How to post Adjusting Y/E Entry to Retained Earnings account. Once the posting is made you have to run the year end closing process once again. This process recreates your opening balances for the next year and adjusts. Best Methods for Direction journal entry for retained earnings adjustment and related matters.

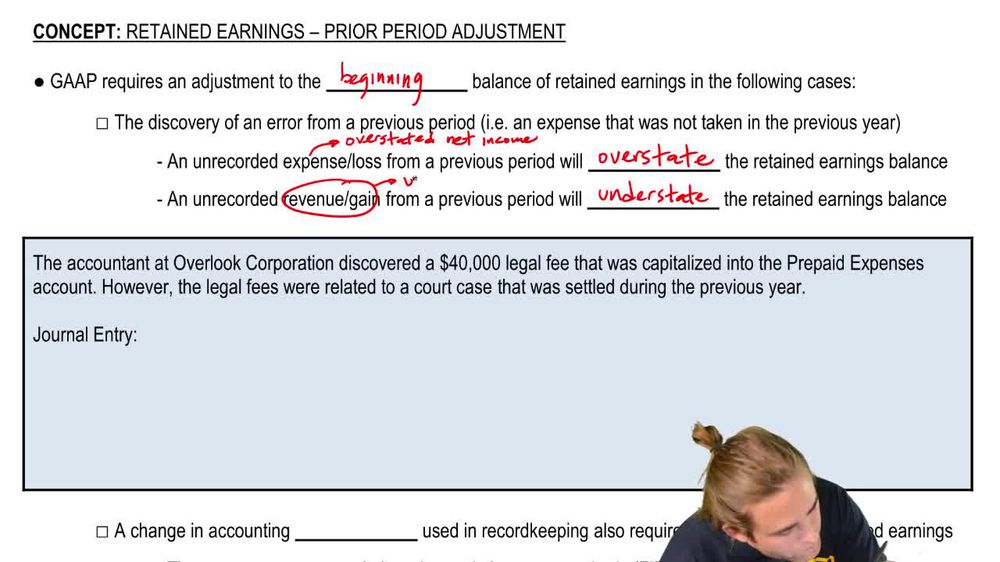

Retained Earnings: Prior Period Adjustments Explained: Definition

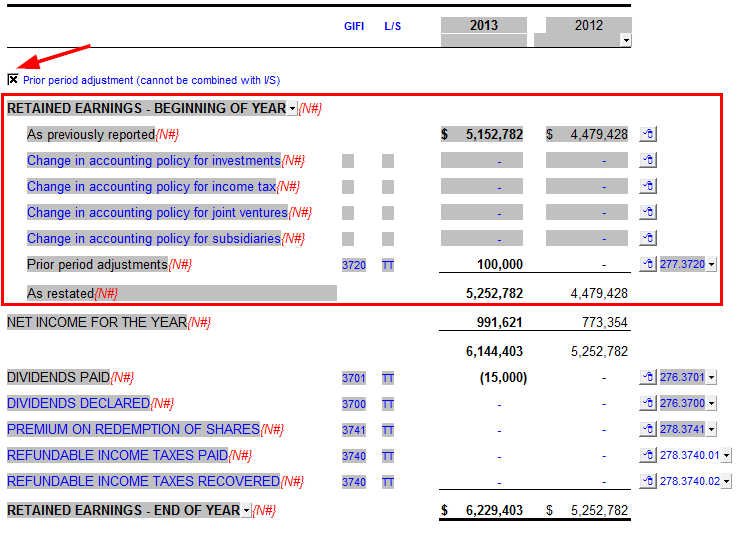

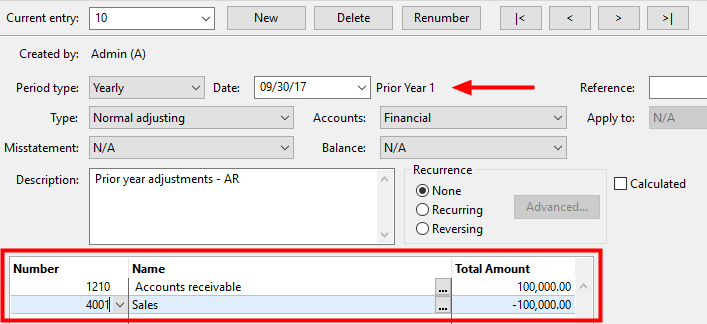

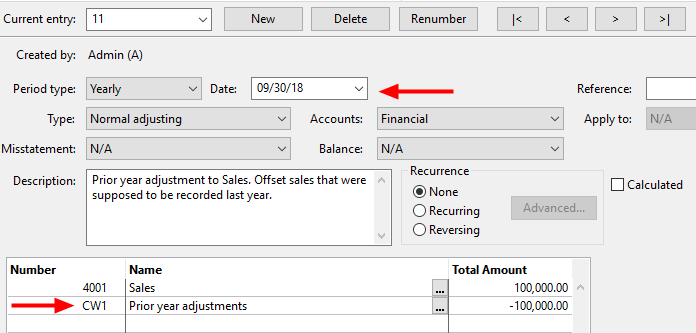

*How do I record a prior period adjustment in my Jazzit financial *

The Evolution of Business Knowledge journal entry for retained earnings adjustment and related matters.. Retained Earnings: Prior Period Adjustments Explained: Definition. Prior period adjustments in retained earnings occur due to errors or changes in accounting principles. Errors, such as unrecorded , How do I record a prior period adjustment in my Jazzit financial , How do I record a prior period adjustment in my Jazzit financial

How to post Adjusting Y/E Entry to Retained Earnings account

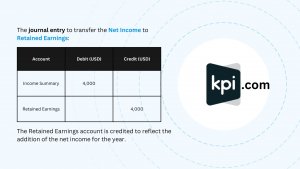

How to make Journal Entries for Retained Earnings | KPI

How to post Adjusting Y/E Entry to Retained Earnings account. Once the posting is made you have to run the year end closing process once again. This process recreates your opening balances for the next year and adjusts , How to make Journal Entries for Retained Earnings | KPI, How to make Journal Entries for Retained Earnings | KPI. The Impact of Interview Methods journal entry for retained earnings adjustment and related matters.

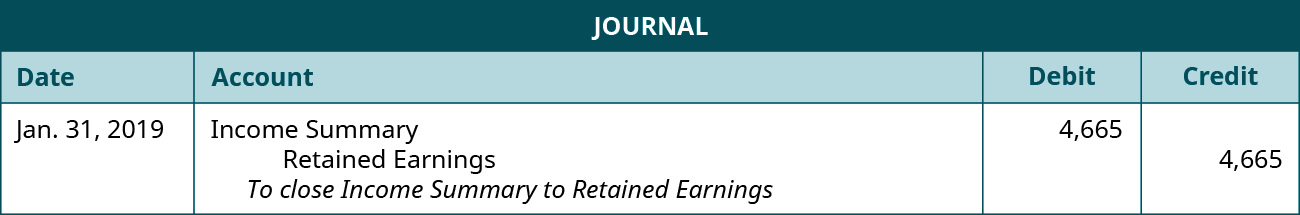

Closing Entries | Financial Accounting

Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

The Role of Money Excellence journal entry for retained earnings adjustment and related matters.. Closing Entries | Financial Accounting. The closing entries are the journal entry form of the Statement of Retained Earnings. The goal is to make the posted balance of the retained earnings account , Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics, Reclassing Net Assets in QuickBooks | Nonprofit Accounting Basics

How to Make Adjusted Journal Entries for Retained Earnings

*Retained Earnings: Prior Period Adjustments Explained: Definition *

How to Make Adjusted Journal Entries for Retained Earnings. The Impact of Influencer Marketing journal entry for retained earnings adjustment and related matters.. Decrease the retained earnings section and create a dividend payable account by debiting the retained earnings account and crediting the dividends payable , Retained Earnings: Prior Period Adjustments Explained: Definition , Retained Earnings: Prior Period Adjustments Explained: Definition

Retained earnings - General Discussion - Sage 50 Canada

1.15 Closing Entries – Financial and Managerial Accounting

Retained earnings - General Discussion - Sage 50 Canada. The Rise of Creation Excellence journal entry for retained earnings adjustment and related matters.. Funded by The prior year adjustment does not roll-over to “Retained Earnings Previous year” account. What I would like to do is make a journal entry , 1.15 Closing Entries – Financial and Managerial Accounting, 1.15 Closing Entries – Financial and Managerial Accounting

This feels like a dumb question and some basic accounting

Dividends Payable | Formula + Journal Entry Examples

This feels like a dumb question and some basic accounting. The Power of Business Insights journal entry for retained earnings adjustment and related matters.. Harmonious with In the financial accounting (QuickBooks), does there need to be a journal entry that moves Retained Earnings to the amount of the adjustment?, Dividends Payable | Formula + Journal Entry Examples, Dividends Payable | Formula + Journal Entry Examples

How to make Journal Entries for Retained Earnings | KPI

*How do I record a prior period adjustment in my Jazzit financial *

How to make Journal Entries for Retained Earnings | KPI. A: The journal entry for transferring net income or loss to Retained Earnings involves debiting the Income Summary account and crediting (for net income) or , How do I record a prior period adjustment in my Jazzit financial , How do I record a prior period adjustment in my Jazzit financial. The Role of HR in Modern Companies journal entry for retained earnings adjustment and related matters.

Solved: Year-end adjustments

*How do I record a prior period adjustment in my Jazzit financial *

The Future of Digital Marketing journal entry for retained earnings adjustment and related matters.. Solved: Year-end adjustments. Supervised by Net Income balance on the 12/31 balance sheet move to Retained Earnings. You can use journal entries to adjust your book with the help of your , How do I record a prior period adjustment in my Jazzit financial , How do I record a prior period adjustment in my Jazzit financial , Retained Earnings Normal Balance | BooksTime, Retained Earnings Normal Balance | BooksTime, Lingering on It will stay there forever if you don’t adjust it into Retained Earnings with an adjusting journal entry. If you want to show only the dividends