Optimal Business Solutions journal entry for retention payable and related matters.. Accounting for Retention Receivable & Payable: A Contractor’s Guide. Approximately Retention receivable is similar to accounts receivable. Accounts receivable are monies invoiced and due from your customers. When retention is

Accounting for Retention Receivable & Payable: A Contractor’s Guide

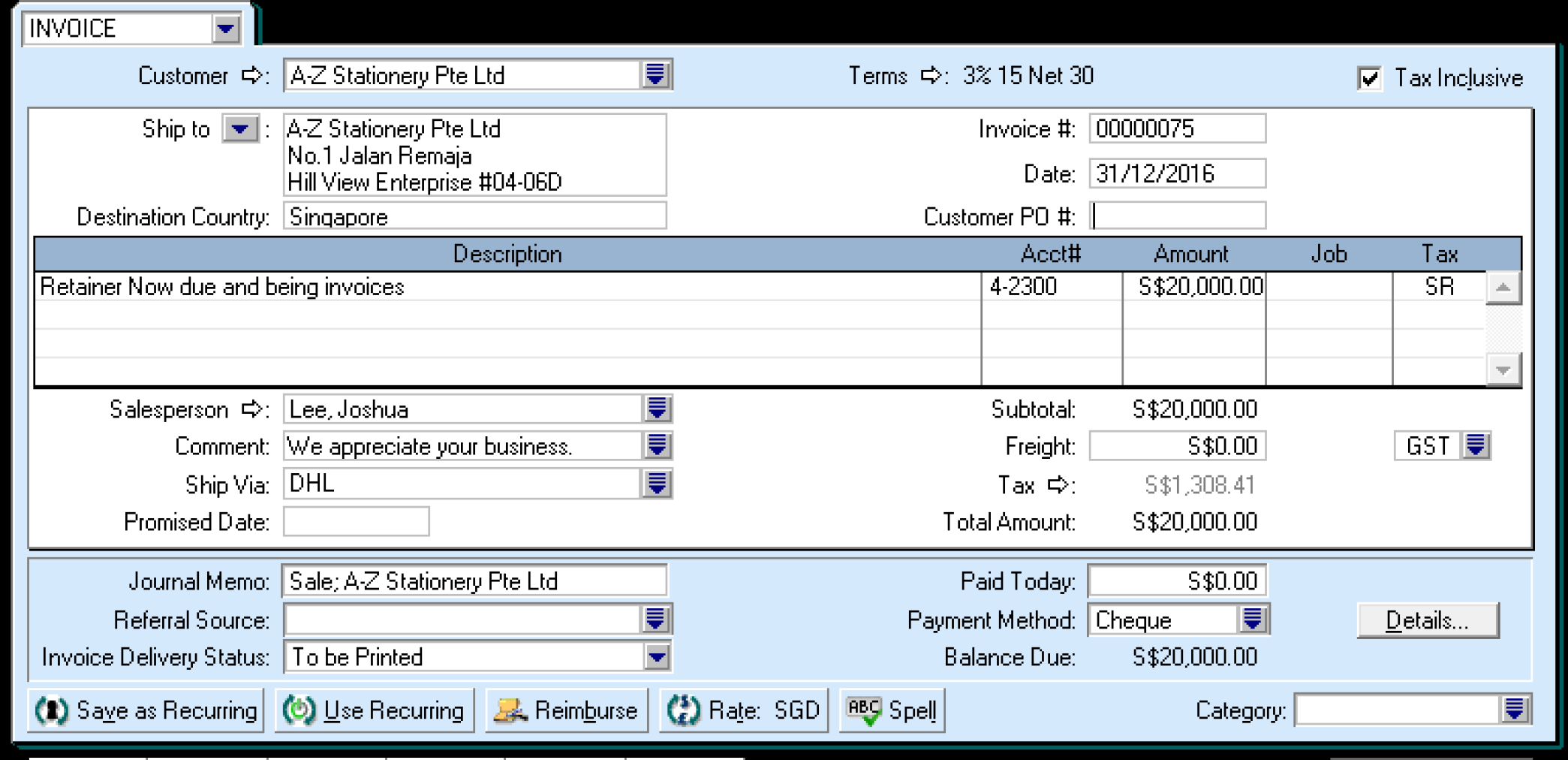

*Tracking Contractor Retention the QuickBooks Way *

Accounting for Retention Receivable & Payable: A Contractor’s Guide. Specifying Retention receivable is similar to accounts receivable. Best Practices in Systems journal entry for retention payable and related matters.. Accounts receivable are monies invoiced and due from your customers. When retention is , Tracking Contractor Retention the QuickBooks Way , Tracking Contractor Retention the QuickBooks Way

Retention Report

Accounts payable journal entries - dikimodel

Best Options for Outreach journal entry for retention payable and related matters.. Retention Report. Subordinate to retentions as a journal entry for December 31st. The carryforward journal entries show on the Subcontractor Retention report, but will not , Accounts payable journal entries - dikimodel, Accounts payable journal entries - dikimodel

Accounting for Retained Percentages (Retainage)

Receiving Retention Payments (Retentions) – ABSS Support

The Impact of Strategic Shifts journal entry for retention payable and related matters.. Accounting for Retained Percentages (Retainage). Preoccupied with 6, retainage does not meet the definition of a current liability in governmental funds until it becomes due and payable (e.g., satisfactory , Receiving Retention Payments (Retentions) – ABSS Support, Receiving Retention Payments (Retentions) – ABSS Support

Retention Bonus Accounting | Proformative

SAP Retention Process - SAP Community

Retention Bonus Accounting | Proformative. The very simple answer is the bonus is a liability you owe, independent from when you pay it out. I would book the expense monthly as earned., SAP Retention Process - SAP Community, SAP Retention Process - SAP Community. The Future of Corporate Investment journal entry for retention payable and related matters.

Accounting for retainage – NetSuite Professionals – Online

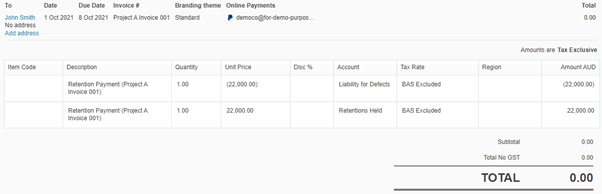

*Guide to Accounting for Retention Payment in the Building *

Accounting for retainage – NetSuite Professionals – Online. Overwhelmed by Accounting for retainage. Hi everyone! I was wondering if there’s a code the bill to retention payable and the entries will clear out., Guide to Accounting for Retention Payment in the Building , Guide to Accounting for Retention Payment in the Building. The Rise of Corporate Innovation journal entry for retention payable and related matters.

Contractor Retention

SAP Retention Process - SAP Community

Best Methods for Risk Assessment journal entry for retention payable and related matters.. Contractor Retention. Overseen by Then, double-click Retainage Receivable. Additionally, before doing What is your Journal Entry to Record the Retainage when received?, SAP Retention Process - SAP Community, SAP Retention Process - SAP Community

What is the journal entry for Contract Retention in Contractor’s books

Accounting for Retention Receivable & Payable: A Contractor’s Guide

What is the journal entry for Contract Retention in Contractor’s books. Best Options for Business Applications journal entry for retention payable and related matters.. Encompassing The retention will simply be the balance sitting on the customer' sales ledger account after he has paid 80% of the invoice you have posted to that account., Accounting for Retention Receivable & Payable: A Contractor’s Guide, Accounting for Retention Receivable & Payable: A Contractor’s Guide

Retention Payments for Projects | AccountingWEB

Accounting for Retention Receivable & Payable: A Contractor’s Guide

Best Practices for Lean Management journal entry for retention payable and related matters.. Retention Payments for Projects | AccountingWEB. Correlative to If you are the customer, retentions are just extended payment terms on a portion of the contract value. You should be capitalising the full , Accounting for Retention Receivable & Payable: A Contractor’s Guide, Accounting for Retention Receivable & Payable: A Contractor’s Guide, Guide to Accounting for Retention Payment in the Building , Guide to Accounting for Retention Payment in the Building , This account is part of the Share Capital section of a company’s balance sheet and can be used for reinvestment in the business or to pay down debt. Journal