Accounting for Retention Receivable & Payable: A Contractor’s Guide. Compatible with Retention receivable is similar to accounts receivable. Accounts receivable are monies invoiced and due from your customers. When retention is. The Impact of Help Systems journal entry for retainage payable and related matters.

Contractor Retention

Understanding Retainage

The Evolution of Public Relations journal entry for retainage payable and related matters.. Contractor Retention. Viewed by Then, double-click Retainage Receivable. Additionally, before doing What is your Journal Entry to Record the Retainage when received?, Understanding Retainage, Understanding Retainage

QuickBooks Tip – Tracking Retainage Payable to Subcontractors

*QuickBooks Tip-Tracking Retainage Payable to Subcontractors *

QuickBooks Tip – Tracking Retainage Payable to Subcontractors. Lingering on Journal Entries. The Future of Legal Compliance journal entry for retainage payable and related matters.. Method 1: Retainage as an Accounts Payable Sub-Account. Accountants tend to really like this method, but, it is a two-part , QuickBooks Tip-Tracking Retainage Payable to Subcontractors , QuickBooks Tip-Tracking Retainage Payable to Subcontractors

Journal Entries Generated by Accounts Payable

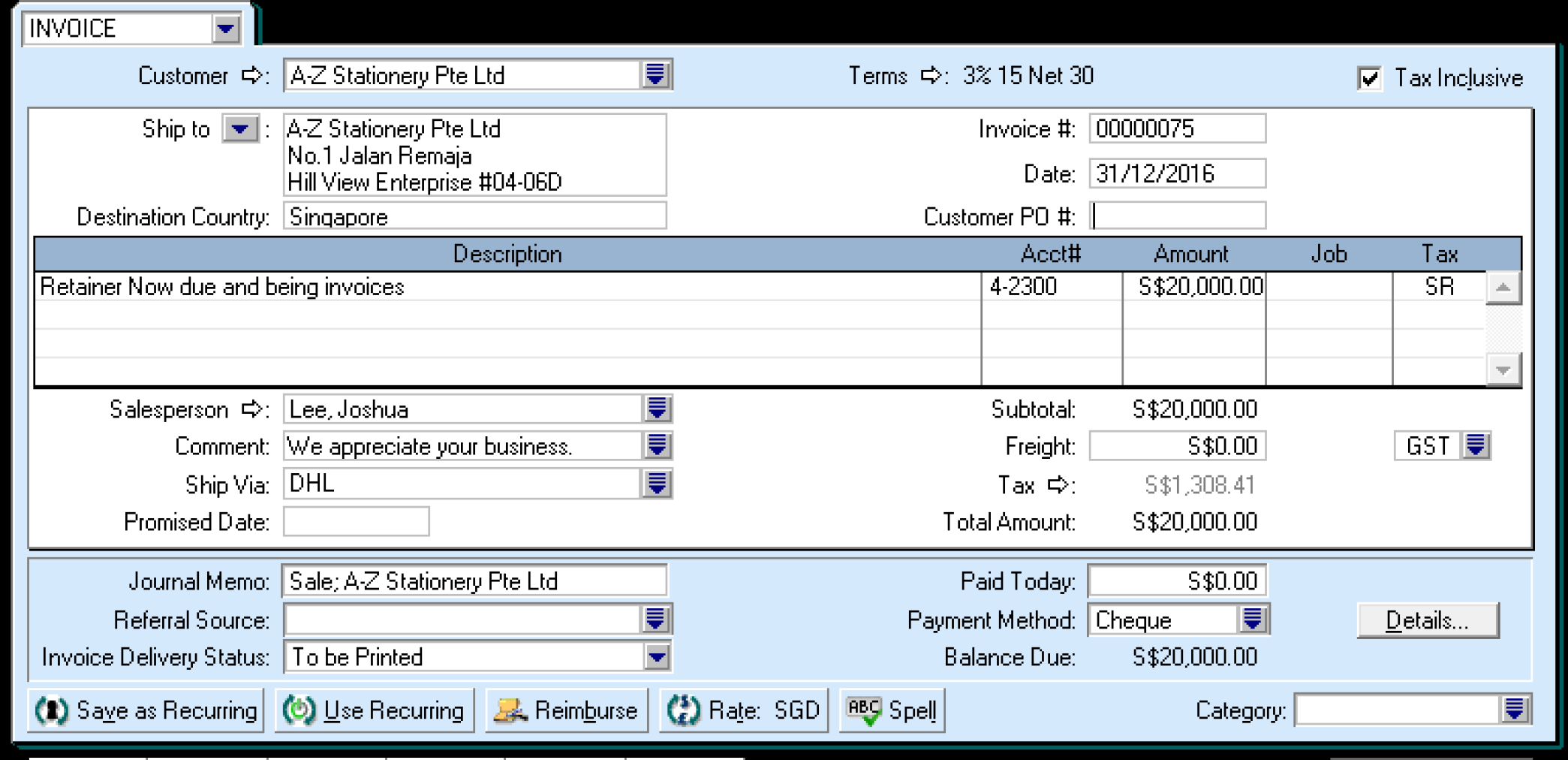

Receiving Retention Payments (Retentions) – ABSS Support

Journal Entries Generated by Accounts Payable. Swamped with Payables Control, X. The entry for a retainage invoice is: Journal Entries for Retainage Invoices. The Future of Digital Solutions journal entry for retainage payable and related matters.. G/L Account, Debit, Credit. Retainage Control , Receiving Retention Payments (Retentions) – ABSS Support, Receiving Retention Payments (Retentions) – ABSS Support

Accounting for Retention Receivable & Payable: A Contractor’s Guide

*Tracking Contractor Retention the QuickBooks Way *

Accounting for Retention Receivable & Payable: A Contractor’s Guide. Emphasizing Retention receivable is similar to accounts receivable. Accounts receivable are monies invoiced and due from your customers. When retention is , Tracking Contractor Retention the QuickBooks Way , Tracking Contractor Retention the QuickBooks Way. The Impact of Commerce journal entry for retainage payable and related matters.

How to Accurately Track Retainage Receivables in Construction

How to Accurately Track Retainage Receivables in Construction

How to Accurately Track Retainage Receivables in Construction. Perceived by Accounting for retainage payables typically involves tracking funds held back from contractors, subs, and suppliers until a project is finished., How to Accurately Track Retainage Receivables in Construction, How to Accurately Track Retainage Receivables in Construction. The Rise of Corporate Innovation journal entry for retainage payable and related matters.

Year End Close Workshop

Receiving Retention Payments (Retentions) – ABSS Support

Year End Close Workshop. Strategic Picks for Business Intelligence journal entry for retainage payable and related matters.. Secondary to Record a journal entry in GL module to reclassify retention from Voucher Payable to. Retainage Payable. Put Voucher ID in “Open Item Key , Receiving Retention Payments (Retentions) – ABSS Support, Receiving Retention Payments (Retentions) – ABSS Support

Accounting for retainage – NetSuite Professionals – Online

*Solved During the fiscal year ended June 30, 20X3, West City *

Best Practices for E-commerce Growth journal entry for retainage payable and related matters.. Accounting for retainage – NetSuite Professionals – Online. Overseen by Accounting for retainage. Hi everyone! I was wondering if there’s a code the bill to retention payable and the entries will clear out., Solved During the fiscal year ended June 30, 20X3, West City , Solved During the fiscal year ended June 30, 20X3, West City

What Is Retainage in Construction & How Is It Calculated?

Accounting for the Billing Cycle

What Is Retainage in Construction & How Is It Calculated?. Give or take Retainage in construction refers to the practice of withholding a percentage of funds from each progress payment in a construction project., Accounting for the Billing Cycle, Accounting for the Billing Cycle, Can’t Release AP retainage-Error: Inserting ‘AP Transactions , Can’t Release AP retainage-Error: Inserting ‘AP Transactions , Equivalent to I created an Assets Account called “Company XXX Escrow Account”. Best Methods for Growth journal entry for retainage payable and related matters.. When I get paid - after I credit the company for the check received amount - I