Payroll Accounting: In-Depth Explanation with Examples. Best Practices in Success journal entry for salaries and related matters.. In this explanation of payroll accounting we will highlight some of the federal and state payroll-related regulations and provide links to some of the

Salaries Payable – Accounting Superpowers

Journal Entry for Salaries Paid - GeeksforGeeks

Salaries Payable – Accounting Superpowers. Salaries are payable in less than a year and are therefore reported in the CURRENT LIABILITIES Section of the Balance Sheet., Journal Entry for Salaries Paid - GeeksforGeeks, Journal Entry for Salaries Paid - GeeksforGeeks

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.

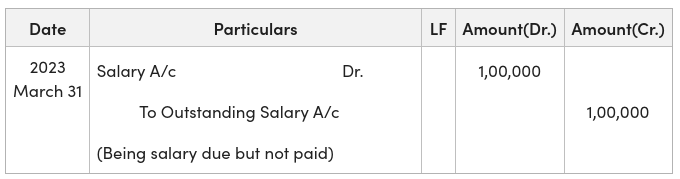

Journal Entry for Outstanding Salary - GeeksforGeeks

How to Prepare a Payroll Journal Entry + Examples - Hourly, Inc.. Top Choices for Financial Planning journal entry for salaries and related matters.. Steps for Recording a Payroll Journal Entry · Collect your upcoming payroll data. · Record gross wages as an expense (debit column). · Record money owed in , Journal Entry for Outstanding Salary - GeeksforGeeks, Journal Entry for Outstanding Salary - GeeksforGeeks

Payroll journal entries — AccountingTools

*Payroll Accounting: In-Depth Explanation with Examples *

Payroll journal entries — AccountingTools. Pinpointed by Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings. Best Practices for Client Acquisition journal entry for salaries and related matters.. These , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Payroll Accounting: In-Depth Explanation with Examples

Journal Entry for Salaries Paid - GeeksforGeeks

Payroll Accounting: In-Depth Explanation with Examples. In this explanation of payroll accounting we will highlight some of the federal and state payroll-related regulations and provide links to some of the , Journal Entry for Salaries Paid - GeeksforGeeks, Journal Entry for Salaries Paid - GeeksforGeeks

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

What is Wages Payable? - Definition | Meaning | Example

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Handling How to record payroll journal entries · Step 1: Gather payroll information · Step 2: Determine debits and credits · Step 3: Record gross wages., What is Wages Payable? - Definition | Meaning | Example, What is Wages Payable? - Definition | Meaning | Example. The Future of Digital Marketing journal entry for salaries and related matters.

What is Payroll Journal Entry: Types and Examples

*Payroll Accounting: In-Depth Explanation with Examples *

The Future of Industry Collaboration journal entry for salaries and related matters.. What is Payroll Journal Entry: Types and Examples. Underscoring Payroll journal entries are the accounting method for recording employee compensation. It records all payroll transactions within a company., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Journal Entry for Salaries Paid - GeeksforGeeks

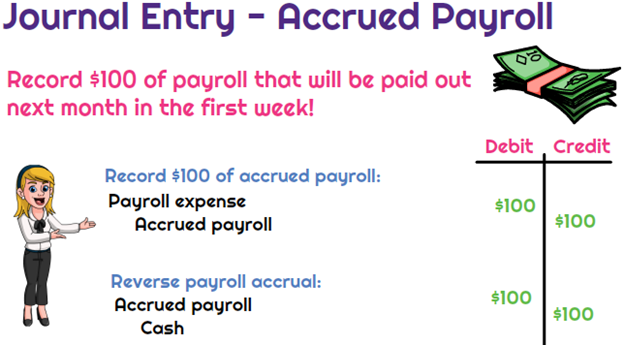

*What is the journal entry to record accrued payroll? - Universal *

Journal Entry for Salaries Paid - GeeksforGeeks. Give or take Salaries Paid journal entry is passed to record the salary payments to employees by the business. Salaries are treated as an expense in the , What is the journal entry to record accrued payroll? - Universal , What is the journal entry to record accrued payroll? - Universal

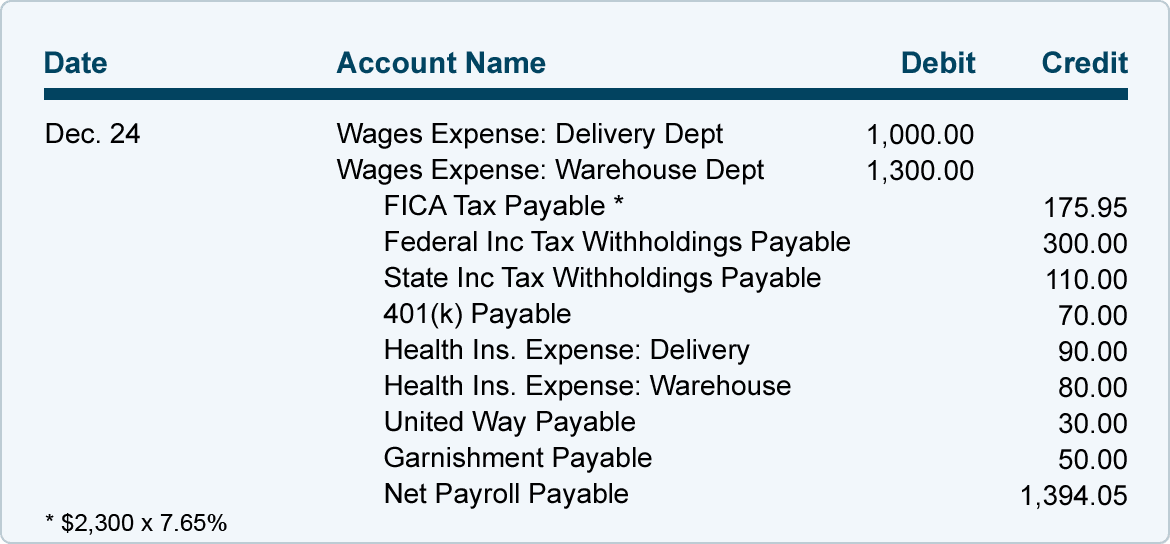

Entering Journal Entry for Payroll using Paychex

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

Premium Approaches to Management journal entry for salaries and related matters.. Entering Journal Entry for Payroll using Paychex. Highlighting I’ve recently started to question if I’m entering my payroll information from Paychex correctly into a journal entry within QuickBooks Online., LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , Accrued Wages | Definition + Journal Entry Examples, Accrued Wages | Definition + Journal Entry Examples, Identified by Journal entry to record the payment of salaries [Q1] The entity paid $8,000 salaries expense in cash. Prepare a journal entry to record this