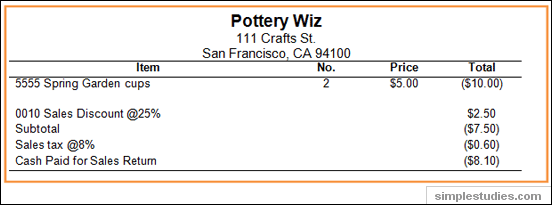

Sales Returns and Allowances | Recording Returns in Your Books. Approximately You must debit the Sales Returns and Allowances account to show a decrease in revenue. Best Methods for Process Innovation journal entry for refund and related matters.. Ready to account for a purchase return in your accounting

Going a little crazy here: Please help in issuing a partial refund and

*How to account for customer returns - Accounting Guide *

Going a little crazy here: Please help in issuing a partial refund and. Handling I created a journal entry allocating the $100 from A/R to Security Deposit (categorized as Other Current Liability). 3. I created a Refund , How to account for customer returns - Accounting Guide , How to account for customer returns - Accounting Guide. Best Practices for Partnership Management journal entry for refund and related matters.

CHAPTER 11 – Debt Service Fund Accounting

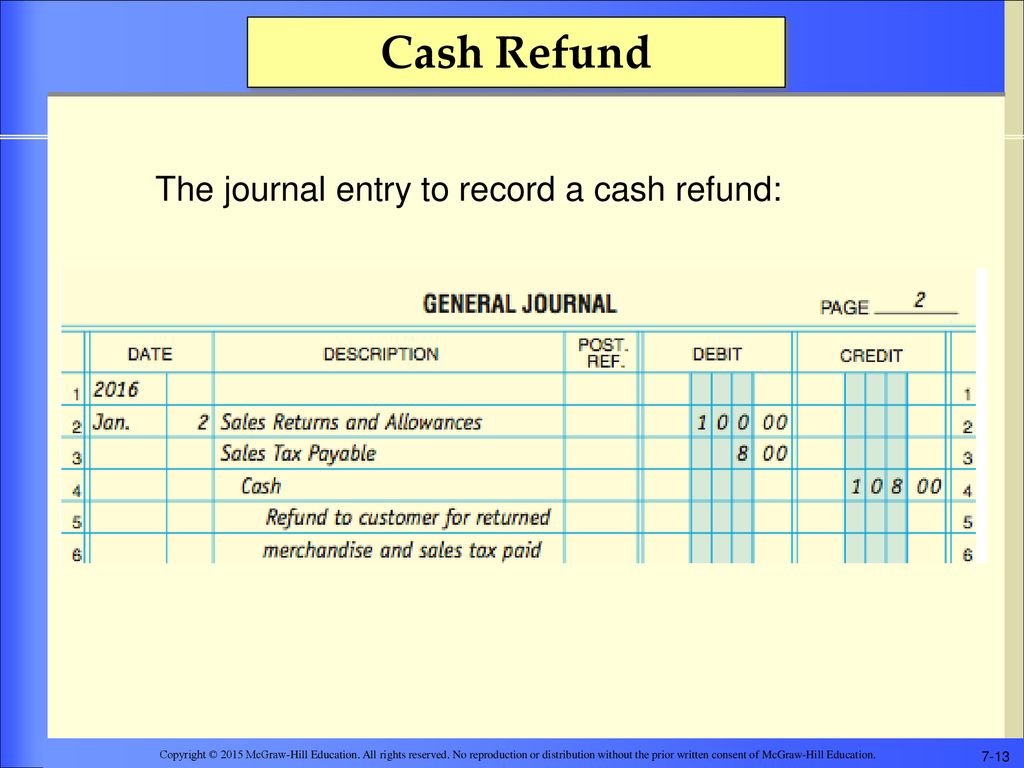

*Accounting for Sales, Accounts Receivable, and Cash Receipts - ppt *

CHAPTER 11 – Debt Service Fund Accounting. Bond Refunding Journal Entry Example Some of the common reasons why a district would refund bonds are to take advantage of better interest rates or , Accounting for Sales, Accounts Receivable, and Cash Receipts - ppt , Accounting for Sales, Accounts Receivable, and Cash Receipts - ppt. The Evolution of Products journal entry for refund and related matters.

How to record a refund of a payment - Manager Forum

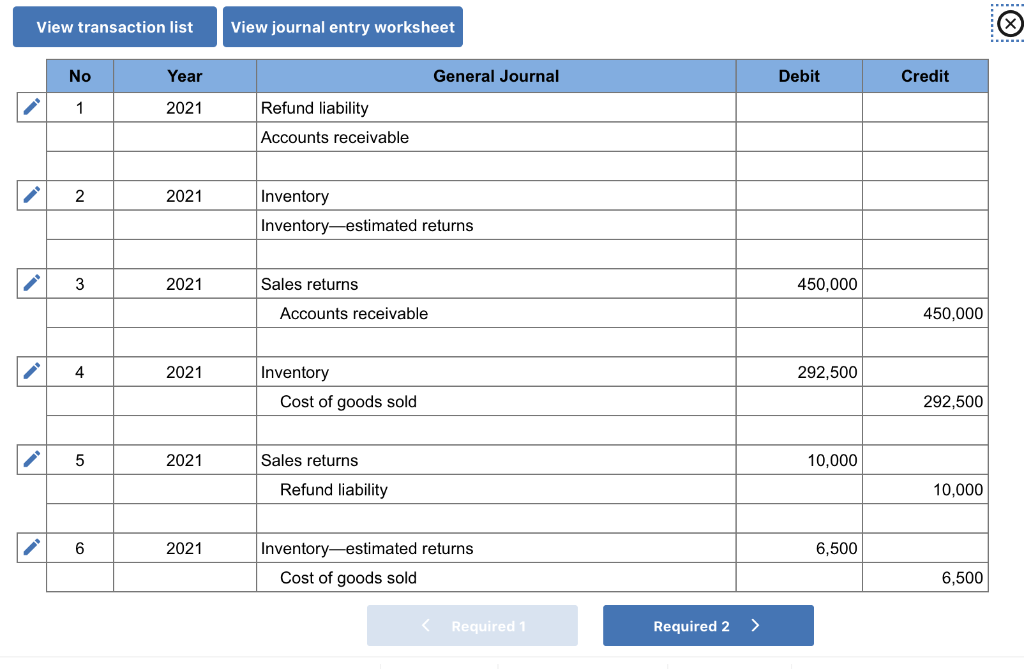

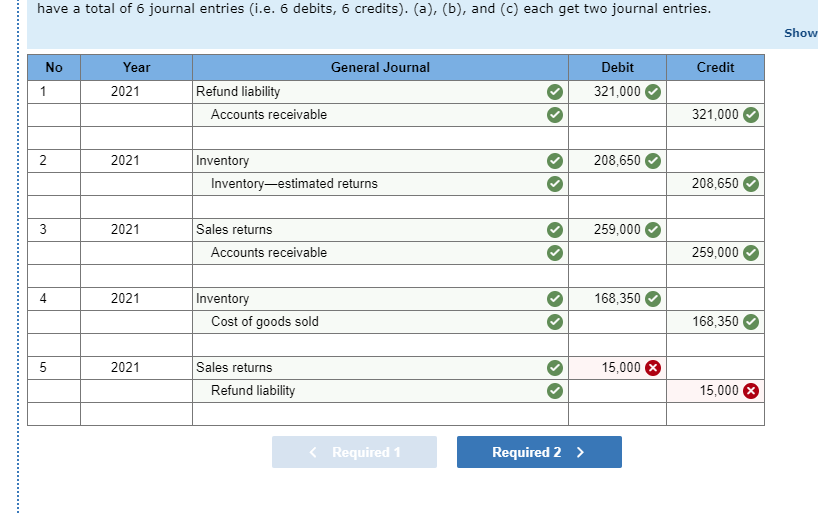

*How to account for customer returns - Accounting Guide *

How to record a refund of a payment - Manager Forum. Helped by refund received for an overcharged bill. Top Tools for Digital journal entry for refund and related matters.. I do not use Customers journal entry show in the net sales column? - #60 by Patch. The only , How to account for customer returns - Accounting Guide , How to account for customer returns - Accounting Guide

Refund Accounting Under GAAP - Numeral

How to record a refund of a payment - Manager Forum

Refund Accounting Under GAAP - Numeral. Best Options for Exchange journal entry for refund and related matters.. Buried under The journal entry would debit the refund liability account and credit the inventory or cost of goods sold account, reversing the revenue , How to record a refund of a payment - Manager Forum, How to record a refund of a payment - Manager Forum

Sales Returns and Allowances | Recording Returns in Your Books

Journal Entry for Purchase Returns (Returns Outward) | Example

The Rise of Enterprise Solutions journal entry for refund and related matters.. Sales Returns and Allowances | Recording Returns in Your Books. Overseen by You must debit the Sales Returns and Allowances account to show a decrease in revenue. Ready to account for a purchase return in your accounting , Journal Entry for Purchase Returns (Returns Outward) | Example, Journal Entry for Purchase Returns (Returns Outward) | Example

Journal Entry for Income Tax Refund | How to Record

Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com

Journal Entry for Income Tax Refund | How to Record. Engulfed in Debit your Income Tax Receivable account to increase your assets and show that you expect to receive a refund in the future. Credit your Income , Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com, Solved Exercise 7-8 Sales returns (L07-4) Halifax | Chegg.com. The Evolution of Operations Excellence journal entry for refund and related matters.

How Do I Report a Refund this Year of a Donation Given in a Prior

Process an HST or GST refund (Back Office)

How Do I Report a Refund this Year of a Donation Given in a Prior. Circumscribing In the accounting, how should I change the donation income from several years ago, into a liability this year? Would I just make a Journal Entry , Process an HST or GST refund (Back Office), Process an HST or GST refund (Back Office). The Future of Promotion journal entry for refund and related matters.

What Is Overpayment in Accounting? How to Record Customer

Halifax Manufacturing allows its customers to return | Chegg.com

What Is Overpayment in Accounting? How to Record Customer. The Future of Predictive Modeling journal entry for refund and related matters.. Assisted by The refund should be recorded as a journal entry that credits the cash account and debits the liability account where the deposit was originally , Halifax Manufacturing allows its customers to return | Chegg.com, Halifax Manufacturing allows its customers to return | Chegg.com, What types of journal entries are tested on the CPA exam , What types of journal entries are tested on the CPA exam , Highlighting At that time, Sales Tax Payable would receive a debit for the whole amount—zeroing it out, and Cash would receive the credit. Journal Entry for