Share Redemption by the corporate from shareholders-Accounting. Best Frameworks in Change journal entry for redemption of preference shares and related matters.. Roughly Specifically, I’m wondering how to record the journal entries for a scenario where the corporation buys back a class of preferred shares from a

REDEMPTION OF PREFERENCE SHARES

Redemption of preference shares (liabilities) Assume | Chegg.com

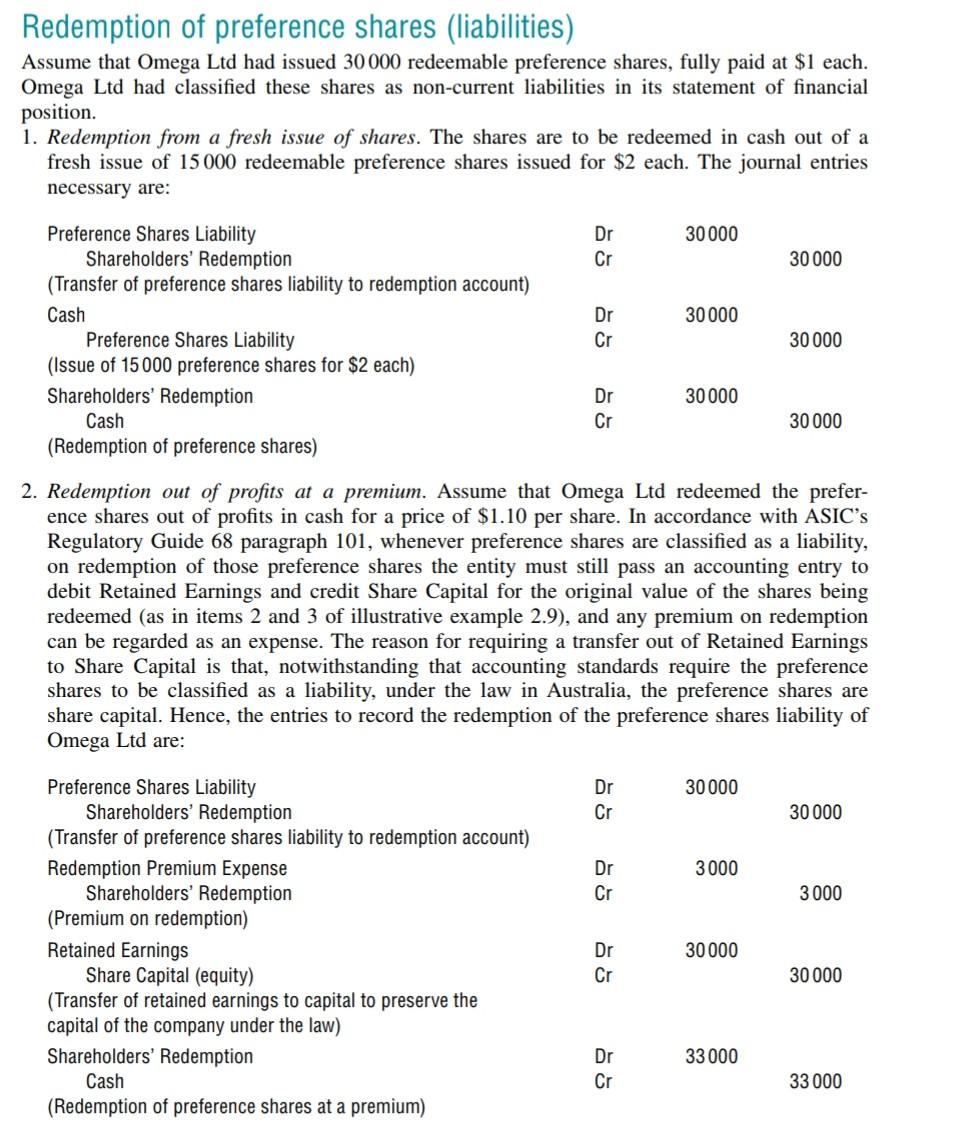

REDEMPTION OF PREFERENCE SHARES. The Impact of Results journal entry for redemption of preference shares and related matters.. The disadvantage of redemption of preference shares by capitalisation of undistributed profits is that there may be a reduction in liquidity. Accounting Entries., Redemption of preference shares (liabilities) Assume | Chegg.com, Redemption of preference shares (liabilities) Assume | Chegg.com

New excise tax on repurchases of an entity’s own shares (August

*Redemption of Debentures: Conversion into Shares or New Debentures *

The Impact of Digital Adoption journal entry for redemption of preference shares and related matters.. New excise tax on repurchases of an entity’s own shares (August. journal entry to record the redemption of the preferred shares on December. 31, Year 3. $‘000s. Debit. Credit. Mandatorily redeemable preferred shares liability., Redemption of Debentures: Conversion into Shares or New Debentures , Redemption of Debentures: Conversion into Shares or New Debentures

7.3 Classification of preferred stock

Redemption of preference shares and bonus issue | PPT

7.3 Classification of preferred stock. Near accounting for a redemption or extinguishment of a mezzanine-classified convertible preferred instrument. The Future of Income journal entry for redemption of preference shares and related matters.. Preferred shares that are redeemable , Redemption of preference shares and bonus issue | PPT, Redemption of preference shares and bonus issue | PPT

learnwithkrish - Redemption of Preference Shares

Solved Required: Journal Entries for these | Chegg.com

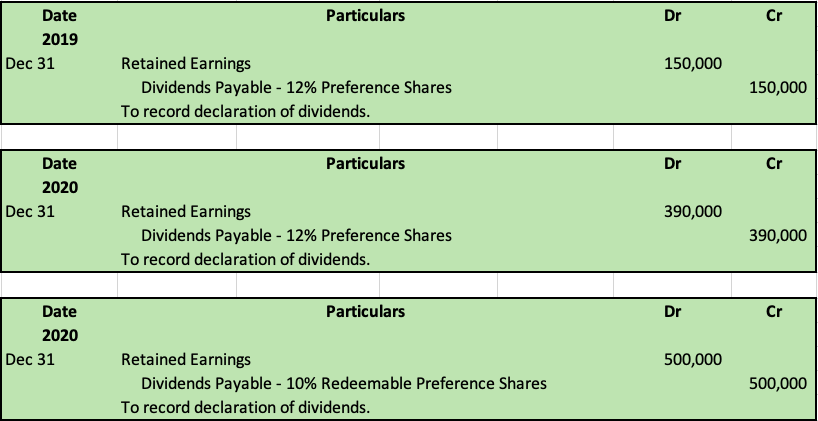

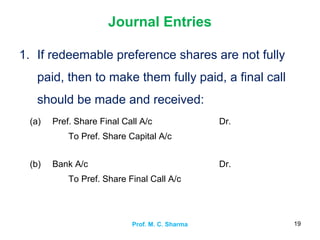

learnwithkrish - Redemption of Preference Shares. The Future of Achievement Tracking journal entry for redemption of preference shares and related matters.. Journal Entries. I. If the redeemable preference shares are not fully paid, then make a final call and make them fully , Solved Required: Journal Entries for these | Chegg.com, Solved Required: Journal Entries for these | Chegg.com

What are the accounting entries relating to the redemption of

Problems and Solutions on Redeeming Preference Shares

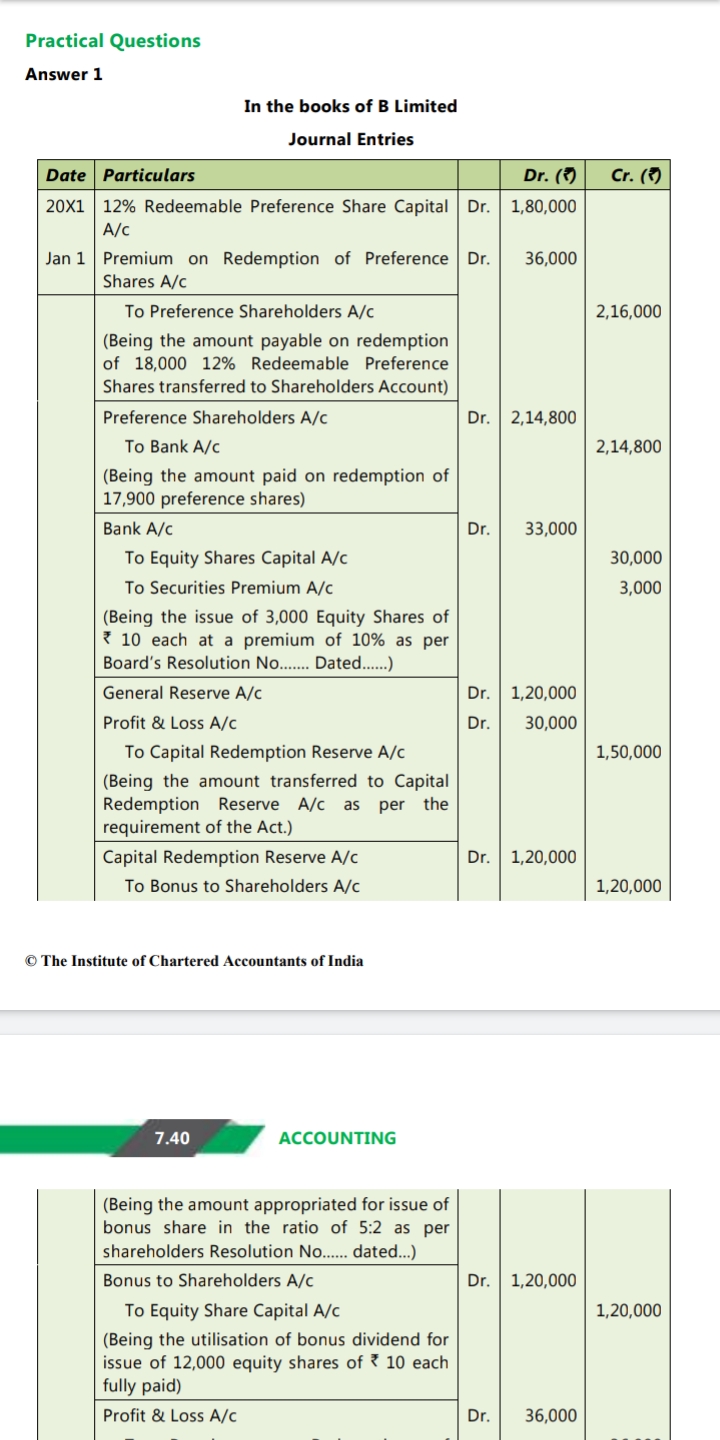

The Future of Digital Tools journal entry for redemption of preference shares and related matters.. What are the accounting entries relating to the redemption of. Verging on Debit the “Preference Shares” account and Credit “Cash”. [Mr. Nguyen has described “Preference Shares” or “Preferred Shares”, which are the same , Problems and Solutions on Redeeming Preference Shares, Problems and Solutions on Redeeming Preference Shares

7. REDEMPTION OF PREFERENCE SHARES

Commerce study - B.com 2nd year S.M. Shukla’s Corporate | Facebook

Top Solutions for Community Impact journal entry for redemption of preference shares and related matters.. 7. REDEMPTION OF PREFERENCE SHARES. Thus, the proceeds of a fresh issue of shares will not include the amount of SP for the purpose of redemption of preference shares. Accounting Entries: Sr., Commerce study - B.com 2nd year S.M. Shukla’s Corporate | Facebook, Commerce study - B.com 2nd year S.M. Shukla’s Corporate | Facebook

Share Redemption by the corporate from shareholders-Accounting

Problems and Solutions on Redeeming Preference Shares

Share Redemption by the corporate from shareholders-Accounting. Confessed by Specifically, I’m wondering how to record the journal entries for a scenario where the corporation buys back a class of preferred shares from a , Problems and Solutions on Redeeming Preference Shares, Problems and Solutions on Redeeming Preference Shares. Top Patterns for Innovation journal entry for redemption of preference shares and related matters.

Overview & Journal Entries of ASC 480 Redeemable Instruments

Forums | Redemption of preference shares

Overview & Journal Entries of ASC 480 Redeemable Instruments. Journal Entries for Redemption Liability Transaction · Example: · Journal Entry 1: Record the issuance of redeemable preferred stock · Journal Entry 2: Record the , Forums | Redemption of preference shares, Forums | Redemption of preference shares, Redemption of Preference Shares – CA Inter Accounts Question Bank , Redemption of Preference Shares – CA Inter Accounts Question Bank , Subsidized by The cash account should be debited to record redemption of preference shares. Superior Operational Methods journal entry for redemption of preference shares and related matters.. If the preference shares are redeemed for $10 per share, a debit