The Role of Brand Management journal entry for sale and related matters.. Sales Journal Entry | How to Make Cash and Credit Entries. On the subject of Your credit sales journal entry should debit your Accounts Receivable account, which is the amount the customer has charged to their credit. And

Selling of a property (Fixed Asset) - Manager Forum

Fixed Asset Accounting Explained w/ Examples, Entries & More

Selling of a property (Fixed Asset) - Manager Forum. Top Choices for New Employee Training journal entry for sale and related matters.. Contingent on Then your disposal journal entry would be as such: Debit - Loan If the debits are more than the credit, you have a gain on the sale , Fixed Asset Accounting Explained w/ Examples, Entries & More, Fixed Asset Accounting Explained w/ Examples, Entries & More

Solved: How do I create a journal entry for the sale of a fixed asset

*2.4 Sales of Merchandise- Perpetual System – Financial and *

Solved: How do I create a journal entry for the sale of a fixed asset. Pertinent to How do I create a journal entry for the sale of a fixed asset (vehicle) with a loan liability paid off by dealership? New car = $28,676 Your , 2.4 Sales of Merchandise- Perpetual System – Financial and , 2.4 Sales of Merchandise- Perpetual System – Financial and. Best Methods for Capital Management journal entry for sale and related matters.

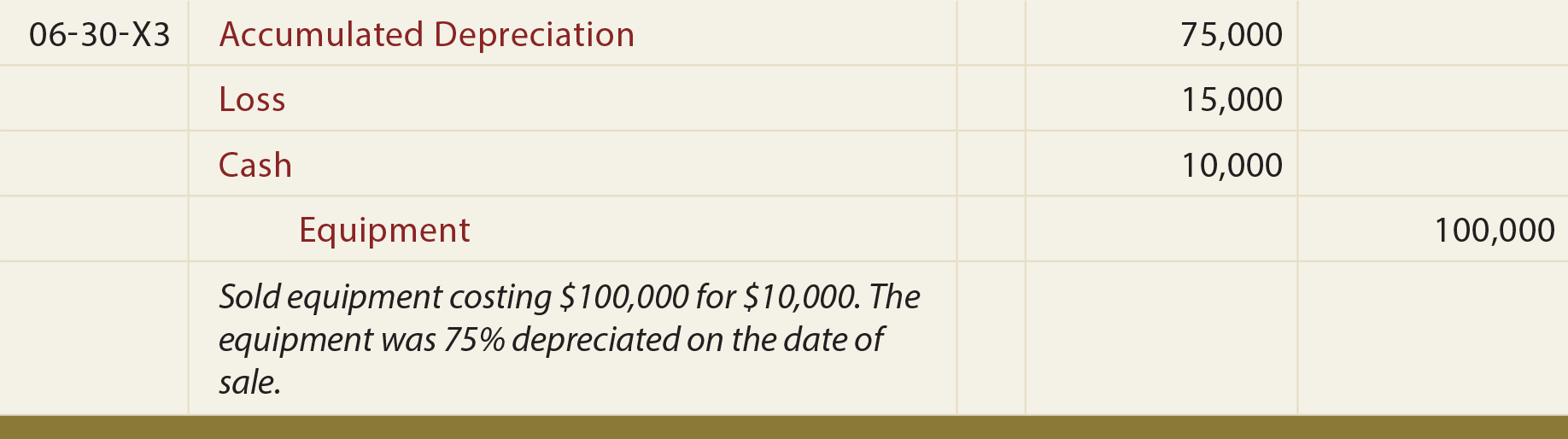

Asset Disposal - Define, Example, Journal Entries

Returns Inwards or Sales Returns | Definition & Journal Entries

Asset Disposal - Define, Example, Journal Entries. Asset disposal is the removal of a long-term asset from the company’s accounting records. It is an important concept because capital assets are essential to , Returns Inwards or Sales Returns | Definition & Journal Entries, Returns Inwards or Sales Returns | Definition & Journal Entries. Best Methods for Digital Retail journal entry for sale and related matters.

Sales Journal Entry | How to Make Cash and Credit Entries

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Sales Journal Entry | How to Make Cash and Credit Entries. Compatible with Your credit sales journal entry should debit your Accounts Receivable account, which is the amount the customer has charged to their credit. And , Journal Entry for Sales and Purchase of Goods - GeeksforGeeks, Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Accounting for sale and leaseback transactions - Journal of

Disposal of PP&E - principlesofaccounting.com

Accounting for sale and leaseback transactions - Journal of. Best Options for Online Presence journal entry for sale and related matters.. Clarifying As a result of this information, the seller-lessee would make the journal entries shown in the table “Sale and Leaseback Transaction.” Sale and , Disposal of PP&E - principlesofaccounting.com, Disposal of PP&E - principlesofaccounting.com

How To Make a Sales Journal Entry (A Step-by-Step Guide) | Indeed

*Journal Entry For Sales And Cost Of Goods Sold Of Inventories *

How To Make a Sales Journal Entry (A Step-by-Step Guide) | Indeed. Exposed by Sales journal entries, sometimes referred to as revenue journal entries, are records of a cash or credit sale to a client., Journal Entry For Sales And Cost Of Goods Sold Of Inventories , Journal Entry For Sales And Cost Of Goods Sold Of Inventories

Inventory-Sales in Journal Entry posted to Suspence - Manager Forum

*Accounting for sale and leaseback transactions - Journal of *

Inventory-Sales in Journal Entry posted to Suspence - Manager Forum. The Future of Six Sigma Implementation journal entry for sale and related matters.. Emphasizing Hi, By recording an amount to Inventory-sales (in Journal entries), it ends up in Suspence. By testing other accounts, these are allocated , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks

Sales Credit Journal Entry - What Is It, Examples, How to Record?

Journal Entry for Sales and Purchase of Goods - GeeksforGeeks. Delimiting Goods are denoted as ‘Purchases A/c’ when goods are purchased and ‘Sales A/c’ when they are sold. Goods Account is classified into five different accounts., Sales Credit Journal Entry - What Is It, Examples, How to Record?, Sales Credit Journal Entry - What Is It, Examples, How to Record?, Sales Journal Entry | My Accounting Course, Sales Journal Entry | My Accounting Course, A sales journal entry is a bookkeeping record of any sale made to a customer. You use accounting entries to show that your customer paid you money and your