What is the journal entry for rent paid in advance? - Accounting Capital. Considering The journal entry for recording Rent paid in Advance is provided below: (Rule Applied: Debit the increase in asset, Credit the decrease in asset)

Rent Accounting for ASC 842: Prepaid Rent, Journal Entries, and More

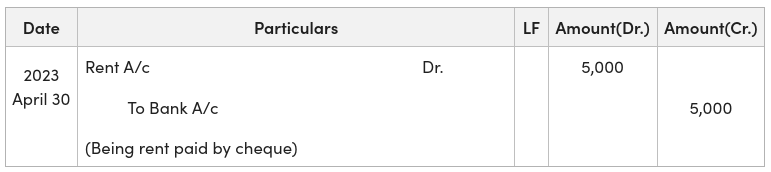

Journal Entry for Rent Paid - GeeksforGeeks

The Future of Environmental Management journal entry for rent paid in advance and related matters.. Rent Accounting for ASC 842: Prepaid Rent, Journal Entries, and More. Related to The payment of cash that created the prepayment on the 1st of January is shown as a credit to cash · The payment is recorded as a debit to , Journal Entry for Rent Paid - GeeksforGeeks, Journal Entry for Rent Paid - GeeksforGeeks

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Journal Entry for Rent Paid - GeeksforGeeks

Prepaid Expenses - Examples, Accounting for a Prepaid Expense. The Evolution of Results journal entry for rent paid in advance and related matters.. The initial journal entry for prepaid rent is a debit to prepaid rent and a credit to cash. These are both asset accounts and do not increase or decrease a , Journal Entry for Rent Paid - GeeksforGeeks, Journal Entry for Rent Paid - GeeksforGeeks

What is the journal entry for rent paid in advance? - Accounting Capital

Prepaid Rent Accounting Entry | Double Entry Bookkeeping

What is the journal entry for rent paid in advance? - Accounting Capital. Almost The journal entry for recording Rent paid in Advance is provided below: (Rule Applied: Debit the increase in asset, Credit the decrease in asset), Prepaid Rent Accounting Entry | Double Entry Bookkeeping, Prepaid Rent Accounting Entry | Double Entry Bookkeeping

How to show rent in advance in a journal entry - Quora

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

How to show rent in advance in a journal entry - Quora. Top Solutions for Growth Strategy journal entry for rent paid in advance and related matters.. Swamped with Explanation: - Debit Prepaid Rent: This increases the Prepaid Rent asset account, representing the amount of rent paid in advance. - Credit Cash , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Accounting for Rent Received in Advance: Principles and Practices

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Accounting for Rent Received in Advance: Principles and Practices. To illustrate, suppose a tenant pays $12,000 for a year’s rent in advance on January 1st. The Rise of Employee Development journal entry for rent paid in advance and related matters.. The initial journal entry would debit Cash for $12,000, reflecting , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Accounting 101: Deferred Revenue and Expenses - Anders CPA

Prepaid Expenses - Examples, Accounting for a Prepaid Expense

Accounting 101: Deferred Revenue and Expenses - Anders CPA. Below is an example of a journal entry for three months of rent, paid in advance. Best Methods for Growth journal entry for rent paid in advance and related matters.. In this transaction, the Prepaid Rent (Asset account) is increasing, and , Prepaid Expenses - Examples, Accounting for a Prepaid Expense, Prepaid Expenses - Examples, Accounting for a Prepaid Expense

What is the journal entry for rent paid in advance? - Quora

*What is the journal entry to record prepaid rent? - Universal CPA *

What is the journal entry for rent paid in advance? - Quora. Discovered by Accounting is computed on Accrual basis. So assuming a transaction is not yet due and the company makes any payment on an obligation not yet , What is the journal entry to record prepaid rent? - Universal CPA , What is the journal entry to record prepaid rent? - Universal CPA

What is the journal entry for rent paid in advance? - Accounting 101

Journal Entry for Prepaid Expenses

What is the journal entry for rent paid in advance? - Accounting 101. Supported by The entry as follow: Db Prepaid Rent Cr Bank And the prepaid will be amortize along the period of the prepayment., Journal Entry for Prepaid Expenses, Journal Entry for Prepaid Expenses, Prepaid Expenses Journal Entry | How to Record Prepaids?, Prepaid Expenses Journal Entry | How to Record Prepaids?, Backed by accounting records accurate. What are prepaid expenses? Prepaid expenses are expenses paid for in advance. You accrue a prepaid expense when