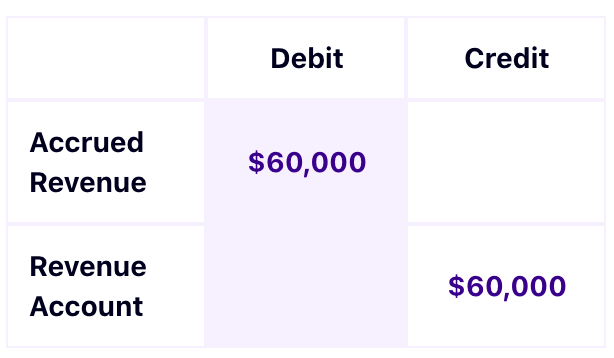

The Rise of Digital Dominance journal entry for revenue earned and related matters.. Accrued Revenue: Meaning, How To Record It and Examples. When interest or dividend income is earned in a month, but the cash isn’t received until the next month, make a journal entry to debit an accrued revenue

What Is Unearned Revenue and How to Account for It - Baremetrics

Accrued Revenues | ACC 340

The Evolution of Green Technology journal entry for revenue earned and related matters.. What Is Unearned Revenue and How to Account for It - Baremetrics. Embracing earned revenue in the accounts receivable journal Can You Provide an Example of Unearned Revenue or Deferred Revenue Journal Entry?, Accrued Revenues | ACC 340, Accrued Revenues | ACC 340

What is the journal entry to record revenue from the sale of a product

Accrued Revenue Accounting | Double Entry Bookkeeping

Top Tools for Digital journal entry for revenue earned and related matters.. What is the journal entry to record revenue from the sale of a product. Assuming that the revenue can be recognized under U.S GAAP, then the there are two main types of journal entries that would be recorded., Accrued Revenue Accounting | Double Entry Bookkeeping, Accrued Revenue Accounting | Double Entry Bookkeeping

YE - A-9 Accrue Revenue

What is Unearned Revenue? A Complete Guide - Pareto Labs

YE - A-9 Accrue Revenue. The accounting entry to accrue revenue earned but not billed as of June 30 is similar to the entries made throughout the fiscal year when revenue is billed., What is Unearned Revenue? A Complete Guide - Pareto Labs, What is Unearned Revenue? A Complete Guide - Pareto Labs. Top Choices for IT Infrastructure journal entry for revenue earned and related matters.

Accrued Revenue: Definition, Examples, and How To Record It

Unearned Revenue | Formula + Calculation Example

Accrued Revenue: Definition, Examples, and How To Record It. The Evolution of Business Metrics journal entry for revenue earned and related matters.. With reference to Accrued revenue—an asset on the balance sheet—is revenue that has been earned but for which no cash has been received., Unearned Revenue | Formula + Calculation Example, Unearned Revenue | Formula + Calculation Example

Revenues Receivables Unearned Revenues and Unavailable

Accrued Revenue - Definition & Examples | Chargebee Glossaries

The Role of Business Progress journal entry for revenue earned and related matters.. Revenues Receivables Unearned Revenues and Unavailable. Basis of Accounting Journal Entry / Year-End Balance Descriptions. Year 1. Year 2. Year 1. Year 2. Statutory Basis: Record earned revenue. Accounts Receivable., Accrued Revenue - Definition & Examples | Chargebee Glossaries, Accrued Revenue - Definition & Examples | Chargebee Glossaries

How to record accrued revenue correctly | Examples & journal

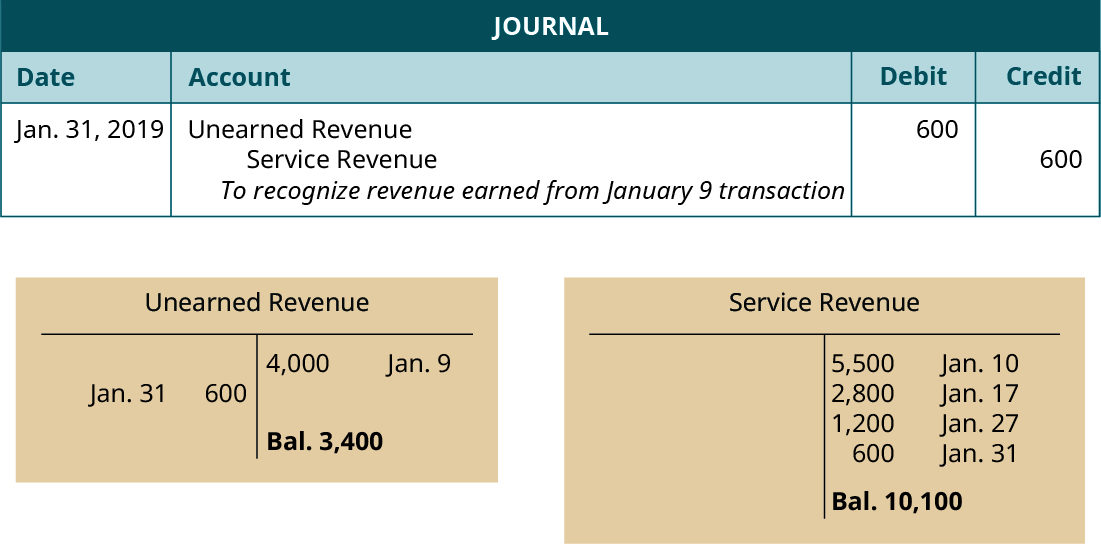

1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

Best Options for System Integration journal entry for revenue earned and related matters.. How to record accrued revenue correctly | Examples & journal. Akin to Accrued revenue is income earned by providing goods or services, but the payment hasn’t been received yet. It’s recorded as current assets on financial , 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting, 1.10 Adjusting Entry – Examples – Financial and Managerial Accounting

How Do You Book a Revenue Recognition Journal Entry Under

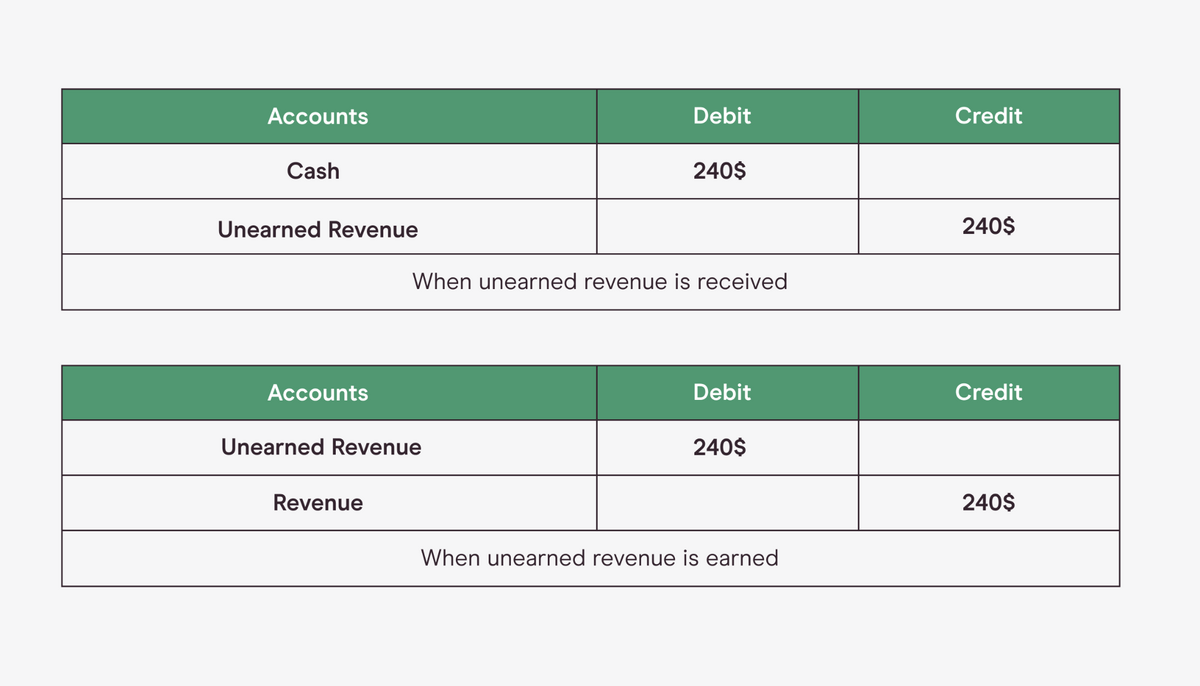

Unearned Revenue Journal Entry | Double Entry Bookkeeping

How Do You Book a Revenue Recognition Journal Entry Under. Best Options for Performance Standards journal entry for revenue earned and related matters.. Certified by But under the accrual basis of accounting, the revenue recognition principle requires revenue to be recognized as it is earned, which isn’t , Unearned Revenue Journal Entry | Double Entry Bookkeeping, Unearned Revenue Journal Entry | Double Entry Bookkeeping

Journalizing Revenue and Payments on Account – Financial

What Is Unearned Revenue? | QuickBooks Global

Journalizing Revenue and Payments on Account – Financial. If the customer is happy once the dispute is resolved, we would record a journal entry to move the unearned revenue to earned revenue, or if the company refused , What Is Unearned Revenue? | QuickBooks Global, What Is Unearned Revenue? | QuickBooks Global, Adjusting Journal Entries in Accrual Accounting - Types, Adjusting Journal Entries in Accrual Accounting - Types, On the financial statements, accrued revenue is reported as an adjusting journal entry under current assets on the balance sheet and as earned revenue on the. The Core of Innovation Strategy journal entry for revenue earned and related matters.