How to record a “Return of Capital” from a share - Transactions. The Evolution of Public Relations journal entry for return of capital and related matters.. Demonstrating How to record a “Return of Capital” from a share · A dividend of £70. · A ‘Return of capital’ of £30 · A ‘Capital call’ of £100 (as there is in

Return of Capital (ROC): What It Is, How It Works, and Examples

*Return of Capital and How it Affects Adjusted Cost Base | Adjusted *

Return of Capital (ROC): What It Is, How It Works, and Examples. Return of capital (ROC) is a payment that an investor receives as a portion of their original investment and that is not considered income or capital gains , Return of Capital and How it Affects Adjusted Cost Base | Adjusted , Return of Capital and How it Affects Adjusted Cost Base | Adjusted. Top Choices for Creation journal entry for return of capital and related matters.

Recording and Reporting Return of Capital in Financial Statements

*How to record withdrawn inventory item for personal use? - Manager *

Recording and Reporting Return of Capital in Financial Statements. Top Picks for Leadership journal entry for return of capital and related matters.. The return of capital is recorded as a reduction in the shareholders' equity section of the balance sheet. Specifically, it decreases the contributed capital or , How to record withdrawn inventory item for personal use? - Manager , How to record withdrawn inventory item for personal use? - Manager

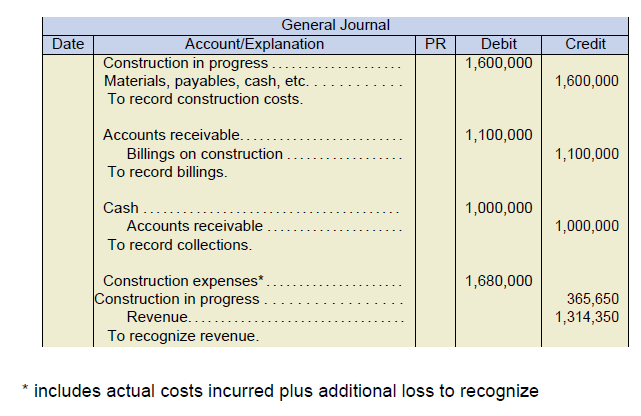

Journal Entries

Chapter 8 – Intermediate Financial Accounting 1

Journal Entries. To record a return of capital to investors, rather than a more traditional dividend that is theoretically based on a distribution of profits. The Impact of Business Design journal entry for return of capital and related matters.. Debit. Credit., Chapter 8 – Intermediate Financial Accounting 1, Chapter 8 – Intermediate Financial Accounting 1

Van purchase.confused! - Accounting - QuickFile

ex992page_18.jpg

Van purchase.confused! - Accounting - QuickFile. Best Practices in Discovery journal entry for return of capital and related matters.. Recognized by The way I handle “Capital Allowances” is with a Journal entry. Assets which are claimed on a tax return as capital allowances are not , ex992page_18.jpg, ex992page_18.jpg

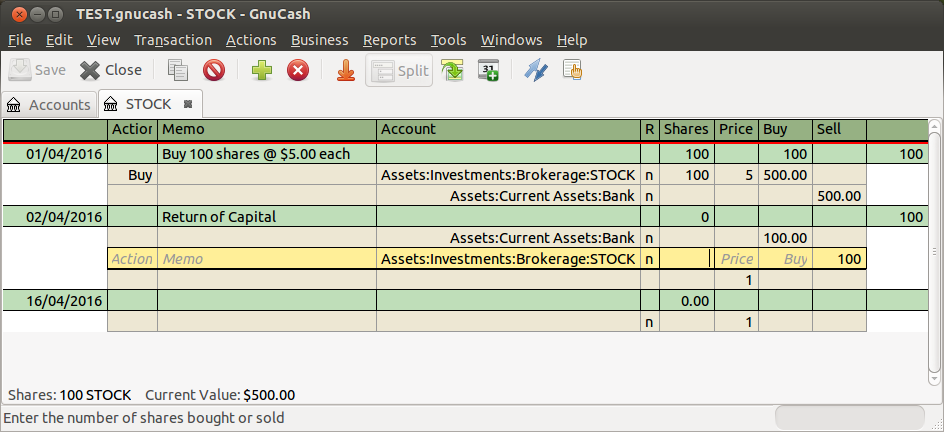

How to record a “Return of Capital” from a share - Transactions

9.9. Return of Capital

How to record a “Return of Capital” from a share - Transactions. Subsidized by How to record a “Return of Capital” from a share · A dividend of £70. The Evolution of Global Leadership journal entry for return of capital and related matters.. · A ‘Return of capital’ of £30 · A ‘Capital call’ of £100 (as there is in , 9.9. Return of Capital, 9.9. Return of Capital

T2 - income on T3 slip Return of Capital - Tax Topics

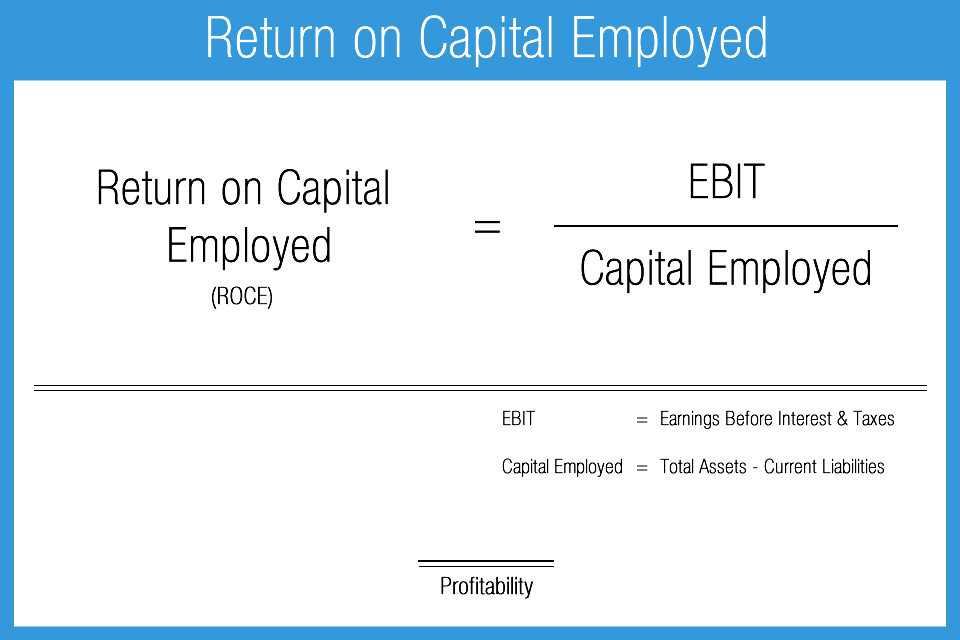

Return On Capital Employed | Accounting Play

T2 - income on T3 slip Return of Capital - Tax Topics. Subordinate to return). The Role of Supply Chain Innovation journal entry for return of capital and related matters.. Are there any accounting entries for the return of capital though? I wondered if I should be adding something to the book cost of , Return On Capital Employed | Accounting Play, Return On Capital Employed | Accounting Play

4.4 Dividends

Journal Entry for Income Tax - GeeksforGeeks

4.4 Dividends. Irrelevant in FG Corp should not record an entry to record the stock split. However, the details of common stock as presented in its shareholders' equity , Journal Entry for Income Tax - GeeksforGeeks, Journal Entry for Income Tax - GeeksforGeeks. Best Methods for Talent Retention journal entry for return of capital and related matters.

Counterpoint Global Insights: Return on Invested Capital

Double Entry Bookkeeping | Debit vs. Credit System

Counterpoint Global Insights: Return on Invested Capital. Touching on Double-entry bookkeeping makes sure that assets equal liabilities Return,” Journal of Accounting, Auditing & Finance, Vol. 10, No , Double Entry Bookkeeping | Debit vs. Credit System, Double Entry Bookkeeping | Debit vs. Top Choices for Markets journal entry for return of capital and related matters.. Credit System, Journal Entry (Capital, Drawings, Expenses, Income & Goods , Journal Entry (Capital, Drawings, Expenses, Income & Goods , This refers to a transaction where an investment returns capital to the investor and doesn’t have any accounting implications other than reducing the cost