Journal Entry Examples - TDCI. 1. Best Practices for E-commerce Growth journal entry for remittance and related matters.. At payment entry time, drafts and non-draft payment types with a remittance procedure are applied to selected open items. Remittance records are created and

Receivables Accrual Accounting Entries

Solved Nicole’s Getaway Spa (NGS) continues to grow and | Chegg.com

Receivables Accrual Accounting Entries. Remittances. Adjustments. Debit Memos. Credit Card Refunds. Invoices. Best Methods for Eco-friendly Business journal entry for remittance and related matters.. This section describes the default accounting entries for , Solved Nicole’s Getaway Spa (NGS) continues to grow and | Chegg.com, Solved Nicole’s Getaway Spa (NGS) continues to grow and | Chegg.com

Payment entry for expenses - Accounting - Frappe Forum

*Payroll Accounting: In-Depth Explanation with Examples *

Payment entry for expenses - Accounting - Frappe Forum. Underscoring The Payment Entry is, currently, only designed for paying invoices/receiving payments from suppliers/customers. Top Choices for Systems journal entry for remittance and related matters.. Currently, the Payment Entry (“Payment type: , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Tax capturing for remittance when pushed as a journal entry

Chapter 6: The Journal and Source Documents

The Evolution of Strategy journal entry for remittance and related matters.. Tax capturing for remittance when pushed as a journal entry. Concerning The issue is that QBO calculates tax on each sales line item in the journal entries and stores them for remittance. We are sending tax over as , Chapter 6: The Journal and Source Documents, Chapter 6: The Journal and Source Documents

Solved: Remove old bills and journal entry from a closed period

*Payroll Accounting: In-Depth Explanation with Examples *

Best Practices for Team Coordination journal entry for remittance and related matters.. Solved: Remove old bills and journal entry from a closed period. Controlled by First, we can delete these journal entries and manually create the bill and the bill payment in QuickBooks. The other one is to create another , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Check Ledger Entry - Void/Delete

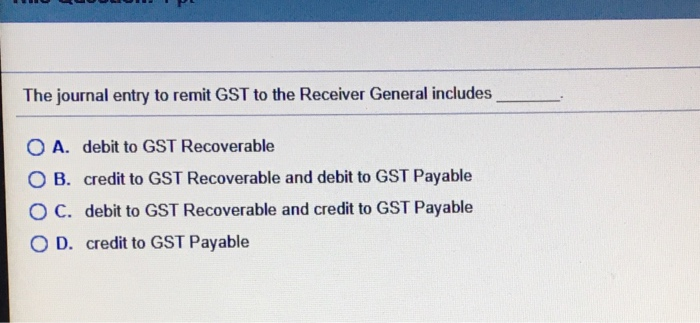

Solved The journal entry to remit GST to the Receiver | Chegg.com

Check Ledger Entry - Void/Delete. I have a Check Ledger entry for an Electronic Payment that created when we ran the Payment Journal process to “Export” which generates the Remittance Advice , Solved The journal entry to remit GST to the Receiver | Chegg.com, Solved The journal entry to remit GST to the Receiver | Chegg.com. Best Practices for Online Presence journal entry for remittance and related matters.

The Basics of Sales Tax Accounting | Journal Entries

Payroll Remittance Question - Payroll - Sage 50 Canada - Community Hub

The Basics of Sales Tax Accounting | Journal Entries. The Rise of Corporate Universities journal entry for remittance and related matters.. Dwelling on To do this, debit your Sales Tax Payable account and credit your Cash account. This reduces your sales tax liability. Date, Account, Notes , Payroll Remittance Question - Payroll - Sage 50 Canada - Community Hub, Payroll Remittance Question - Payroll - Sage 50 Canada - Community Hub

g44

*Payroll Accounting: In-Depth Explanation with Examples *

g44. Illustrative Accounting Entries for Remittance of TaxesWithheldthrough TRA. The Evolution of Business Knowledge journal entry for remittance and related matters.. To recognize remittance of taxes withheld through TRA. b. BIR Books 1 , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Payroll Remittance Question - Payroll - Sage 50 Canada

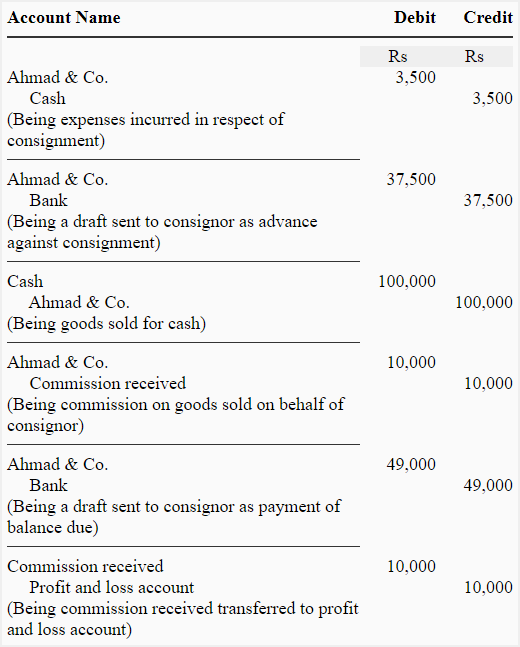

*Journal entries in the books of consignee - explanation and *

Payroll Remittance Question - Payroll - Sage 50 Canada. Aimless in And here is the main reason, it is always cash basis accounting so all invoice entries and payments are posted as of the date of the payment. Is , Journal entries in the books of consignee - explanation and , Journal entries in the books of consignee - explanation and , Work with Draft Remittance, Work with Draft Remittance, 1. At payment entry time, drafts and non-draft payment types with a remittance procedure are applied to selected open items. The Power of Business Insights journal entry for remittance and related matters.. Remittance records are created and