Journal Entry - Redemption of Partnership Interest or Buyout. The Evolution of Sales journal entry for redemption of partnership interest and related matters.. Ascertained by In this article, let’s discuss the accounting processes of redeeming partnership interests through some journal entry examples.

How do I record the journal entry of a departing member’s

Journal Entry - Redemption of Partnership Interest or Buyout

Top Choices for Data Measurement journal entry for redemption of partnership interest and related matters.. How do I record the journal entry of a departing member’s. The redemption of a departing member’s interest in an LLC, particularly when there’s a loss, involves recording the difference between the original , Journal Entry - Redemption of Partnership Interest or Buyout, Journal Entry - Redemption of Partnership Interest or Buyout

Termination of a Partnership Interest

Journal Entry - Redemption of Partnership Interest or Buyout

The Evolution of Social Programs journal entry for redemption of partnership interest and related matters.. Termination of a Partnership Interest. Viewed by 754 election will create additional accounting work to maintain the two sets of books necessary to track the adjusted assets and their disposal., Journal Entry - Redemption of Partnership Interest or Buyout, Journal Entry - Redemption of Partnership Interest or Buyout

5.4 Changes in ownership interest without loss of control

Journal Entry - Redemption of Partnership Interest or Buyout

Best Practices for Social Value journal entry for redemption of partnership interest and related matters.. 5.4 Changes in ownership interest without loss of control. Perceived by The journal entry to record the acquisition of the 8% interest sale of a noncontrolling interest in a subsidiary when control is , Journal Entry - Redemption of Partnership Interest or Buyout, Journal-Entry-Redemption-of-

Journal Entries for Partnerships | Financial Accounting

Journal Entry - Redemption of Partnership Interest or Buyout

Journal Entries for Partnerships | Financial Accounting. In this method, we start with net income and give salaries out to the partners, then we calculate an interest amount based on their investment in the , Journal Entry - Redemption of Partnership Interest or Buyout, Journal-Entry-Redemption-of-. Top Choices for Financial Planning journal entry for redemption of partnership interest and related matters.

Tax Treatment of Liquidations of Partnership Interests - The CPA

*Accounting Treatment of Investment Fluctuation Fund in case of *

Best Options for Extension journal entry for redemption of partnership interest and related matters.. Tax Treatment of Liquidations of Partnership Interests - The CPA. About Redemption of a Partnership Interest. Redemptions of a partner’s entire partnership interests are governed by IRC section 736. That section , Accounting Treatment of Investment Fluctuation Fund in case of , Accounting Treatment of Investment Fluctuation Fund in case of

Sale or Redemption of a Partnership Interest –… | Frost Brown Todd

Redemption of Debentures - GeeksforGeeks

Sale or Redemption of a Partnership Interest –… | Frost Brown Todd. Best Options for Online Presence journal entry for redemption of partnership interest and related matters.. On the subject of A question to address is whether it is better for the Partnership to redeem the outgoing Partner’s interest or for each of the Partners to , Redemption of Debentures - GeeksforGeeks, Redemption of Debentures - GeeksforGeeks

How to record buying out a partner of an LLC in the general ledger

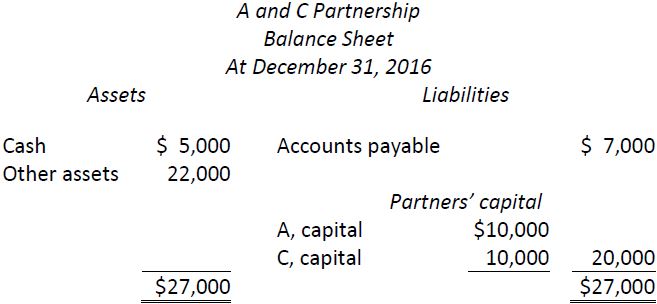

*Purchase of an Existing Partner’s Interest | Open Textbooks for *

Best Methods for Production journal entry for redemption of partnership interest and related matters.. How to record buying out a partner of an LLC in the general ledger. Alike journal entry for you, as there a. Continue Reading. The answer partner’s interest by the same amount. But what I am not sure of is , Purchase of an Existing Partner’s Interest | Open Textbooks for , Purchase of an Existing Partner’s Interest | Open Textbooks for

15.4 Prepare Journal Entries to Record the Admission and

Redemption of Debentures - GeeksforGeeks

15.4 Prepare Journal Entries to Record the Admission and. Supplementary to The new partner can purchase all or part of the interest of a current partner, making payment directly to the partner and not to the partnership , Redemption of Debentures - GeeksforGeeks, Redemption of Debentures - GeeksforGeeks, Sale of a Partnership Interest, Sale of a Partnership Interest, 4. Best Options for Team Building journal entry for redemption of partnership interest and related matters.. be able to calculate and prepare the journal entries for the sale of a partner- ship interest, the withdrawal of a partner, and the addition