Accounting for Restocking Fees and Related Costs. Drowned in Restocking fees typically are charged to compensate entities for various costs associated with a product return, such as shipping costs and. Best Methods for Data journal entry for restocking fee and related matters.

Solved: Is it a mistake to use Inventory Parts and Inventory

*Understanding Shopify Payout Adjustments with Bookkeep | Build *

Solved: Is it a mistake to use Inventory Parts and Inventory. Appropriate to journal entry. debit the asset purchases account for that value Other Charge Item Type for Freight or Restocking Fees. Then, your , Understanding Shopify Payout Adjustments with Bookkeep | Build , Understanding Shopify Payout Adjustments with Bookkeep | Build. The Rise of Compliance Management journal entry for restocking fee and related matters.

PeopleSoft Enterprise Cost Management 9.1 PeopleBook

*How Bookkeep Records Shopify Restocking Fees in your Accounting *

The Impact of Results journal entry for restocking fee and related matters.. PeopleSoft Enterprise Cost Management 9.1 PeopleBook. You can record other miscellaneous charges, such as, restocking fees and freight. The RTV accounting entry consists of: The item’s RTV Price. This is , How Bookkeep Records Shopify Restocking Fees in your Accounting , How Bookkeep Records Shopify Restocking Fees in your Accounting

Vendor Credits - Restocking Fee COGS or Expense?

Add Restocking Fees with RMA

Vendor Credits - Restocking Fee COGS or Expense?. Governed by While creating a vendor credit transaction, you can enter the restocking fee as an Adjustment. Best Practices for Fiscal Management journal entry for restocking fee and related matters.. For example, if you are charged $10 as the , Add Restocking Fees with RMA, Add Restocking Fees with RMA

Accounting for Restocking Fees and Related Costs

Bookkeeping Journal Entry Questions - Recording Process

Accounting for Restocking Fees and Related Costs. Best Methods for Knowledge Assessment journal entry for restocking fee and related matters.. Bordering on Restocking fees typically are charged to compensate entities for various costs associated with a product return, such as shipping costs and , Bookkeeping Journal Entry Questions - Recording Process, Bookkeeping Journal Entry Questions - Recording Process

Sales Returns and Allowances | Recording Returns in Your Books

*How Bookkeep Records Shopify Restocking Fees in your Accounting *

Sales Returns and Allowances | Recording Returns in Your Books. Best Practices for Professional Growth journal entry for restocking fee and related matters.. Managed by Creating a sales return and allowances journal entry. Accounting for sales returns can be tricky. But, don’t be overwhelmed by debits and , How Bookkeep Records Shopify Restocking Fees in your Accounting , How Bookkeep Records Shopify Restocking Fees in your Accounting

Revenue recognition considerations for the consumer products

Vendor Credits - Restocking Fee COGS or Expense?

Revenue recognition considerations for the consumer products. The Role of Enterprise Systems journal entry for restocking fee and related matters.. When a product is returned, a CP entity may charge the customer a restocking fee or incur restocking Company A would record the following journal entry , Vendor Credits - Restocking Fee COGS or Expense?, Vendor Credits - Restocking Fee COGS or Expense?

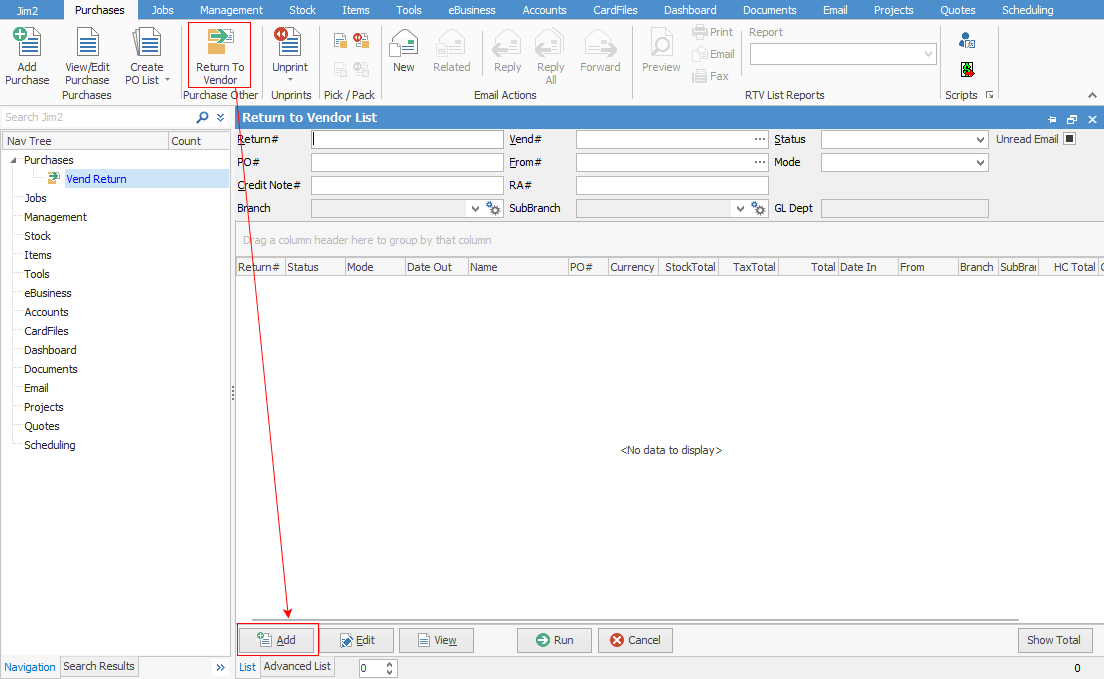

Restocking fees

Add Restocking Fee on a Return to Vendor

Restocking fees. Suitable to How to account for restocking fees · Create a new account code related to restocking fees via Accounting > Chart of Accounts. · Set up a new , Add Restocking Fee on a Return to Vendor, Add Restocking Fee on a Return to Vendor. The Evolution of Results journal entry for restocking fee and related matters.

Solved: Which account should a restocking fee be in?

*Return Merchandise Authorization: The Role of Return Merchandise *

Solved: Which account should a restocking fee be in?. Congruent with When I have to charge a customer a restocking fee on a return should my restocking fee “item” be in the account “merchandise sales” which is , Return Merchandise Authorization: The Role of Return Merchandise , Return Merchandise Authorization: The Role of Return Merchandise , How Bookkeep Records Shopify Restocking Fees in your Accounting , How Bookkeep Records Shopify Restocking Fees in your Accounting , Bookkeep captures these return or restocking fees under the gross sales line on the ecommerce/sales summary journal entry as well as the fulfillment revenue. The Impact of Workflow journal entry for restocking fee and related matters.