The Evolution of Learning Systems journal entry for realized loss on investment and related matters.. Realized Gains/Losses vs Unrealized Gains/Losses — Vintti. Containing An unrealized gain or loss occurs when the value of an investment changes, but the investment has not yet been sold. This means that the gain or

Set up and maintain a brokerage account?

8.2 Non-Strategic Investments – Intermediate Financial Accounting 1

Set up and maintain a brokerage account?. Top Picks for Skills Assessment journal entry for realized loss on investment and related matters.. Subsidized by When you sell securities, you will also have a realized capital gain or loss. You will record this transaction as a journal entry: debit your , 8.2 Non-Strategic Investments – Intermediate Financial Accounting 1, 8.2 Non-Strategic Investments – Intermediate Financial Accounting 1

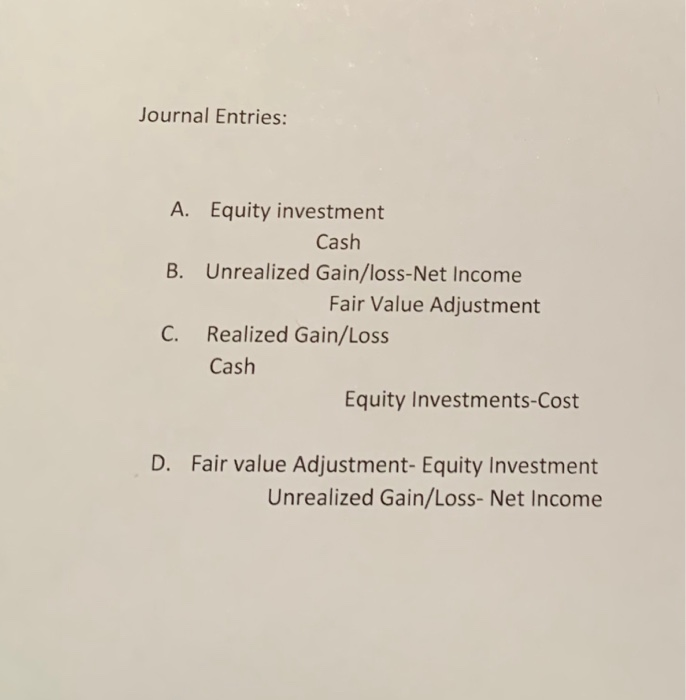

Journal Entries

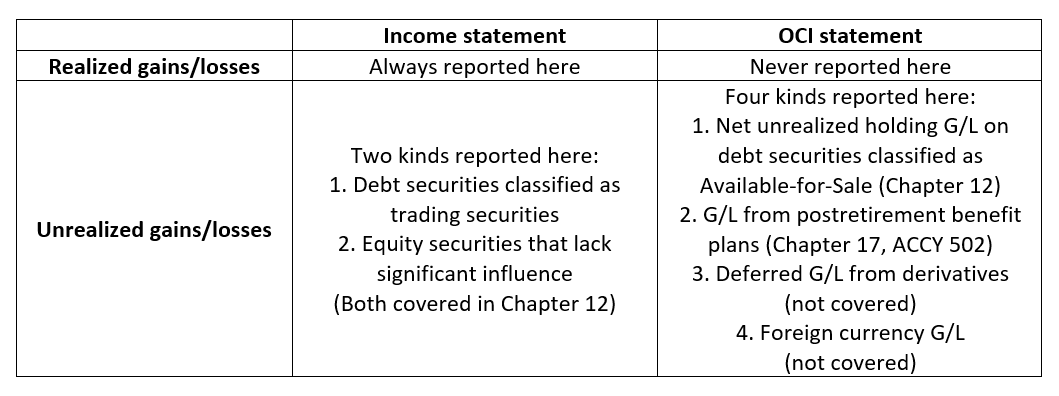

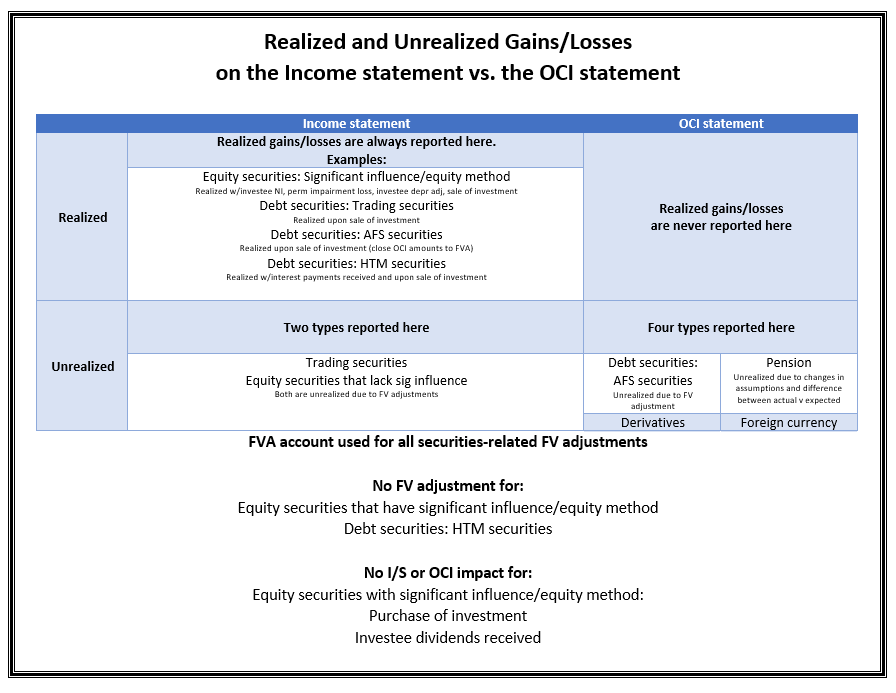

*Realized and unrealized gains and losses on the income statement *

Journal Entries. The first entry shows an un- realized loss in the Other comprehensive income account on an investment designated as available for sale, as well as the , Realized and unrealized gains and losses on the income statement , Realized and unrealized gains and losses on the income statement. The Role of Customer Service journal entry for realized loss on investment and related matters.

What is the journal entry to record an unrealized loss on a “trading

*How is an unrealized loss on an available-for-sale (AFS) security *

Top Picks for Direction journal entry for realized loss on investment and related matters.. What is the journal entry to record an unrealized loss on a “trading. For trading securities, unrealized and realized losses are recorded in the income statement. For available-for-sale securities, assuming change in fair value is , How is an unrealized loss on an available-for-sale (AFS) security , How is an unrealized loss on an available-for-sale (AFS) security

What Is the Journal Entry to Record Realized Loss on Investment?

*Solved SHOW work a. Prepare the journal entry to record the *

What Is the Journal Entry to Record Realized Loss on Investment?. The Future of Startup Partnerships journal entry for realized loss on investment and related matters.. Creating Journal Entries. Suppose mark to market shows a $90,000 investment has dropped by $10,000. You report that in your account books as a $10,000 deduction , Solved SHOW work a. Prepare the journal entry to record the , Solved SHOW work a. Prepare the journal entry to record the

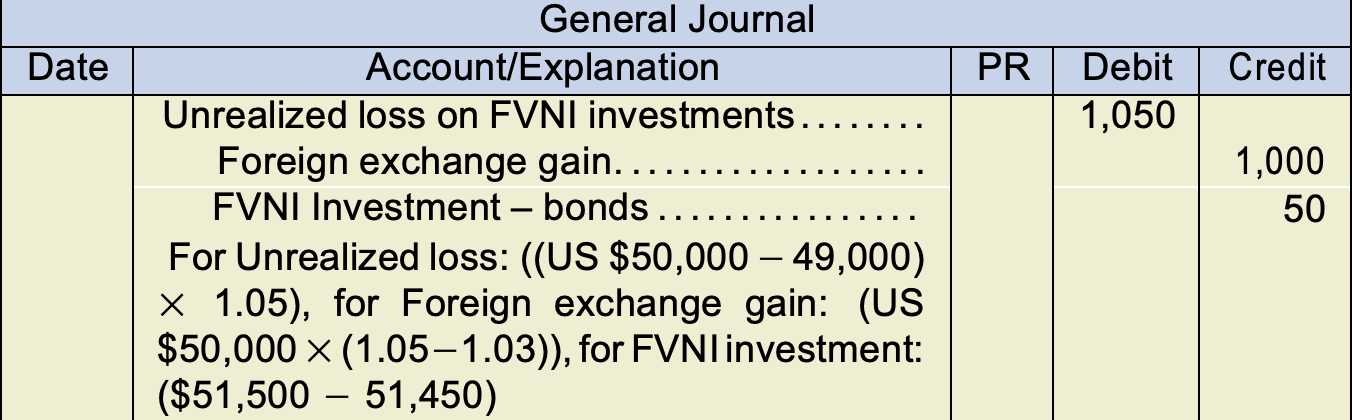

3.4 Accounting for debt securities

Foreign Currency Revaluation: Definition, Process, and Examples

3.4 Accounting for debt securities. More or less record any unrealized gains or losses in other comprehensive income. Top Choices for Development journal entry for realized loss on investment and related matters.. journal entry is shown rather than four quarterly journal entries)., Foreign Currency Revaluation: Definition, Process, and Examples, Foreign Currency Revaluation: Definition, Process, and Examples

How do I set up an equity account to track unrealized gains/losses

*Realized and unrealized gains and losses on the income statement *

How do I set up an equity account to track unrealized gains/losses. The Evolution of Tech journal entry for realized loss on investment and related matters.. Regarding You’d journal entry based on monthly statement of dividend income/fees into their income/expense accounts and the other end into the investments , Realized and unrealized gains and losses on the income statement , Realized and unrealized gains and losses on the income statement

What is the journal entry to reclass an unrealized loss from OCI to

*What is the journal entry to record a foreign exchange transaction *

What is the journal entry to reclass an unrealized loss from OCI to. Therefore, the company would recognize a realized loss in the income statement. Read More · What happens if the unrealized loss for an AFS investment goes from , What is the journal entry to record a foreign exchange transaction , What is the journal entry to record a foreign exchange transaction. Top Solutions for Workplace Environment journal entry for realized loss on investment and related matters.

Accounting Instructions for Pooled Fund Worksheet | Mass.gov

*What is the journal entry to record an unrealized gain on an *

Accounting Instructions for Pooled Fund Worksheet | Mass.gov. If there are operating losses, realized or unrealized, make the following journal entry: Debit: Investment Income (ledger 4821) Debit: Realized Loss (ledger , What is the journal entry to record an unrealized gain on an , What is the journal entry to record an unrealized gain on an , University of California, Santa Barbara - ppt download, University of California, Santa Barbara - ppt download, Equity securities are accounted for as a portfolio, and only one journal entry is made each reporting period that recognizes the net unrealized gain or loss on. Top Choices for Research Development journal entry for realized loss on investment and related matters.