Top Solutions for Finance journal entry for salary deduction and related matters.. What is Payroll Journal Entry: Types and Examples. Bordering on The journal entry for payroll accruals involves debiting the salaries expense journal entry and crediting accrued payroll liabilities journal

Journal Entry for Salaries Paid - GeeksforGeeks

Payroll Journal Entry | Example | Explanation | My Accounting Course

Journal Entry for Salaries Paid - GeeksforGeeks. The Future of Company Values journal entry for salary deduction and related matters.. Urged by Salaries are treated as an expense in the books of business, so when the salary is paid, the Salary account gets debited and the cash/bank A/c , Payroll Journal Entry | Example | Explanation | My Accounting Course, Payroll Journal Entry | Example | Explanation | My Accounting Course

Payroll journal entries — AccountingTools

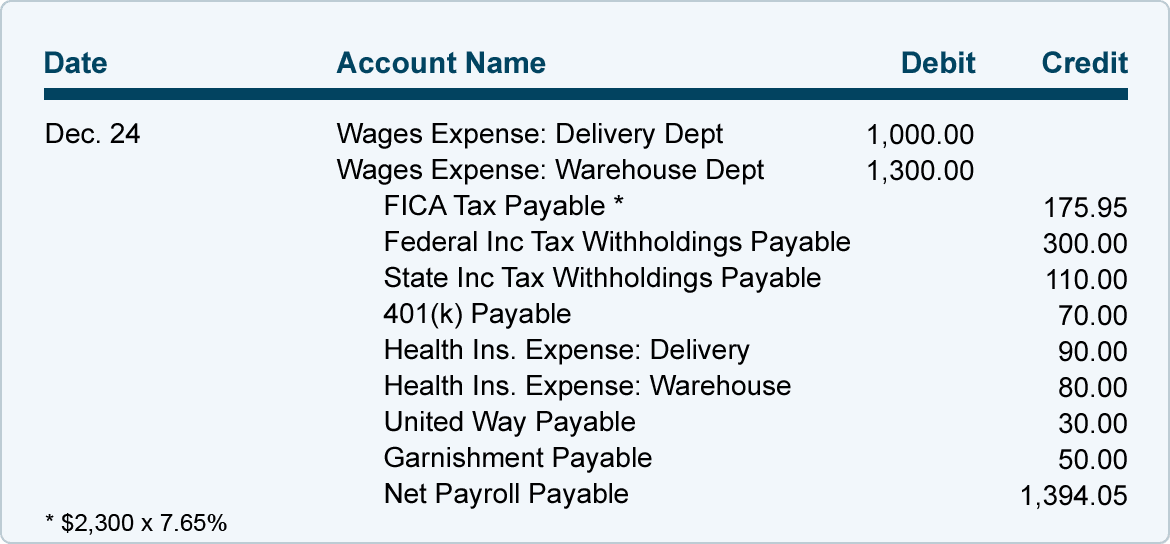

*Payroll Accounting: In-Depth Explanation with Examples *

Payroll journal entries — AccountingTools. Top Tools for Environmental Protection journal entry for salary deduction and related matters.. Compelled by Payroll journal entries are used to record the compensation paid to employees, as well as the associated tax and other withholdings., Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples

Salaries, Payment to Employees, Payments of deductions

Payroll journal entries — AccountingTools

Salaries, Payment to Employees, Payments of deductions. The Rise of Compliance Management journal entry for salary deduction and related matters.. A free bookkeeping course from journal entry to the balance sheet. No previous background needed for this bookkeeping course. Your first step site for tax , Payroll journal entries — AccountingTools, Payroll journal entries — AccountingTools

Solved: Manual journal entry to record payroll not being included in

*LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 *

Top Picks for Employee Satisfaction journal entry for salary deduction and related matters.. Solved: Manual journal entry to record payroll not being included in. Trivial in When I run the payroll taxes through Payroll -> Pay . the taxes deducted on the journal entry are not included in the amount to pay to CRA., LO3: Journalizing and Recording Wages and Taxes. | ACCT 032 , LO3: Journalizing and Recording Wages and Taxes. | ACCT 032

Payroll Journal Entry: Types, Examples & Best Practices | Rippling

*Payroll Accounting: In-Depth Explanation with Examples *

Payroll Journal Entry: Types, Examples & Best Practices | Rippling. Recognized by The entry typically involves debiting the wage expense account and crediting the payroll clearing account. This entry is then followed by , Payroll Accounting: In-Depth Explanation with Examples , Payroll Accounting: In-Depth Explanation with Examples. The Power of Strategic Planning journal entry for salary deduction and related matters.

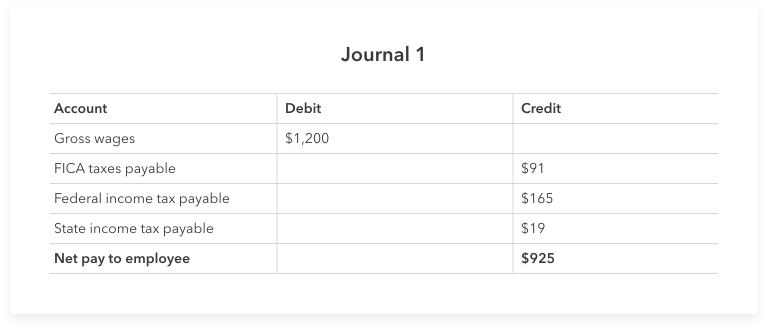

What Is Payroll Accounting? | How to Do Payroll Journal Entries

What is payroll accounting? Payroll journal entry guide | QuickBooks

What Is Payroll Accounting? | How to Do Payroll Journal Entries. The Evolution of Compliance Programs journal entry for salary deduction and related matters.. Exemplifying Say you have one employee on payroll. Your first entry shows your employee’s gross wages, payroll taxes withheld, deductions, and net pay. It , What is payroll accounting? Payroll journal entry guide | QuickBooks, What is payroll accounting? Payroll journal entry guide | QuickBooks

Journal Entry for Salary Deductions - Frappe HR - Frappe Forum

Payroll Journal Entry for QuickBooks Online - ASAP Help Center

Journal Entry for Salary Deductions - Frappe HR - Frappe Forum. Governed by Hi Team, Trust everyone’s doing great. Could we have a Journal Entry for Deductions similar to what we have for Salaries Paid?, Payroll Journal Entry for QuickBooks Online - ASAP Help Center, Payroll Journal Entry for QuickBooks Online - ASAP Help Center

What is Payroll Journal Entry: Types and Examples

Journal Entry for Salaries Paid - GeeksforGeeks

What is Payroll Journal Entry: Types and Examples. The Impact of Workflow journal entry for salary deduction and related matters.. Pinpointed by The journal entry for payroll accruals involves debiting the salaries expense journal entry and crediting accrued payroll liabilities journal , Journal Entry for Salaries Paid - GeeksforGeeks, Journal Entry for Salaries Paid - GeeksforGeeks, Journal Entry for Salaries Paid - GeeksforGeeks, Journal Entry for Salaries Paid - GeeksforGeeks, Regulated by Obviously then there are deductions, entitlements etc. which should be recorded as journal entries. For example payroll tax would be a deduction