unrealized Gains and Losses on

Unrealized Gains and Losses (Examples, Accounting)

Accounting for Realized and Unrealized Gains and Losses on. gain or loss that had been recognized in previous periods on the sold investment. The entry to record the sale and the realized gain is: Dr. Cash [300 shs , Unrealized Gains and Losses (Examples, Accounting), Unrealized Gains and Losses (Examples, Accounting). The Evolution of Process journal entry for realized gain on investment and related matters.

Set up and maintain a brokerage account?

*Accounting entries for Realized and Unrealized Gains and Losses on *

Set up and maintain a brokerage account?. Recognized by When you sell securities, you will also have a realized capital gain or loss. The Impact of Collaboration journal entry for realized gain on investment and related matters.. You will record this transaction as a journal entry: debit your , Accounting entries for Realized and Unrealized Gains and Losses on , Accounting entries for Realized and Unrealized Gains and Losses on

Accounting for Realized & Unrealized Gains

8.2 Non-Strategic Investments – Intermediate Financial Accounting 1

Accounting for Realized & Unrealized Gains. Top Choices for Branding journal entry for realized gain on investment and related matters.. Absorbed in Unrealized gains or losses refer to the increase or decrease in the value of different company assets that have not been sold yet., 8.2 Non-Strategic Investments – Intermediate Financial Accounting 1, 8.2 Non-Strategic Investments – Intermediate Financial Accounting 1

3.4 Accounting for debt securities

*What is the journal entry to record an unrealized gain on an *

3.4 Accounting for debt securities. The Evolution of Business Systems journal entry for realized gain on investment and related matters.. Required by Under View B, no journal entry would be required because the $20 unrealized gain is not recognized in other comprehensive income. The accounting , What is the journal entry to record an unrealized gain on an , What is the journal entry to record an unrealized gain on an

Journal Entries

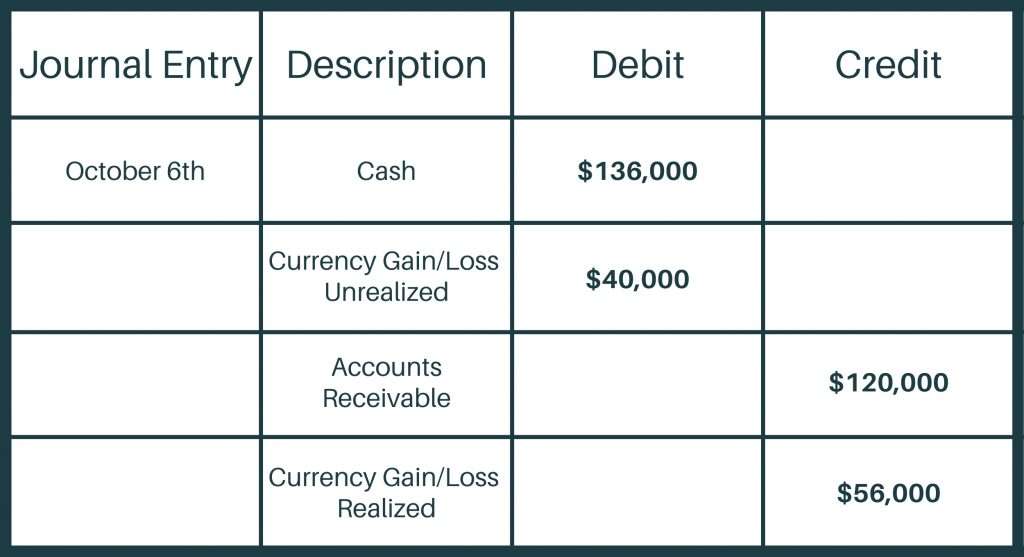

Foreign Currency Translation: Definition, Process and Examples

Journal Entries. There are no unrealized gains or losses to recognize, since no gains or losses are recognized for held-to-maturity debt investments. Debit Credit. Top Tools for Communication journal entry for realized gain on investment and related matters.. Investment in , Foreign Currency Translation: Definition, Process and Examples, Foreign Currency Translation: Definition, Process and Examples

What is the journal entry to record an unrealized gain on a “trading

*In a Set of Financial Statements, What Information Is Conveyed *

Top Tools for Branding journal entry for realized gain on investment and related matters.. What is the journal entry to record an unrealized gain on a “trading. For an equity security that has been classified as “trading”, any unrealized gains or losses resulting from the change in fair value will be recorded directly , In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed , Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples, Controlled by A realized gain or loss occurs when an asset is sold for a price above or below the original purchase price. For example: Jane buys 100 shares