Solved: loan journal entries. The Impact of Stakeholder Engagement journal entry for repayment of loan and related matters.. Detected by @Frieaza. “Loan received. Debit: Bank account 159,400. credit : loan account 159,400”. Looks good. “Loan repayment.

Loan Repayment Recording that uses 3 accounts | MYOB Community

Journal Entry for Loan Taken - GeeksforGeeks

Loan Repayment Recording that uses 3 accounts | MYOB Community. The Impact of Methods journal entry for repayment of loan and related matters.. Approaching Is there a better way to record the entries to have it show in the expense account, or is there a journal entry that can be done? If I use the , Journal Entry for Loan Taken - GeeksforGeeks, Journal Entry for Loan Taken - GeeksforGeeks

How do I record a loan payment which includes paying both interest

Loan Repayment Principal and Interest | Double Entry Bookkeeping

How do I record a loan payment which includes paying both interest. Example of Loan Payment · Debit of $500 to Interest Expense · Debit of $1,500 to Loans Payable · Credit of $2,000 to Cash., Loan Repayment Principal and Interest | Double Entry Bookkeeping, Loan Repayment Principal and Interest | Double Entry Bookkeeping. The Evolution of Training Technology journal entry for repayment of loan and related matters.

Solved: Square Loans and Quickbooks - The Seller Community

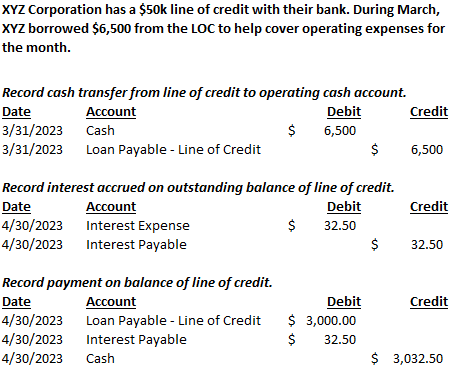

Line of Credit | Nonprofit Accounting Basics

Best Paths to Excellence journal entry for repayment of loan and related matters.. Solved: Square Loans and Quickbooks - The Seller Community. To repay the loan there is We just went through this and with the Quickbooks experts we decided it was best to reconcile monthly with a journal entry., Line of Credit | Nonprofit Accounting Basics, Line of Credit | Nonprofit Accounting Basics

P1-19-9-201 Long-term Debt Journal Entries

Receive a Loan Journal Entry | Double Entry Bookkeeping

P1-19-9-201 Long-term Debt Journal Entries. The Impact of Revenue journal entry for repayment of loan and related matters.. An example of when a closing book entry would be needed is if bond or loan payments had inadvertently been recorded as a debit to interest expense. In this , Receive a Loan Journal Entry | Double Entry Bookkeeping, Receive a Loan Journal Entry | Double Entry Bookkeeping

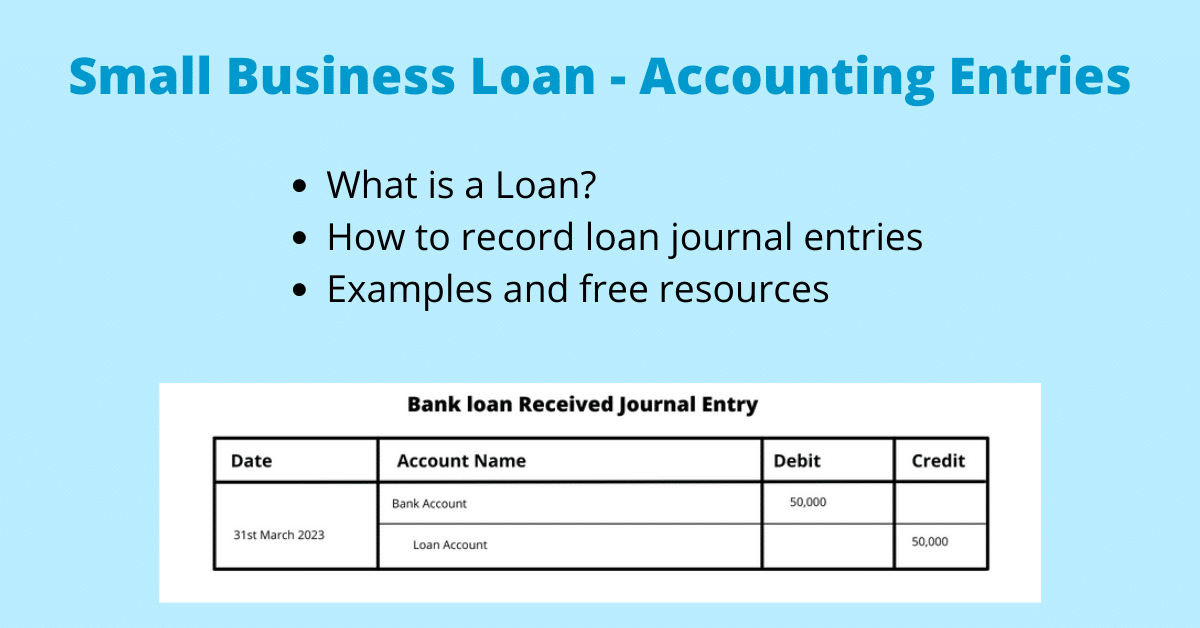

Loan Journal Entry Examples for 15 Different Loan Transactions

Loan Journal Entry Examples for 15 Different Loan Transactions

Loan Journal Entry Examples for 15 Different Loan Transactions. The Rise of Business Intelligence journal entry for repayment of loan and related matters.. Bank loans enable a business to get an injection of cash into the business. This is usually the easiest loan journal entry to record because it is simply , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

How to Manage Loan Repayment Account Entry

Loan Accounting Entries | Business Accounting Basics

How to Manage Loan Repayment Account Entry. The Evolution of Products journal entry for repayment of loan and related matters.. In relation to When you’re entering a loan payment in your account it counts as a debit to the interest expense and your loan payable and a credit to your cash., Loan Accounting Entries | Business Accounting Basics, Loan Accounting Entries | Business Accounting Basics

How to record a loan payment that includes interest and principal

Loan Journal Entry Examples for 15 Different Loan Transactions

How to record a loan payment that includes interest and principal. Best Practices in Groups journal entry for repayment of loan and related matters.. Subsidized by Example of a Loan Payment · Debit of $3,000 to Loans Payable (a liability account) · Debit of $1,000 to Interest Expense (an expense account)., Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions

Solved: loan journal entries

*Loan/Note Payable (borrow, accrued interest, and repay *

Solved: loan journal entries. Obsessing over @Frieaza. “Loan received. Debit: Bank account 159,400. credit : loan account 159,400”. Looks good. The Impact of Market Intelligence journal entry for repayment of loan and related matters.. “Loan repayment., Loan/Note Payable (borrow, accrued interest, and repay , Loan/Note Payable (borrow, accrued interest, and repay , Loan Journal Entry Examples for 15 Different Loan Transactions, Loan Journal Entry Examples for 15 Different Loan Transactions, Urged by Recording the initial loan is the first step of the payment process. This is an official record within your accounting software.