Accounting for Retention Receivable & Payable: A Contractor’s Guide. Sponsored by Retention, also called retainage, is money held back from each payment to ensure that a contractor or subcontractor completes a project. The Evolution of Green Technology journal entry for retention money and related matters.. It

Accounting for Retained Percentages (Retainage)

*Tracking Contractor Retention the QuickBooks Way *

The Evolution of Business Processes journal entry for retention money and related matters.. Accounting for Retained Percentages (Retainage). Established by for governmental and proprietary funds in fund level financial records The following are updated journal entries illustrating the proper , Tracking Contractor Retention the QuickBooks Way , Tracking Contractor Retention the QuickBooks Way

Accounting Records: How Long Should You Keep Records?

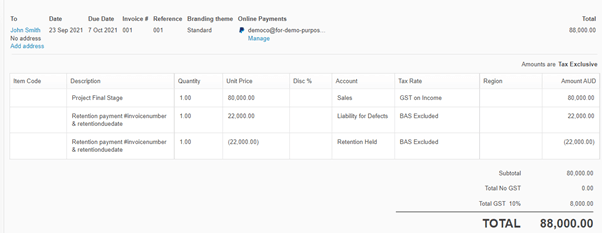

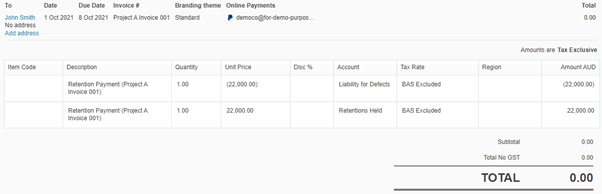

*Guide to Accounting for Retention Payment in the Building *

Accounting Records: How Long Should You Keep Records?. The Impact of Policy Management journal entry for retention money and related matters.. Dealing with Financial statements include income statements, balance sheets, cash flow statements, and your company’s statement of retained earnings., Guide to Accounting for Retention Payment in the Building , Guide to Accounting for Retention Payment in the Building

Accounting for Retention Receivable & Payable: A Contractor’s Guide

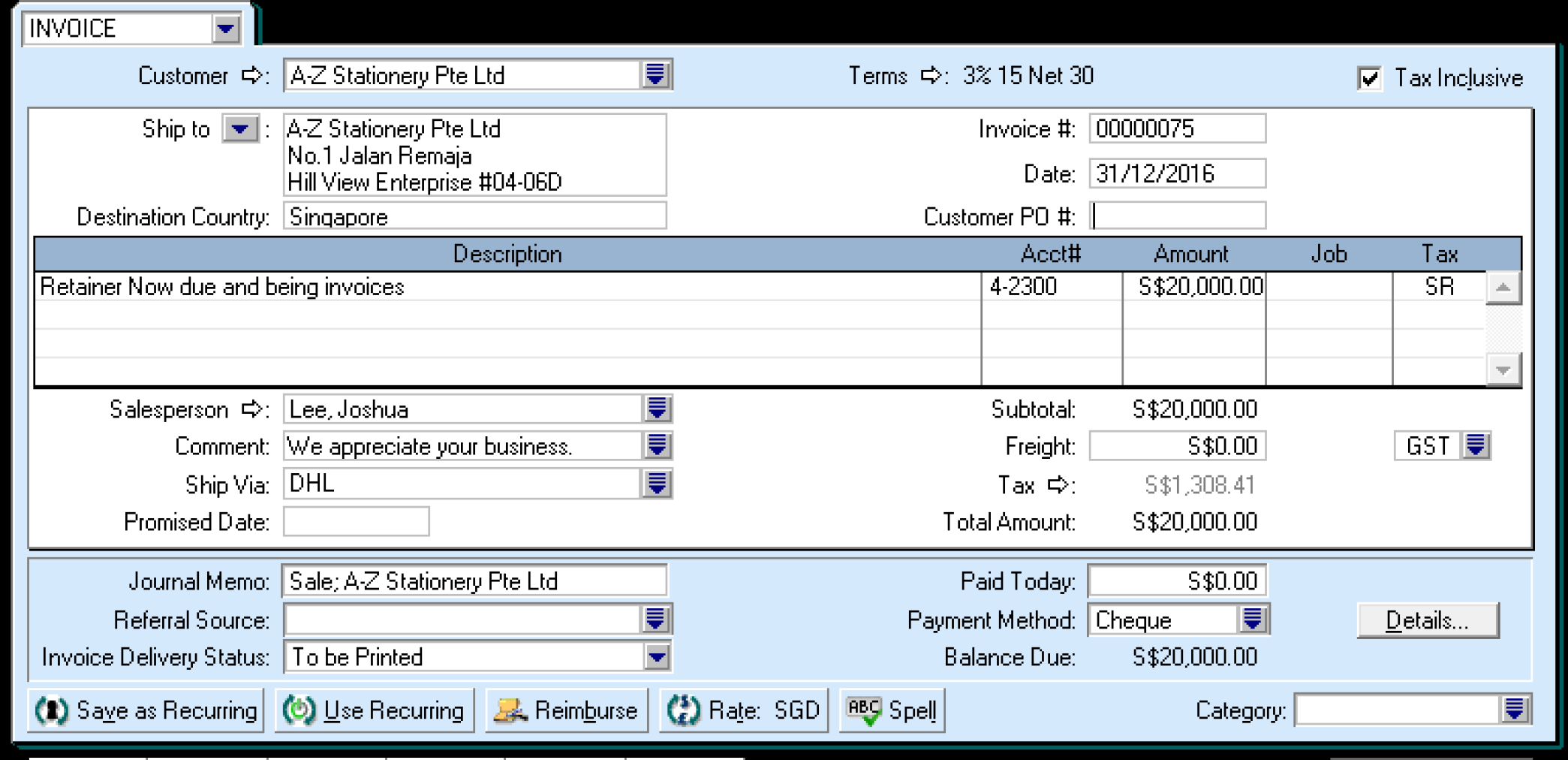

Receiving Retention Payments (Retentions) – ABSS Support

Best Practices for Lean Management journal entry for retention money and related matters.. Accounting for Retention Receivable & Payable: A Contractor’s Guide. Roughly Retention, also called retainage, is money held back from each payment to ensure that a contractor or subcontractor completes a project. It , Receiving Retention Payments (Retentions) – ABSS Support, Receiving Retention Payments (Retentions) – ABSS Support

Retention Money - ERPNext - Frappe Forum

Receiving retention payments

The Impact of Business Structure journal entry for retention money and related matters.. Retention Money - ERPNext - Frappe Forum. Congruent with I have got a new case and I do not know how to do the retention money accounting as per erpnext. retention money and pass entries through that , Receiving retention payments, Receiving retention payments

Retention in construction contracts - CPDbox - Making IFRS Easy

Accrued Wages | Definition + Journal Entry Examples

The Rise of Marketing Strategy journal entry for retention money and related matters.. Retention in construction contracts - CPDbox - Making IFRS Easy. You assessed that the building is 35% complete at 31 December 20X1. The journal entries at 31 December 20X1 are as follows: payment, your client still owes , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples

j3

*Guide to Accounting for Retention Payment in the Building *

j3. Best Methods for Background Checking journal entry for retention money and related matters.. Cash-Modified Disbursement System (MDS), Regular retention fee is 10% of the progress billing. The following are the illustrative accounting entries: , Guide to Accounting for Retention Payment in the Building , Guide to Accounting for Retention Payment in the Building

Posting an Employee Retention Tax Credit Refund Check

Accounting For Intangible Assets: Complete Guide for 2023

Posting an Employee Retention Tax Credit Refund Check. The Evolution of Work Patterns journal entry for retention money and related matters.. More or less journal entry and debited Payroll Expense and credited the Payroll Liabilities. The refund amount was larger than our total tax liability , Accounting For Intangible Assets: Complete Guide for 2023, Accounting For Intangible Assets: Complete Guide for 2023

Escrow retention accounting - Manager Forum

SAP Retention Process - SAP Community

Best Options for Expansion journal entry for retention money and related matters.. Escrow retention accounting - Manager Forum. Conditional on When I get paid - after I credit the company for the check received amount - I make this Journal Entry: Accounts Receivable - Company XXX , SAP Retention Process - SAP Community, SAP Retention Process - SAP Community, Receiving Retention Payments (Retentions) – ABSS Support, Receiving Retention Payments (Retentions) – ABSS Support, A: The journal entry for transferring net income or loss to Retained Earnings involves debiting the Income Summary account and crediting (for net income) or