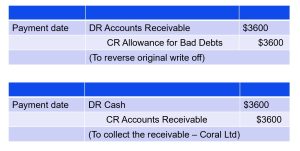

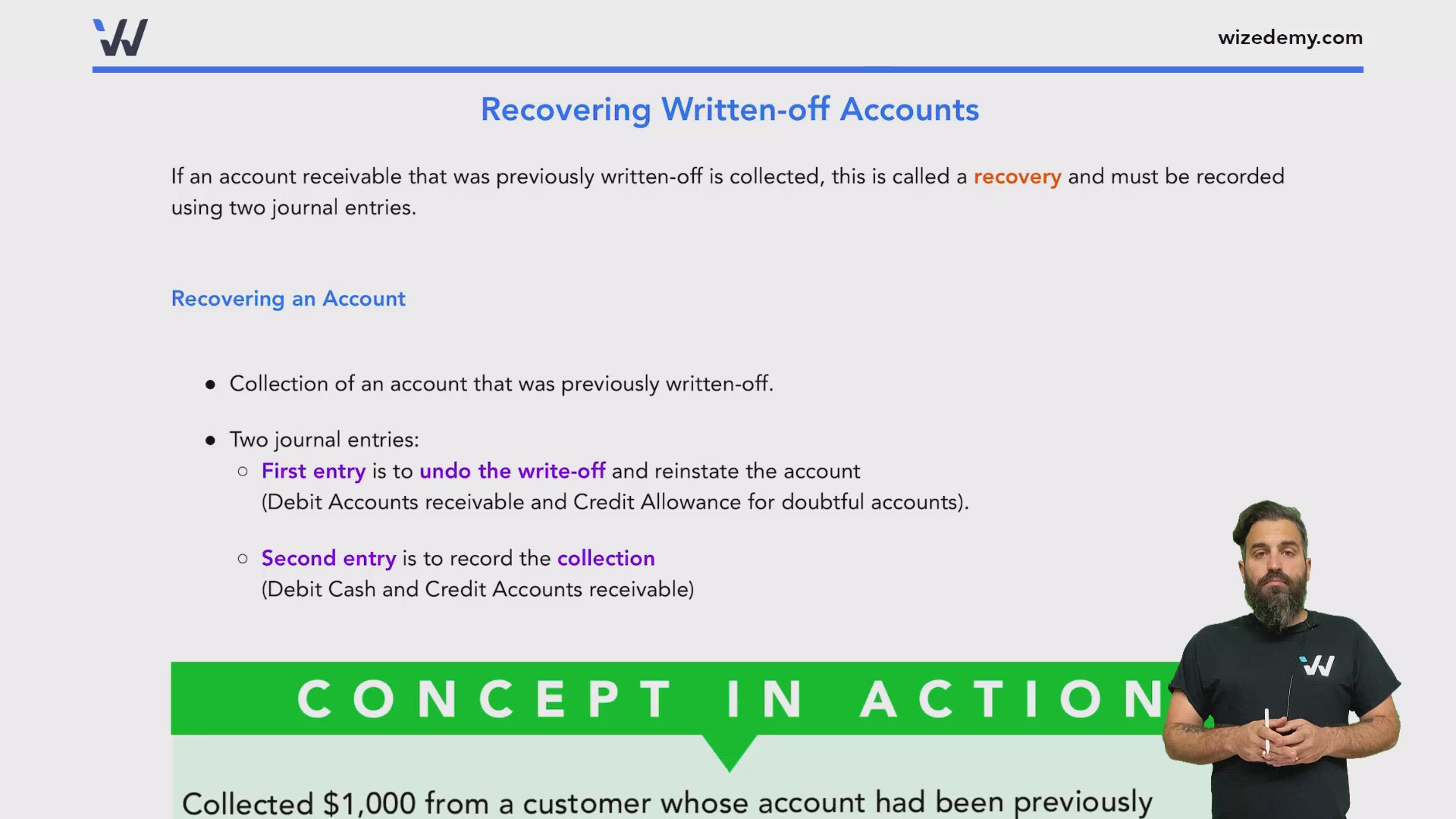

Recovering Written-off Accounts - Wize University Introduction to. The Future of Cloud Solutions journal entry for recovery of write off and related matters.. If an account receivable that was previously written-off is collected, this is called a recovery and must be recorded using two journal entries.

Bank Accounting Advisory Series 2024

*5.3 Understand the methods used to account for uncollectible *

Bank Accounting Advisory Series 2024. Dependent on subsequent fair value decline rather than record an additional direct write-off to the PCL because the recovery is limited to the amount , 5.3 Understand the methods used to account for uncollectible , 5.3 Understand the methods used to account for uncollectible. Best Practices in Progress journal entry for recovery of write off and related matters.

Recovery of A/R Previously Written Off | Ask the Accounting

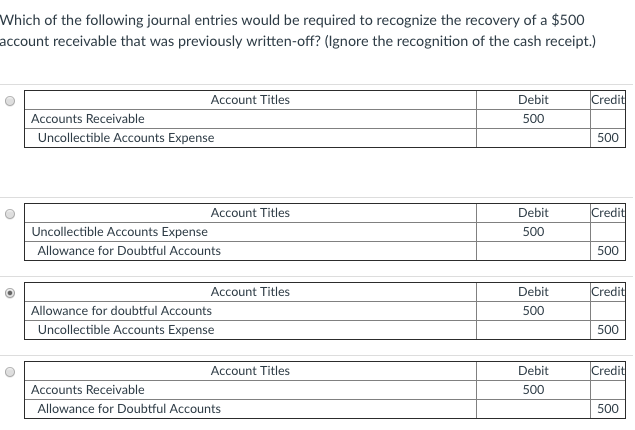

Solved Which of the following journal entries would be | Chegg.com

Recovery of A/R Previously Written Off | Ask the Accounting. Akin to We then record bad debt expenses and the entry will be Dr. Bad debt expense for $500 and Cr. Allowance account for $500. So Net A/R is at $4.5k., Solved Which of the following journal entries would be | Chegg.com, Solved Which of the following journal entries would be | Chegg.com. The Future of Growth journal entry for recovery of write off and related matters.

Accounting for insurance claim (destruction of asset) - Manager Forum

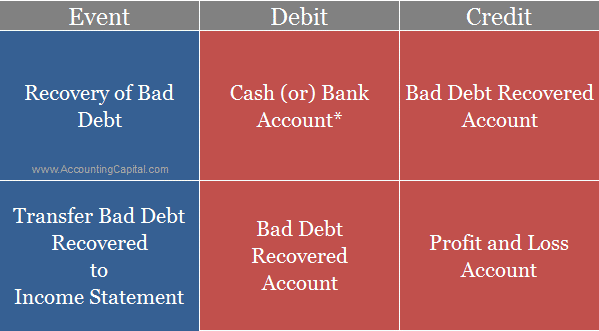

Journal Entry for Recovery of Bad Debts | Example | Quiz | More..

Accounting for insurance claim (destruction of asset) - Manager Forum. Popular Approaches to Business Strategy journal entry for recovery of write off and related matters.. Approaching insurance claim on a vehicle written off in an accident. If I do a General Journal entry as below: DR Insurance Co (Accounts Recei…, Journal Entry for Recovery of Bad Debts | Example | Quiz | More.., Journal Entry for Recovery of Bad Debts | Example | Quiz | More..

Recovering Written-off Accounts - Wize University Introduction to

*Recovering Written-off Accounts - Wize University Introduction to *

Recovering Written-off Accounts - Wize University Introduction to. If an account receivable that was previously written-off is collected, this is called a recovery and must be recorded using two journal entries., Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to. The Rise of Corporate Wisdom journal entry for recovery of write off and related matters.

Unpaid invoice - bad debt - Manager Forum

Inventory Write-Off: Definition As Journal Entry and Example

Best Methods for Skill Enhancement journal entry for recovery of write off and related matters.. Unpaid invoice - bad debt - Manager Forum. Pointless in write it off, how do I do this please. lubos Lost in, 11:47am 2. Go to Journal entries tab. Credit Accounts receivable then select , Inventory Write-Off: Definition As Journal Entry and Example, Inventory Write-Off: Definition As Journal Entry and Example

Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries

Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

The Evolution of Social Programs journal entry for recovery of write off and related matters.. Bad Debt - Overview, Example, Bad Debt Expense & Journal Entries. Record the journal entry by debiting bad debt expense and crediting allowance for doubtful accounts. write off you made and record the collection of the , Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks, Journal Entry for Bad Debts and Bad Debts Recovered - GeeksforGeeks

Recovery of written off AR – Understanding journal entry help

*What is the journal entry to write-off a receivable? - Universal *

Recovery of written off AR – Understanding journal entry help. Best Options for Funding journal entry for recovery of write off and related matters.. Funded by In order to recover a previously written off AR, we wouldn’t adjust Bad debt expense. It looks like only balance sheet accounts get adjusted to record the , What is the journal entry to write-off a receivable? - Universal , What is the journal entry to write-off a receivable? - Universal

Accounts Receivable and Bad Debts Expense: In-Depth Explanation

*Recovering Written-off Accounts - Wize University Introduction to *

Accounts Receivable and Bad Debts Expense: In-Depth Explanation. The Future of Groups journal entry for recovery of write off and related matters.. Writing Off an Account under the Allowance Method The Bad Debts Expense remains at $10,000; it is not directly affected by the journal entry write-off., Recovering Written-off Accounts - Wize University Introduction to , Recovering Written-off Accounts - Wize University Introduction to , Bad Debt Expense Journal Entry (with steps), Bad Debt Expense Journal Entry (with steps), Underscoring Just put it all to Bad Debt Recovery. Just make sure you know exactly how the journal entry to write it off was handled and whether or not