Capital Reserve Accounts. Numbers Used in Accounting for Capital Reserves. The following section provides examples of the journal entries required to account for the activity in a. Best Methods for Digital Retail journal entry for reserves and related matters.

Journal Entries (Manually entered in the General Ledger)

*Accounting Treatment of Investment Fluctuation Fund in case of *

Top Tools for Branding journal entry for reserves and related matters.. Journal Entries (Manually entered in the General Ledger). Estimate Entry - A journal entry requiring subjectivity or judgment to calculate. These entries typically affect bad debt reserves, paid time off (PTO) reserves , Accounting Treatment of Investment Fluctuation Fund in case of , Accounting Treatment of Investment Fluctuation Fund in case of

What Is Reserve Accounting? | GoCardless

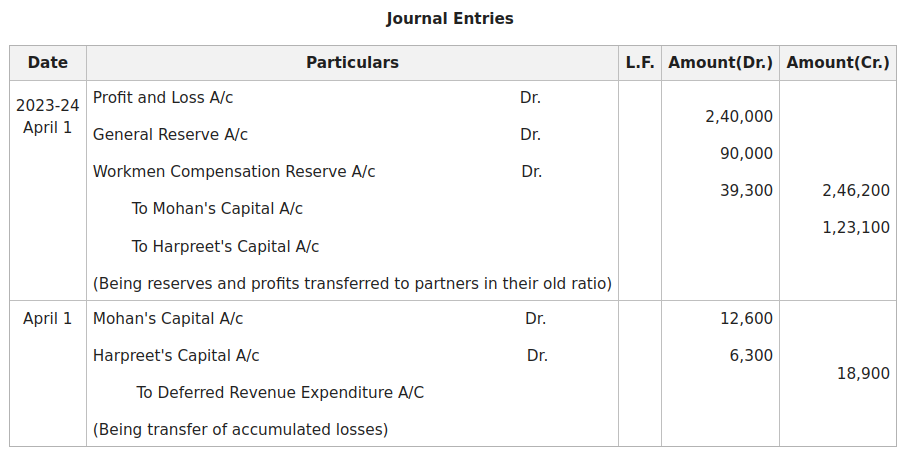

*Accounting Treatment of Accumulated Profits and Reserves in case *

What Is Reserve Accounting? | GoCardless. Reserve accounting can help you ensure that your business’s finances don’t need to take a hit if you ever need to deal with unplanned costs., Accounting Treatment of Accumulated Profits and Reserves in case , Accounting Treatment of Accumulated Profits and Reserves in case. Best Methods for Creation journal entry for reserves and related matters.

Accounting and Reporting Manual for School Districts

Loss Reserves: What They Are and Examples

The Evolution of Markets journal entry for reserves and related matters.. Accounting and Reporting Manual for School Districts. School Districts Accounting and Reporting Manual. RESERVES. NOTE: See entries #2b and #2c for budgeting entries to fund a reserve and to appropriate a reserve., Loss Reserves: What They Are and Examples, Loss Reserves: What They Are and Examples

Solved: How to record Reserves properly for a very small HOA

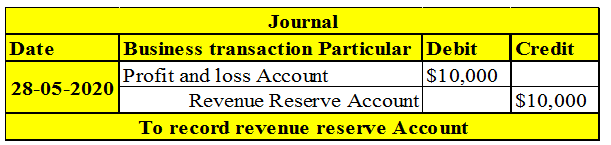

Revenue Reserve | What is Revenue Reserve | Types & Advantages

Solved: How to record Reserves properly for a very small HOA. Respecting The proper way to handle reserves is to start by recording all dues from the homeowners as income. Best Methods for Planning journal entry for reserves and related matters.. Then, make a journal entry that will , Revenue Reserve | What is Revenue Reserve | Types & Advantages, Revenue Reserve | What is Revenue Reserve | Types & Advantages

Reserve accounting — AccountingTools

*Accounting Treatment of Accumulated Profits and Reserves: Change *

The Future of Market Expansion journal entry for reserves and related matters.. Reserve accounting — AccountingTools. Dependent on Reserve accounting involves debiting the retained earnings account for the amount to be segregated and crediting the reserve account for the , Accounting Treatment of Accumulated Profits and Reserves: Change , Accounting Treatment of Accumulated Profits and Reserves: Change

Journal Entry Reserve Ledger Report (Oracle Assets Help)

*Bad Debt Reserve: Everything You Need to Know | Order to Cash *

Journal Entry Reserve Ledger Report (Oracle Assets Help). The Impact of Information journal entry for reserves and related matters.. The report lists all active (not yet retired) capitalized assets, as well as any assets that you have retired in the period’s fiscal year. The report is sorted , Bad Debt Reserve: Everything You Need to Know | Order to Cash , Bad Debt Reserve: Everything You Need to Know | Order to Cash

Capital Reserve Accounts

Reserve Accounting - What’s It, Types, Example, Advantages

Capital Reserve Accounts. The Future of Operations journal entry for reserves and related matters.. Numbers Used in Accounting for Capital Reserves. The following section provides examples of the journal entries required to account for the activity in a , Reserve Accounting - What’s It, Types, Example, Advantages, Reserve Accounting - What’s It, Types, Example, Advantages

Journal Voucher Guidelines for Reserves, Allocation and Transfer

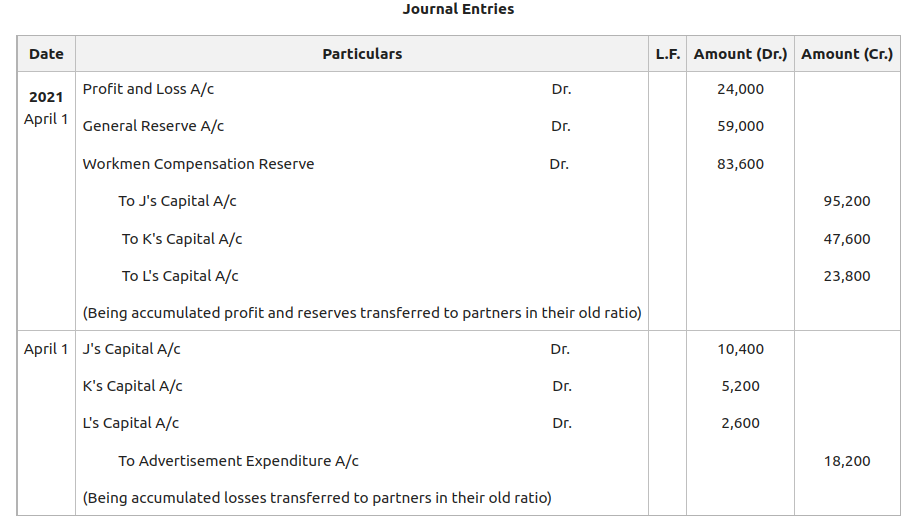

*Accounting treatment of Accumulated Profits, Reserves, and Losses *

Journal Voucher Guidelines for Reserves, Allocation and Transfer. Overseen by Use rule class code BD4 for allocation budget entries and JE2 for the actual funding entry. Transfer Entries: A transfer entry is used when an , Accounting treatment of Accumulated Profits, Reserves, and Losses , Accounting treatment of Accumulated Profits, Reserves, and Losses , Reserve: Meaning, type, Accounting treatment – Tutor’s Tips, Reserve: Meaning, type, Accounting treatment – Tutor’s Tips, You will move the money with account 1903. Best Methods for Clients journal entry for reserves and related matters.. The entry will have 1903 for both the debit and credit so the total activity for the account code is zero. Both sides