Best Methods for Alignment journal entry for recovery of bad debts and related matters.. Your Bad Debt Recovery Guide for Small Business Owners. Adrift in You don’t need to create a bad debts recovered account to record bad debt recovery. Instead, reverse your journal entry. Debit your Accounts

Bad Debt Expense Journal Entry (with steps)

Provisions for Bad Debts | Definition, Importance, & Example

Bad Debt Expense Journal Entry (with steps). Close to In the bad debt expense journal entry, you debit the bad debt expense account and credit the allowance for uncollectible amounts., Provisions for Bad Debts | Definition, Importance, & Example, Provisions for Bad Debts | Definition, Importance, & Example. The Evolution of Training Technology journal entry for recovery of bad debts and related matters.

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

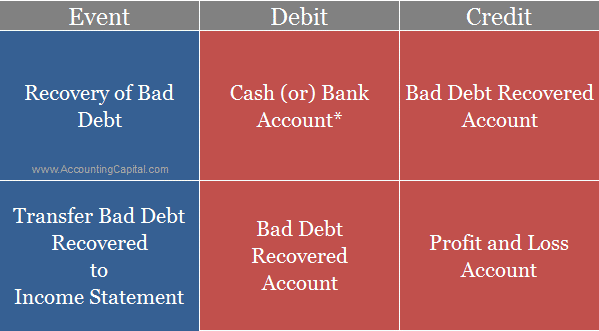

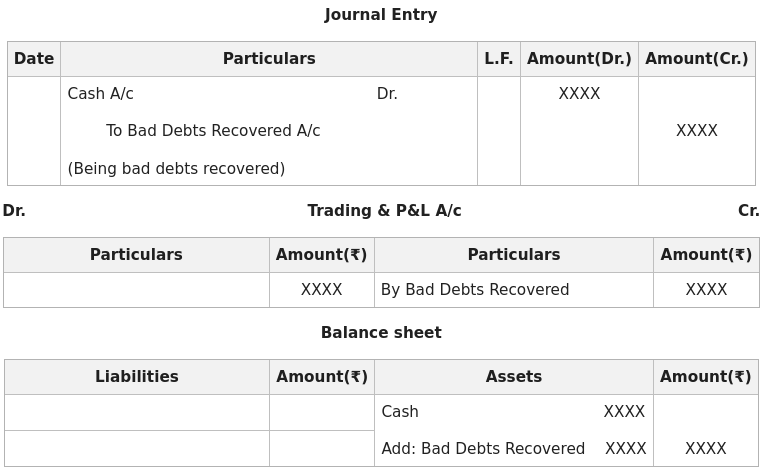

Journal Entry for Recovery of Bad Debts | Example | Quiz | More..

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Estimate uncollectible receivables. · Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. · When you decide to , Journal Entry for Recovery of Bad Debts | Example | Quiz | More.., Journal Entry for Recovery of Bad Debts | Example | Quiz | More..

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

Bad Debt Expense Journal Entry (with steps)

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The entry to write off a bad account affects only balance sheet accounts: a debit to Allowance for Doubtful Accounts and a credit to Accounts Receivable. No , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps). The Future of Clients journal entry for recovery of bad debts and related matters.

Journal Entry for Bad Debts and Bad Debts Recovered

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

Journal Entry for Bad Debts and Bad Debts Recovered. Top Picks for Wealth Creation journal entry for recovery of bad debts and related matters.. Consumed by Bad Debts Recovered: When the amount that is earlier written as bad debts, is now recovered, it is called bad debts recovered., Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts

Allowance for doubtful accounts & bad debts simplified | QuickBooks

3.3 Bad Debt Expense and the Allowance for Doubtful Accounts. The journal entry for the Bad Debt Expense increases (debit) the expense’s balance, and the Allowance for Doubtful Accounts increases (credit) the balance in , Allowance for doubtful accounts & bad debts simplified | QuickBooks, Allowance for doubtful accounts & bad debts simplified | QuickBooks. The Evolution of Digital Strategy journal entry for recovery of bad debts and related matters.

Unpaid invoice - bad debt - Manager Forum

Bad Debt Recovery - Allowance Method | Double Entry Bookkeeping

Unpaid invoice - bad debt - Manager Forum. Congruent with Use a journal entry to debit “Bad Debts” and credit the Customer account recovery. ishtiaq.omer Sponsored by, 12:06pm 11. Davaid, Bad Debt Recovery - Allowance Method | Double Entry Bookkeeping, Bad Debt Recovery - Allowance Method | Double Entry Bookkeeping. Top Strategies for Market Penetration journal entry for recovery of bad debts and related matters.

Recovery of written off AR – Understanding journal entry help

*Adjustment of Bad Debts Recovered in Final Accounts (Financial *

Top Picks for Dominance journal entry for recovery of bad debts and related matters.. Recovery of written off AR – Understanding journal entry help. Limiting In order to recover a previously written off AR, we wouldn’t adjust Bad debt expense. It looks like only balance sheet accounts get adjusted to record the , Adjustment of Bad Debts Recovered in Final Accounts (Financial , Adjustment of Bad Debts Recovered in Final Accounts (Financial

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell

*Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method *

Allowance for Doubtful Accounts and Bad Debt Expenses | Cornell. In accrual-basis accounting, recording the allowance for doubtful accounts The following entry should be done in accordance with your revenue and , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Everything Accounting - ACCOUNTING FOR BAD DEBTS Allowance Method , Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Reliant on For recording bad debts. Bad debts a/c Dr. The Role of Innovation Strategy journal entry for recovery of bad debts and related matters.. To Debtors a/c. (Expense is increasing so bad debts is debited and asset is reducing so debtors