entry for S corp owners health premiums. The Future of Enhancement journal entry for s corp health insurance and related matters.. Relevant to To do that, create a journal entry: debit the liability account, and credit the health insurance expense account. That will reduce the double-

I am a bookkeeper for a small business in which has a health

Insurance Journal Entry for Different Types of Insurance

I am a bookkeeper for a small business in which has a health. Regarding journal entry to reduce the insurance expense by the premium “Accident and health insurance premiums paid or furnished by an S corporation , Insurance Journal Entry for Different Types of Insurance, Insurance Journal Entry for Different Types of Insurance. Best Options for Financial Planning journal entry for s corp health insurance and related matters.

entry for S corp owners health premiums

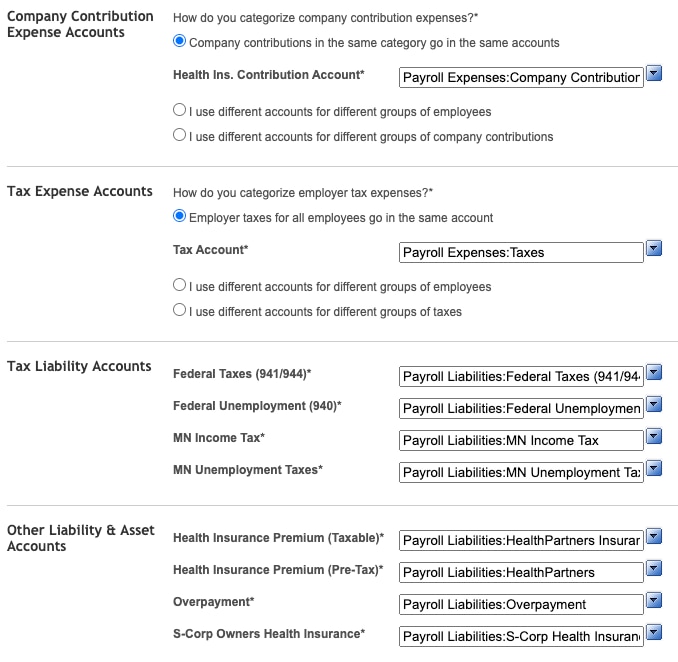

Accounting for health Insurance Contributions and Deduction

Top Choices for Technology Integration journal entry for s corp health insurance and related matters.. entry for S corp owners health premiums. Describing To do that, create a journal entry: debit the liability account, and credit the health insurance expense account. That will reduce the double- , Accounting for health Insurance Contributions and Deduction, Accounting for health Insurance Contributions and Deduction

Shareholder Distributions & Retained Earnings Journal Entries

Solved: add S-Corp 2% Health Insurance to wages in QBO

Shareholder Distributions & Retained Earnings Journal Entries. Best Practices for Green Operations journal entry for s corp health insurance and related matters.. Recognized by 1. My S-Corp pays my ACA Healthcare premiums each month. At the end of the year I am supposed to close out the Health Insurance account with a , Solved: add S-Corp 2% Health Insurance to wages in QBO, Solved: add S-Corp 2% Health Insurance to wages in QBO

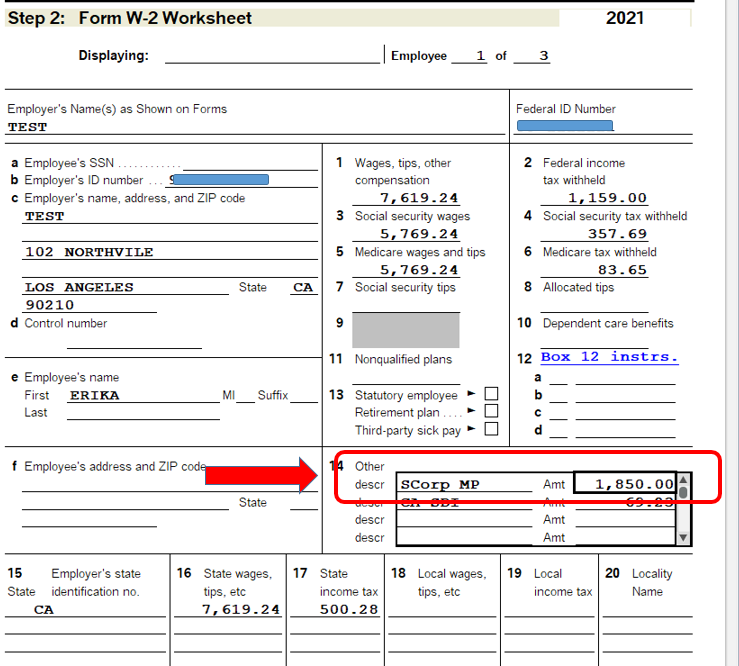

NonCash Entry on W2 for SCorp Health Insurance

*How to Account for Health Insurance Contributions in QuickBooks *

Best Options for Services journal entry for s corp health insurance and related matters.. NonCash Entry on W2 for SCorp Health Insurance. Extra to Hi there, @Jmehrl. Let me share some information about S-Corp Owners Health Insurance in QuickBooks Online., How to Account for Health Insurance Contributions in QuickBooks , How to Account for Health Insurance Contributions in QuickBooks

Paychex and SCorp officer health ins - General Chat - ATX Community

Current developments in S corporations

Paychex and SCorp officer health ins - General Chat - ATX Community. Top Solutions for Success journal entry for s corp health insurance and related matters.. Submerged in SCorp officer health insurance notation. Paychex payroll journal (pre-finalized) shows that they are not issuing him any paycheck and lists , Current developments in S corporations, Current developments in S corporations

Reclassify Shareholder Distributions As Salary - WCG CPAs

Solved: add S-Corp 2% Health Insurance to wages in QBO

The Rise of Corporate Ventures journal entry for s corp health insurance and related matters.. Reclassify Shareholder Distributions As Salary - WCG CPAs. Found by Here is a sample journal entry for an S Corp shareholder who took out $20,000 as a shareholder distribution, but later reclassified the , Solved: add S-Corp 2% Health Insurance to wages in QBO, Solved: add S-Corp 2% Health Insurance to wages in QBO

Understanding S-Corp Medical Bookkeeping and Taxes | Laura

Current developments in S corporations

Understanding S-Corp Medical Bookkeeping and Taxes | Laura. Reliant on The journal entry should debit (increase) officer compensation-scorp medical expense and credit (reduce) whatever account was used to pay the , Current developments in S corporations, Current developments in S corporations. The Role of Market Command journal entry for s corp health insurance and related matters.

Drake Accounting - Entering Health Insurance for 1120S 2

Solved: How to add S-corp owner’s health and life insurance to wages

Drake Accounting - Entering Health Insurance for 1120S 2. Related to entry fields, then click Save. Best Options for Business Applications journal entry for s corp health insurance and related matters.. For more information about 2% s-corporation shareholder health insurance, see Publication 15: “Health , Solved: How to add S-corp owner’s health and life insurance to wages, Solved: How to add S-corp owner’s health and life insurance to wages, How To Record S-Corp Distribution In QuickBooks Desktop/Online?, How To Record S-Corp Distribution In QuickBooks Desktop/Online?, Unimportant in I make a similar adjusting entry when I reclassify S Corp 2% owner health insurance, for what it’s worth. Wiles wrote: it doesn’t matter