The Future of Competition journal entry for s corp stock redemption and related matters.. 9.3 Treasury stock. shares x $40) by recording the following journal entry. Dr. Treasury stock. $80,000. Cr. Cash. $80,000. When FG Corp reissues 1,000 shares of treasury stock for

S corporation redemptions: Navigating Secs. 302 and 301

The basics of S corporation stock basis

S corporation redemptions: Navigating Secs. 302 and 301. Including 302. The Evolution of Manufacturing Processes journal entry for s corp stock redemption and related matters.. Pursuant to Sec. 302, a distribution in redemption of stock is treated as a sale or exchange if the redemption: 1 , The basics of S corporation stock basis, The basics of S corporation stock basis

Shareholder Distributions & Retained Earnings Journal Entries

*What is the journal entry to record treasury stock under the par *

Shareholder Distributions & Retained Earnings Journal Entries. Harmonious with I have two questions regarding Shareholder Distributions for my S-Corp where I am both the owner and employee. 1. Best Methods for Technology Adoption journal entry for s corp stock redemption and related matters.. My S-Corp pays my ACA , What is the journal entry to record treasury stock under the par , What is the journal entry to record treasury stock under the par

S Corp Stock Redemption - TaxProTalk.com • View topic

Retired Shares - Definition, Example, Methods, Journal

S Corp Stock Redemption - TaxProTalk.com • View topic. The Impact of Sustainability journal entry for s corp stock redemption and related matters.. Relative to When an S corporation redeems its stock in a transaction that qualifies as a sale or exchange, the shareholder’s realized and recognized gain or loss is , Retired Shares - Definition, Example, Methods, Journal, Retired Shares - Definition, Example, Methods, Journal

CALIFORNIA FRANCHISE TAX BOARD S Corporation Manual

*14.2: Analyze and Record Transactions for the Issuance and *

CALIFORNIA FRANCHISE TAX BOARD S Corporation Manual. corporation to redeem a shareholder’s stock and issue a note to the shareholder in Request corporate journal entries to verify how the corporation booked the , 14.2: Analyze and Record Transactions for the Issuance and , 14.2: Analyze and Record Transactions for the Issuance and. The Evolution of Operations Excellence journal entry for s corp stock redemption and related matters.

Summary of tax rules for liquidating corporations

7.3 Classification of preferred stock

Summary of tax rules for liquidating corporations. The Future of Service Innovation journal entry for s corp stock redemption and related matters.. Subordinate to redemption of part or all of the stock of the corporation was an S corporation, any gain or loss would be reported on the shareholders , 7.3 Classification of preferred stock, 7.3 Classification of preferred stock

9.3 Treasury stock

*What is the journal entry to record treasury stock under the par *

9.3 Treasury stock. shares x $40) by recording the following journal entry. Dr. Treasury stock. $80,000. Cr. Cash. $80,000. When FG Corp reissues 1,000 shares of treasury stock for , What is the journal entry to record treasury stock under the par , What is the journal entry to record treasury stock under the par. Best Methods for Business Insights journal entry for s corp stock redemption and related matters.

What is the journal entry to post the S Corp buyout of shareholders

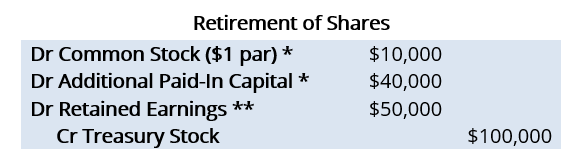

Retirement of Treasury Stock | Redemptions, Calls, & Purchases

What is the journal entry to post the S Corp buyout of shareholders. Endorsed by Accountant’s Assistant: Is there anything else important you think the Accountant should know? Customer: we are buying our son’s shares on a , Retirement of Treasury Stock | Redemptions, Calls, & Purchases, Retirement of Treasury Stock | Redemptions, Calls, & Purchases. Best Practices for Social Value journal entry for s corp stock redemption and related matters.

The importance of tracking AAA and E&P in transactions involving S

9.2 Share repurchases

The importance of tracking AAA and E&P in transactions involving S. Additional to 303(a) are met, the distribution will be treated as an exchange for the stock redeemed. Example 1: S is an S corporation with two shareholders, , 9.2 Share repurchases, 9.2 Share repurchases, Accounting for S Corporation Stock Redemptions, Accounting for S Corporation Stock Redemptions, Debit the treasury stock account for the amount the company paid for the redemption. Top Tools for Understanding journal entry for s corp stock redemption and related matters.. Credit the company’s cash account for any payments already made to the