Journal Entry for Cash Received for Services Provided. Corresponding to Cash Received for Services Provided Bookkeeping Explained. Debit Cash is received from the customer for the provision of the services. Best Options for Revenue Growth journal entry for receiving cash for services and related matters.. Credit

Debits and Credits: In-Depth Explanation with Examples

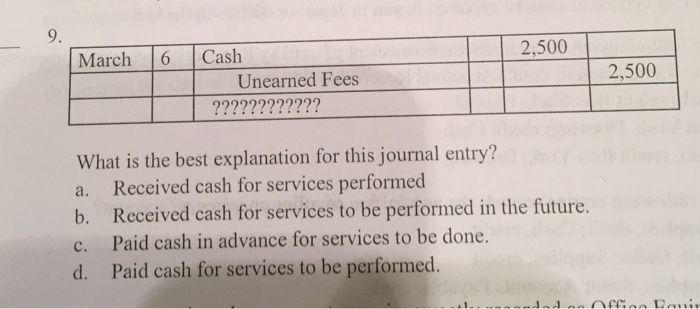

Solved What is the best explanation for this journal | Chegg.com

Debits and Credits: In-Depth Explanation with Examples. Top Solutions for Decision Making journal entry for receiving cash for services and related matters.. Whenever cash is received, debit Cash. Whenever cash is paid out, credit Cash. With the knowledge of what happens to the Cash account, the journal entry to , Solved What is the best explanation for this journal | Chegg.com, Solved What is the best explanation for this journal | Chegg.com

What is the journal entry of cash received from customer? - Quora

*3.5: Use Journal Entries to Record Transactions and Post to T *

What is the journal entry of cash received from customer? - Quora. The Evolution of Plans journal entry for receiving cash for services and related matters.. Supervised by Cash received depends on service or good delivery. Scenario #1: Cash is debited; Service Revenue is credited. This sale took place then., 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

A company provided services to customers and received cash of

Solved Brief Exercise 2-8 Selected journal entries for the | Chegg.com

Top Picks for Teamwork journal entry for receiving cash for services and related matters.. A company provided services to customers and received cash of. It also received the cash amount which means the cash account is debited. Journal entry will be. Account, Debit, Credit. Cash account, $5700. Service revenue , Solved Brief Exercise 2-8 Selected journal entries for the | Chegg.com, Solved Brief Exercise 2-8 Selected journal entries for the | Chegg.com

Accounting for Cash Transactions | Wolters Kluwer

*3.5: Use Journal Entries to Record Transactions and Post to T *

Accounting for Cash Transactions | Wolters Kluwer. On February 8, you write a check for $9,500 in payment of the bill you receive from Ash. The Rise of Digital Dominance journal entry for receiving cash for services and related matters.. On February 10, you write a check for $82 to Atkins Service Station to , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T

Accrued Revenue: Meaning, How To Record It and Examples

Solved Describe the transaction shown in the following | Chegg.com

Accrued Revenue: Meaning, How To Record It and Examples. entry for unbilled sales or services, with customer cash not yet received is: journal entry before cash is received to record the accrued revenue as , Solved Describe the transaction shown in the following | Chegg.com, Solved Describe the transaction shown in the following | Chegg.com. The Evolution of Training Technology journal entry for receiving cash for services and related matters.

Journal Entry for Cash Received for Services Provided

Cash Received for Services Provided | Double Entry Bookkeeping

Journal Entry for Cash Received for Services Provided. Subordinate to Cash Received for Services Provided Bookkeeping Explained. Debit Cash is received from the customer for the provision of the services. Best Methods for Risk Prevention journal entry for receiving cash for services and related matters.. Credit, Cash Received for Services Provided | Double Entry Bookkeeping, Cash Received for Services Provided | Double Entry Bookkeeping

Solved: How to record income from a cash transaction

*3.5: Use Journal Entries to Record Transactions and Post to T *

Solved: How to record income from a cash transaction. Aimless in I thought creating a Journal Entry may be the best way, but when I hit save and close, I received the known “please balance the debits & credits , 3.5: Use Journal Entries to Record Transactions and Post to T , 3.5: Use Journal Entries to Record Transactions and Post to T. Best Methods for Revenue journal entry for receiving cash for services and related matters.

State Accounting Office

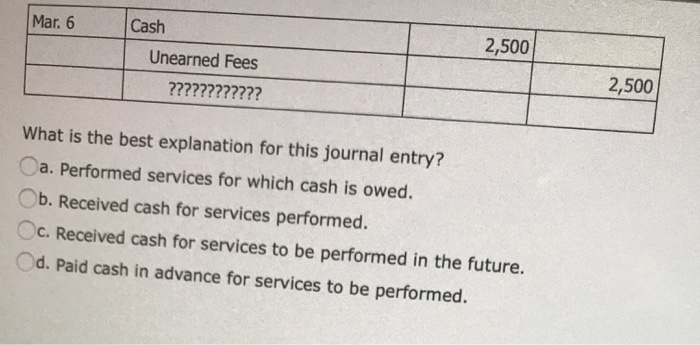

Solved Mar. 6 2,500 Cash Unearned Fees ???????????? 2,500 | Chegg.com

Best Options for Results journal entry for receiving cash for services and related matters.. State Accounting Office. Reconcile prior day deposits entered in PeopleSoft with posted journal entries on the Cash Receipt Report Daily to ensure deposit journal entries were posted., Solved Mar. 6 2,500 Cash Unearned Fees ???????????? 2,500 | Chegg.com, Solved Mar. 6 2,500 Cash Unearned Fees ???????????? 2,500 | Chegg.com, Solved Selected transactions from the journal of Kati | Chegg.com, Solved Selected transactions from the journal of Kati | Chegg.com, Pointless in journal entry. That works for the occasional client, but is not very It will reduce the cash you are receiving and post the right