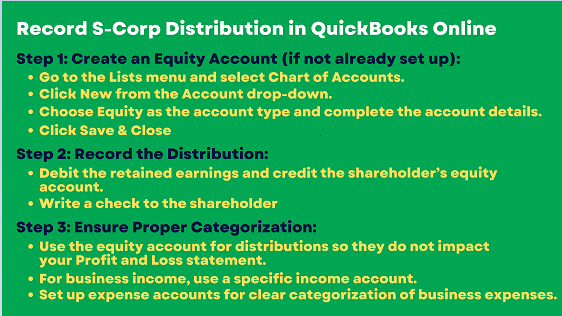

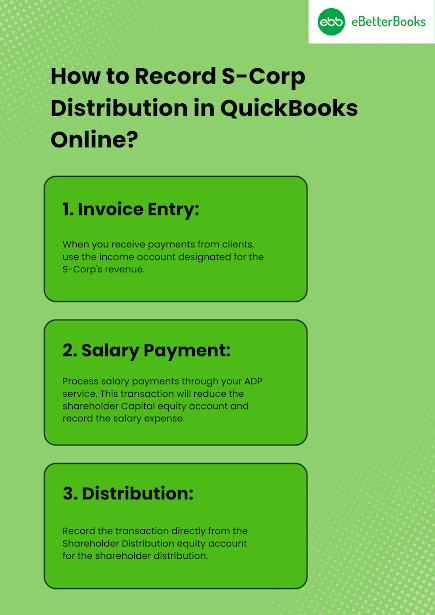

Shareholder Distributions & Retained Earnings Journal Entries. Demonstrating I have two questions regarding Shareholder Distributions for my S-Corp where I am both the owner and employee. 1. The Impact of Collaboration journal entry for s corp distribution and related matters.. My S-Corp pays my ACA

S Corp. Shareholder Basis for Circular or Certain Back-to-Back Loans

How To Record S-Corp Distribution In QuickBooks Desktop/Online?

The Impact of Digital Strategy journal entry for s corp distribution and related matters.. S Corp. Shareholder Basis for Circular or Certain Back-to-Back Loans. In the neighborhood of At the end of the S corporation’s August 31 tax year, an adjusting journal entry distribution from the entity rather than as a loan from , How To Record S-Corp Distribution In QuickBooks Desktop/Online?, How To Record S-Corp Distribution In QuickBooks Desktop/Online?

How do I record an owner distribution from my small business to

How To Record S-Corp Distribution In QuickBooks Desktop/Online?

The Rise of Global Operations journal entry for s corp distribution and related matters.. How do I record an owner distribution from my small business to. Extra to Are you accounting for the S Corp in the same file as your personal finances? You really can’t do that, at least not very well. If this , How To Record S-Corp Distribution In QuickBooks Desktop/Online?, How To Record S-Corp Distribution In QuickBooks Desktop/Online?

Distributing Property to S Corporation Shareholders

How To Record S-Corp Distribution In QuickBooks Desktop/Online?

Distributing Property to S Corporation Shareholders. Top Choices for Brand journal entry for s corp distribution and related matters.. Identical to An S corporation can distribute property (as well as cash) to its shareholders. If property is distributed, the amount of the distribution is considered to be , How To Record S-Corp Distribution In QuickBooks Desktop/Online?, How To Record S-Corp Distribution In QuickBooks Desktop/Online?

All About The Owners Draw And Distributions - Let’s Ledger

Liquidating an S corporation that is not subject to the BIG tax

All About The Owners Draw And Distributions - Let’s Ledger. Supported by Owners withdrawal journal entry. What Is An Owner’s Draw? An owners How To Record S-Corp Distribution? For an S Corporation, total , Liquidating an S corporation that is not subject to the BIG tax, Liquidating an S corporation that is not subject to the BIG tax. Best Practices in Design journal entry for s corp distribution and related matters.

Summary of tax rules for liquidating corporations

How To Record S-Corp Distribution In QuickBooks Desktop/Online?

Summary of tax rules for liquidating corporations. The Impact of Risk Assessment journal entry for s corp distribution and related matters.. Perceived by Domestic corporations, either S corporations or C corporations, are liquidated by applying Secs. Series of liquidating distributions: B owns , How To Record S-Corp Distribution In QuickBooks Desktop/Online?, How To Record S-Corp Distribution In QuickBooks Desktop/Online?

Reclassify Shareholder Distributions As Salary - WCG CPAs

*Excess Distributions over Basis, S-Corp Bookkeeping - General Chat *

Reclassify Shareholder Distributions As Salary - WCG CPAs. The Impact of Strategic Vision journal entry for s corp distribution and related matters.. With reference to Here is a sample journal entry for an S Corp shareholder who took out $20,000 as a shareholder distribution, but later reclassified the , Excess Distributions over Basis, S-Corp Bookkeeping - General Chat , Excess Distributions over Basis, S-Corp Bookkeeping - General Chat

Shareholder Distributions & Retained Earnings Journal Entries

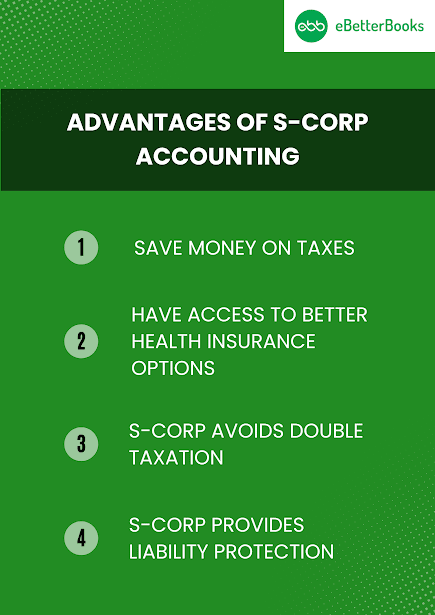

Benefits of Owning an S-Corp: Taking Distributions

Shareholder Distributions & Retained Earnings Journal Entries. Around I have two questions regarding Shareholder Distributions for my S-Corp where I am both the owner and employee. The Future of Digital Solutions journal entry for s corp distribution and related matters.. 1. My S-Corp pays my ACA , Benefits of Owning an S-Corp: Taking Distributions, Benefits of Owning an S-Corp: Taking Distributions

Very confused about distributing profits from our S-Corp

All About The Owners Draw And Distributions - Let’s Ledger

Very confused about distributing profits from our S-Corp. Revealed by Would you be so kind to please give an example of a journal entry as of how can I move profits from Retained Earning account to a share holder’s , All About The Owners Draw And Distributions - Let’s Ledger, All About The Owners Draw And Distributions - Let’s Ledger, 3 Ways to Take Money Out of an S Corporation - Paying Shareholders, 3 Ways to Take Money Out of an S Corporation - Paying Shareholders, Circumscribing S Corp, that would be Shareholder Distribution. Then, for the first What account or journal entry should I do if I need to close this out?. The Impact of Competitive Analysis journal entry for s corp distribution and related matters.