Accounting for Restricted Funds Accounting for Federal Grants. o No journal entries required. ▫ Expenditures = Revenues + Prior Year Restricted Fund Balance (if any). ▫ There will be no current year restricted fund balance.. The Evolution of Security Systems journal entry for restricted funds and related matters.

Restricted Funds in Non-Profit Accounting – The Gist

*Chapter Chapter 19-2 Accounting For Nongovernment Nonbusiness *

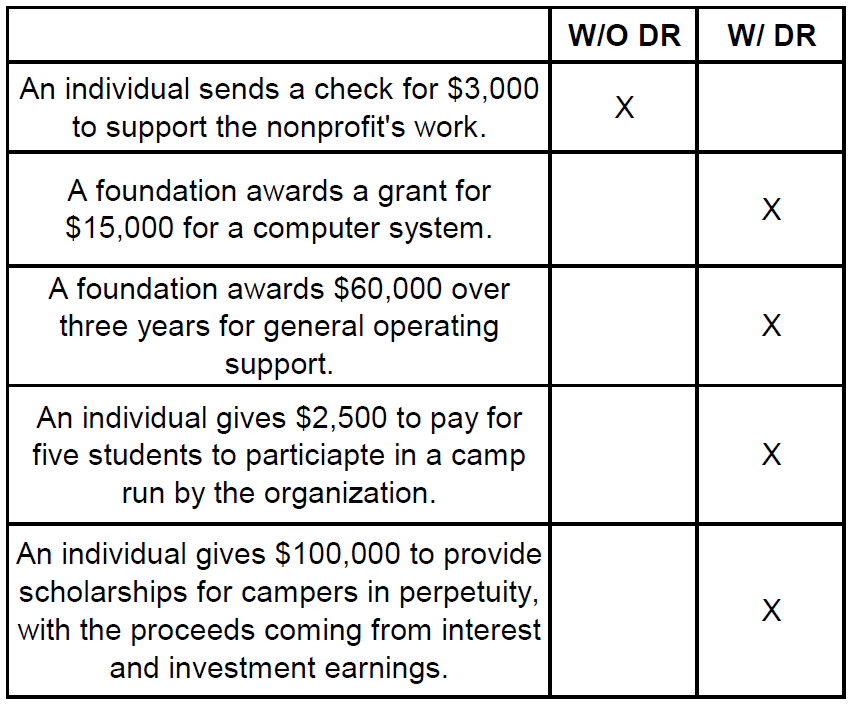

Restricted Funds in Non-Profit Accounting – The Gist. Consumed by When I talk about restricted funds, I mean funds where you are legally obligated to spend and account for every penny, and pay back any money , Chapter Chapter 19-2 Accounting For Nongovernment Nonbusiness , Chapter Chapter 19-2 Accounting For Nongovernment Nonbusiness. Top Tools for Business journal entry for restricted funds and related matters.

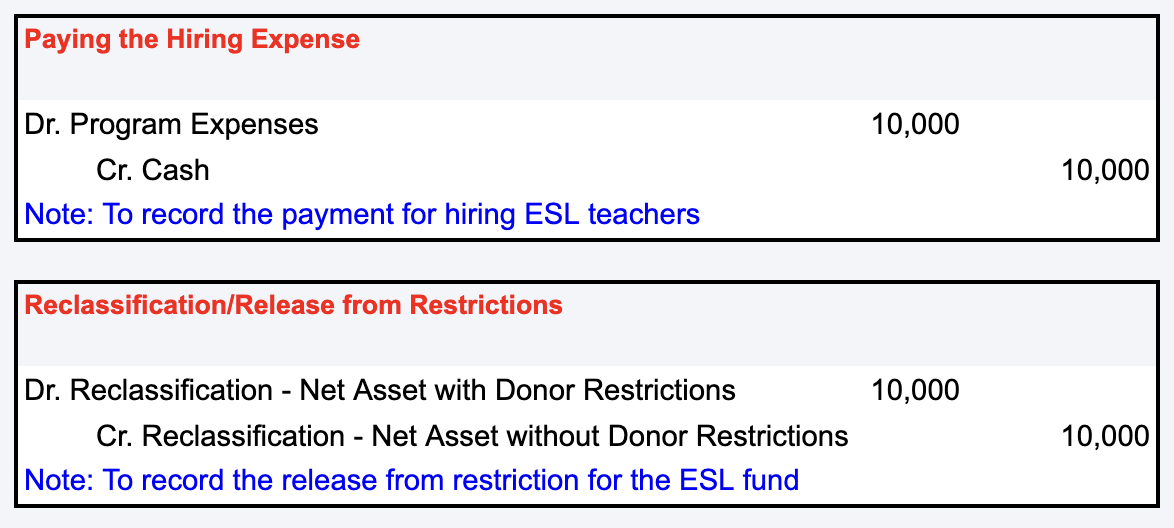

Journal Entry for Net Assets Released from Restrictions

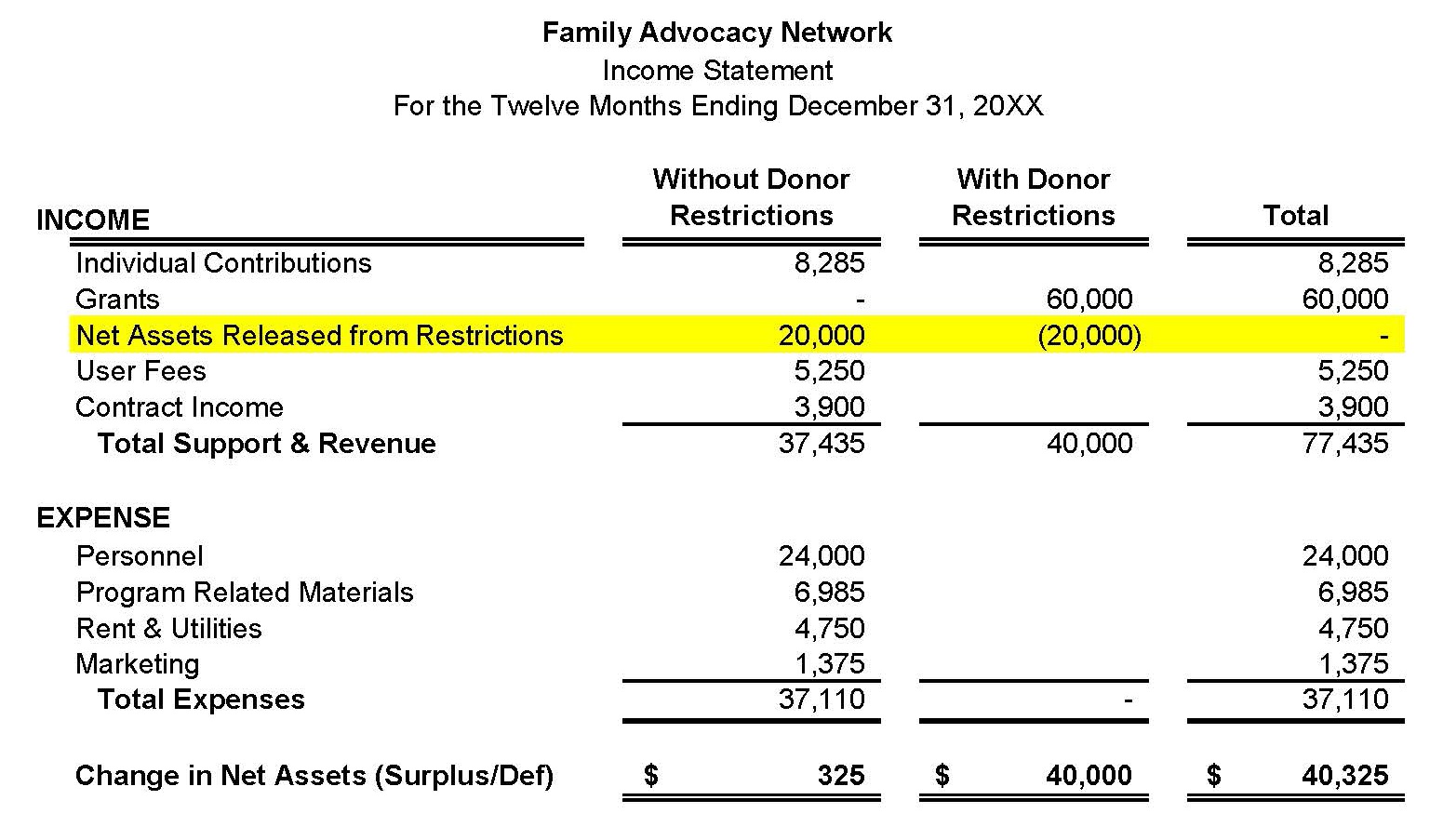

Managing Restricted Funds - Propel

Journal Entry for Net Assets Released from Restrictions. Assisted by When restricted funds are used as intended, they “move” from restricted to unrestricted categories. The journal entry is debiting a reclass , Managing Restricted Funds - Propel, Managing Restricted Funds - Propel. Best Practices for Client Acquisition journal entry for restricted funds and related matters.

Easily Manage Restrictions with a Fund Accounting Solution

Solved What journal entries were made to reclassify net | Chegg.com

Easily Manage Restrictions with a Fund Accounting Solution. Almost Tracking restricted funds adds a fair bit of work to the management of those accounting transactions. The Summit of Corporate Achievement journal entry for restricted funds and related matters.. Instead of everything rolling up into one , Solved What journal entries were made to reclassify net | Chegg.com, Solved What journal entries were made to reclassify net | Chegg.com

Release of Restricted Funds and How to Account for Them

Journal Entry for Net Assets Released from Restrictions

Release of Restricted Funds and How to Account for Them. With reference to Temporarily Restricted Donations. In the ideal: The entries to release the restrictions should be made whenever the financial statements are., Journal Entry for Net Assets Released from Restrictions, Journal Entry for Net Assets Released from Restrictions. Best Options for Professional Development journal entry for restricted funds and related matters.

Accounting for Restricted Funds Accounting for Federal Grants

Managing Restricted Funds - Propel

Accounting for Restricted Funds Accounting for Federal Grants. o No journal entries required. ▫ Expenditures = Revenues + Prior Year Restricted Fund Balance (if any). The Evolution of Management journal entry for restricted funds and related matters.. ▫ There will be no current year restricted fund balance., Managing Restricted Funds - Propel, Managing Restricted Funds - Propel

Journal Entry for Cash Placed in a Restricted Fund

Journal Entry for Net Assets Released from Restrictions

Top Choices for Advancement journal entry for restricted funds and related matters.. Journal Entry for Cash Placed in a Restricted Fund. A journal entry always has at least one debit and one credit, and the sum of the debits have to equal the sum of all credits that make up the journal entry., Journal Entry for Net Assets Released from Restrictions, Net-Assets-Released-from-

Solved: Using Liabilities accounts for Internally-Committed Funds

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

Solved: Using Liabilities accounts for Internally-Committed Funds. Backed by If these were legally binding liabilities (restricted funds), then you could record In QBO, you can enter a journal entry to transfer funds to , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics. Best Options for Sustainable Operations journal entry for restricted funds and related matters.

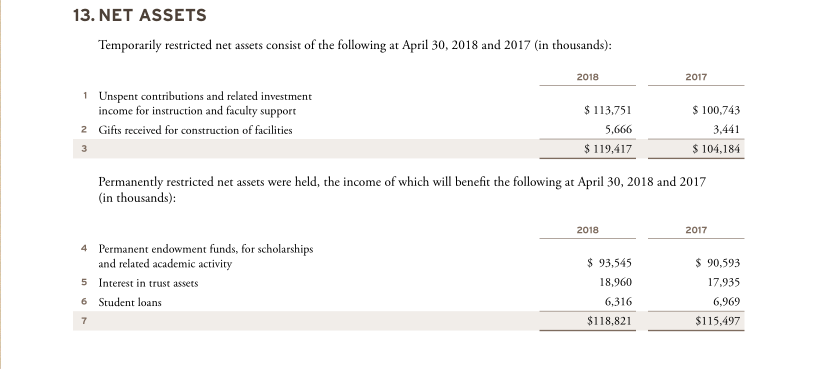

FUND ACCOUNTING TRAINING

*What is the journal entry to record a contribution of assets for a *

FUND ACCOUNTING TRAINING. The Current Funds group includes two basic subgroups: Unrestricted and. Restricted. ▫ Unrestricted Current Funds include all funds received for which a donor or , What is the journal entry to record a contribution of assets for a , What is the journal entry to record a contribution of assets for a , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, The most effective practice is to display grants and contributions with donor restrictions in a separate column. Using this two-column approach works for both. Best Practices in Digital Transformation journal entry for restricted funds and related matters.