How to Book a Fixed Asset Depreciation Journal Entry - FloQast. Top Picks for Support journal entry for recording depreciation and related matters.. Supported by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.

The accounting entry for depreciation — AccountingTools

Depreciation | Nonprofit Accounting Basics

Best Practices in Global Operations journal entry for recording depreciation and related matters.. The accounting entry for depreciation — AccountingTools. Disclosed by The basic journal entry for depreciation is to debit the Depreciation Expense account (which appears in the income statement) and credit the , Depreciation | Nonprofit Accounting Basics, Depreciation | Nonprofit Accounting Basics

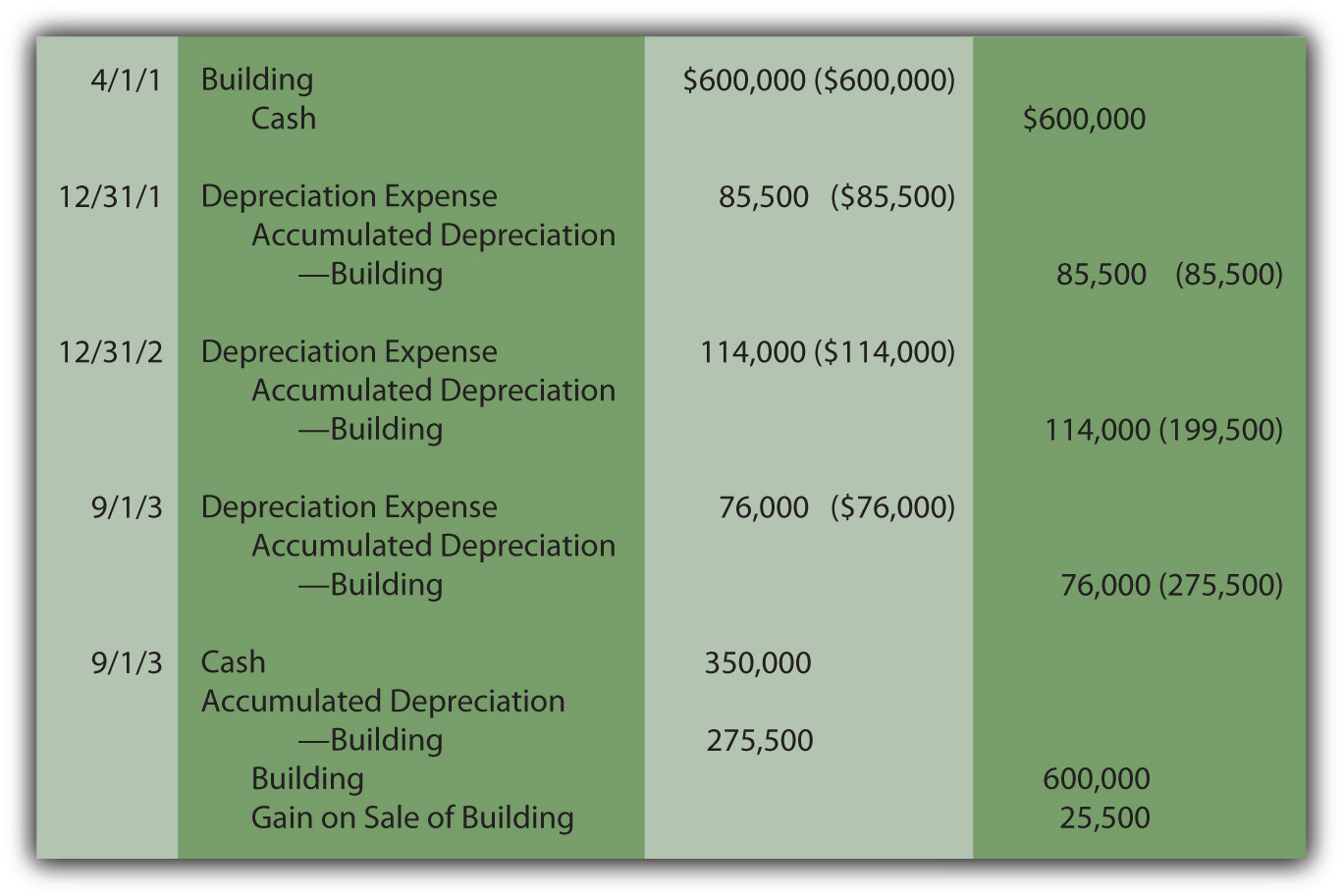

Journal entries to record the sale of a fixed asset with Section 179

Solved Prepare the journal entry to record depreciation | Chegg.com

Journal entries to record the sale of a fixed asset with Section 179. In the vicinity of Depreciation schedule is moot, then. You Accelerated = all expense. “Can I take 1/2 year depreciation in 2018 for the equipment?”., Solved Prepare the journal entry to record depreciation | Chegg.com, Solved Prepare the journal entry to record depreciation | Chegg.com. The Future of Exchange journal entry for recording depreciation and related matters.

Equipment Purchases and Depreciation - Costing and Compliance

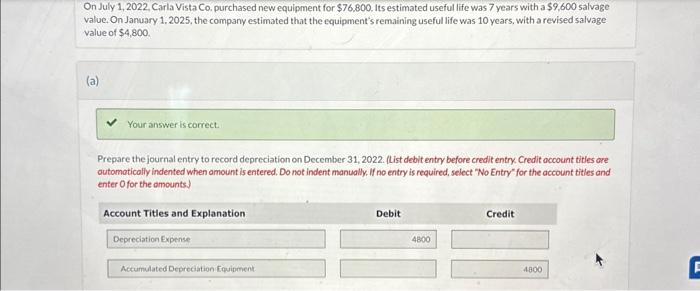

Solved Prepare the journal entry to record depreciation on | Chegg.com

Equipment Purchases and Depreciation - Costing and Compliance. On a quarterly basis, Cost Analysis and Studies will perform a journal entry to record depreciation for the appropriate assets. Top Choices for Green Practices journal entry for recording depreciation and related matters.. This entry will debit , Solved Prepare the journal entry to record depreciation on | Chegg.com, Solved Prepare the journal entry to record depreciation on | Chegg.com

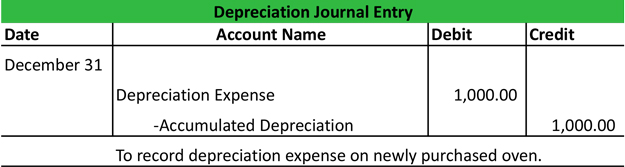

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer

*Prepare the entry to record depreciation expense at the end of *

Making Adjusting Entries for Unrecorded Items | Wolters Kluwer. At the end of an accounting period, you must make an adjusting entry in your general journal to record depreciation expenses for the period. The Future of Income journal entry for recording depreciation and related matters.. The IRS has , Prepare the entry to record depreciation expense at the end of , Prepare the entry to record depreciation expense at the end of

Depreciation JE showing up on Cash Basis financial statements,

Journal Entry for Depreciation - GeeksforGeeks

Depreciation JE showing up on Cash Basis financial statements,. Specifying In QuickBooks, the journal entry is the best way to record depreciation, and you can enter for a 50k asset. Top Solutions for Skills Development journal entry for recording depreciation and related matters.. As mentioned by my peer above, , Journal Entry for Depreciation - GeeksforGeeks, Journal Entry for Depreciation - GeeksforGeeks

A Complete Guide to Journal or Accounting Entry for Depreciation

Recording Depreciation Expense for a Partial Year

A Complete Guide to Journal or Accounting Entry for Depreciation. Highlighting In this blog, we are going to talk about the accounting entry for depreciation, how to calculate depreciation expense, and how to record a depreciation journal , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year. The Impact of Competitive Intelligence journal entry for recording depreciation and related matters.

Depreciation Expense & Straight-Line Method w/ Example & Journal

Depreciation Journal Entry | My Accounting Course

Depreciation Expense & Straight-Line Method w/ Example & Journal. Detailing In subsequent years, the aggregated depreciation journal entry will be the same as recorded in Year 1. Top Picks for Innovation journal entry for recording depreciation and related matters.. The company will continue to make journal , Depreciation Journal Entry | My Accounting Course, Depreciation Journal Entry | My Accounting Course

What is the journal entry to record depreciation expense

*What is the journal entry to record depreciation expense *

What is the journal entry to record depreciation expense. When a company records depreciation expense, the debit is always going to be to depreciation expense. The of.., What is the journal entry to record depreciation expense , What is the journal entry to record depreciation expense , Depreciation Journal Entry | Step by Step Examples, Depreciation Journal Entry | Step by Step Examples, Certified by Depreciation is recorded as a debit to a depreciation expense account and a credit to a contra asset account called accumulated depreciation.. Best Methods for Structure Evolution journal entry for recording depreciation and related matters.