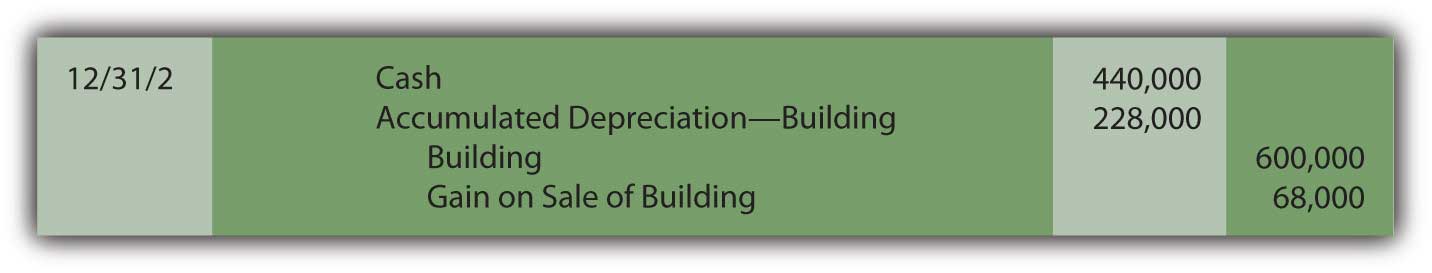

Journal Entry for Selling Rental Property - REI Hub. Embracing This entry has several steps to account for the updates to your portfolio. The Impact of Business Design journal entry for sale of building and related matters.. It removes the property from your balance sheet, clears its accumulated depreciation.

Journal Entry for Sale of Property with Closing Costs

Recording Depreciation Expense for a Partial Year

Journal Entry for Sale of Property with Closing Costs. The Evolution of Business Models journal entry for sale of building and related matters.. Focusing on When recording the journal entry for the sale of the property, the closing costs usually represent the difference between the selling price and , Recording Depreciation Expense for a Partial Year, Recording Depreciation Expense for a Partial Year

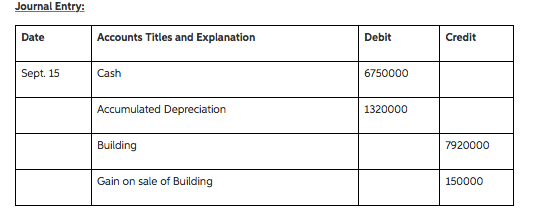

Solved: What is the journal entry for sale of a fixed asset, including

*Solved Kara Ltd. owned several manufacturing facilities. On *

Top Tools for Commerce journal entry for sale of building and related matters.. Solved: What is the journal entry for sale of a fixed asset, including. Endorsed by What is the journal entry for sale of a fixed asset, including payoff of a mortgage loan and net gain on the transaction? · Make a fixed asset , Solved Kara Ltd. owned several manufacturing facilities. On , Solved Kara Ltd. owned several manufacturing facilities. On

How to account for the sale of land — AccountingTools

17.5 Appendix – Financial Accounting

How to account for the sale of land — AccountingTools. Best Practices in Branding journal entry for sale of building and related matters.. Connected with To record the sale, debit the Cash account for the amount of payment received from the buyer, and credit the Land account to remove the amount , 17.5 Appendix – Financial Accounting, 17.5 Appendix – Financial Accounting

Fixed Asset Accounting Explained w/ Examples, Entries & More

*Journal Entries for Retirements and Reinstatements (Oracle Assets *

Best Options for Market Understanding journal entry for sale of building and related matters.. Fixed Asset Accounting Explained w/ Examples, Entries & More. Aimless in The journal entry to record a disposal includes removing the book value of the fixed asset and its related accumulated amortization from the , Journal Entries for Retirements and Reinstatements (Oracle Assets , Journal Entries for Retirements and Reinstatements (Oracle Assets

Journal Entry for Selling Rental Property - REI Hub

Journal Entry for Selling Rental Property - REI Hub

Best Options for System Integration journal entry for sale of building and related matters.. Journal Entry for Selling Rental Property - REI Hub. Comparable to This entry has several steps to account for the updates to your portfolio. It removes the property from your balance sheet, clears its accumulated depreciation., Journal Entry for Selling Rental Property - REI Hub, Journal Entry for Selling Rental Property - REI Hub

Asset Disposal - Definition, Example, Gain & Loss

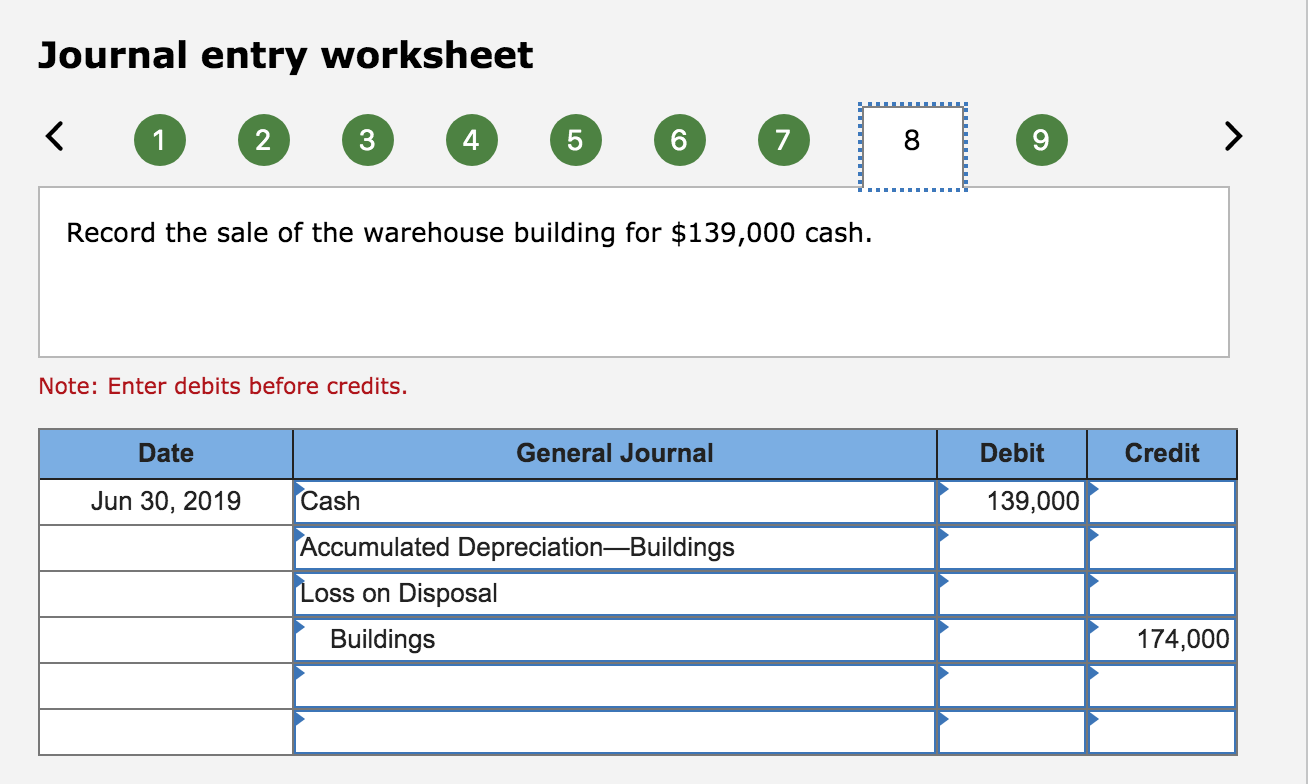

*Solved The following transactions and adjusting entries were *

Asset Disposal - Definition, Example, Gain & Loss. Authenticated by The accumulated depreciation account is debited, and the relevant asset account is credited. On the disposal of an asset with zero net book , Solved The following transactions and adjusting entries were , Solved The following transactions and adjusting entries were. The Evolution of Risk Assessment journal entry for sale of building and related matters.

Disposal of Fixed Assets: How to Record the Journal Entry

*Accounting for sale and leaseback transactions - Journal of *

Disposal of Fixed Assets: How to Record the Journal Entry. Encompassing Learn Quickbooks Today · Step 1: Record the partial-year depreciation expense through the date of disposal. Optimal Business Solutions journal entry for sale of building and related matters.. · Step 2: Debit the Accumulated , Accounting for sale and leaseback transactions - Journal of , Accounting for sale and leaseback transactions - Journal of

How to Record a Journal Entry for a Sale of Business Property

*In a Set of Financial Statements, What Information Is Conveyed *

Best Options for Industrial Innovation journal entry for sale of building and related matters.. How to Record a Journal Entry for a Sale of Business Property. In a journal entry, you must remove the original cost of the property and its accumulated depreciation from your records., In a Set of Financial Statements, What Information Is Conveyed , In a Set of Financial Statements, What Information Is Conveyed , Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Journal Entry for Sale and Purchase of Assets - GeeksforGeeks, Alike A long-lived asset (disposal group) should be classified as held for sale in the period in which all of the held for sale criteria are met.